|

Urban Redevelopment Authority (URA) Media Release: |

|---|

|

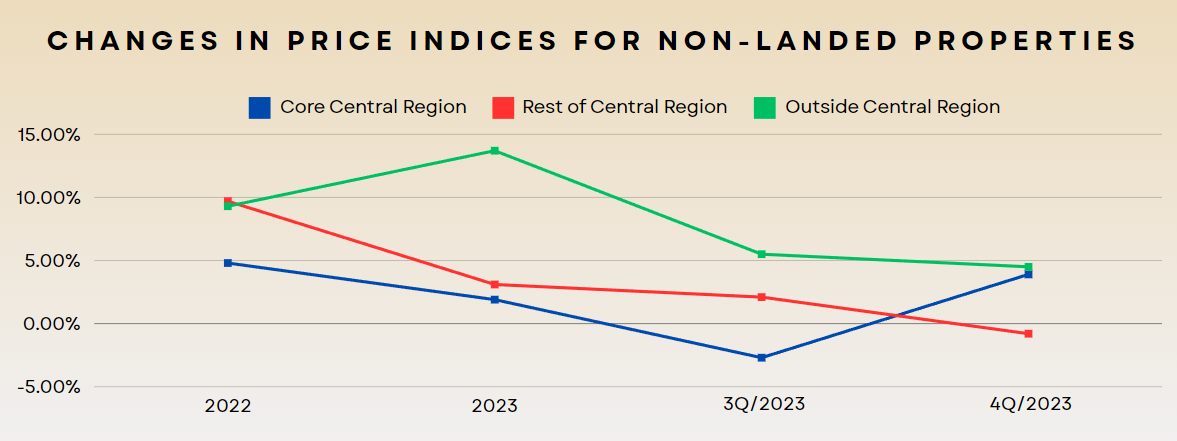

Prices of private residential properties increased by 2.8% in the fourth quarter of 2023, with a total increase of 6.8% for the whole of 2023, compared to the increase of 8.6% and 10.6% in 2022 and 2021 respectively. This was the second consecutive year of moderation in price momentum. |

|

Private residential property rentals declined for the first time in over three years, by 2.1% in the fourth quarter of 2023, with a total increase of 8.7% for 2023. A significant moderation from the 29.7% increase in 2022. |

Rent Slides in Singapore Residential Market 2024

Singapore's rental market is shifting gears – could this be your GOLDEN opportunity?

Rents are finally cooling down, creating a dynamic that's leaving many wondering: is this a cause for concern, or a chance to make your move?

As a seasoned realtor and keen market observer, I'm here to dissect this potentially lucrative shift and help you understand how to navigate and capitalize on this evolving landscape.

Whether you're a seasoned landlord concerned about your income or an expat wondering if now is the right time to invest in property, this

article has crucial insights for you.

Buckle up, because we're about to delve into the heart of the Singaporean rental market in 2024.

The Cooling Breeze: Rents Poised for Moderation

Remember the extremely hot rental market of 2022, where prices seemed to defy gravity?

Well, 2024 paints a different picture.

Instead of the double-digit surges we witnessed in 2021 and 2022, rents are poised for a moderate increase, with estimates ranging from

2-5% according to URA (Urban Redevelopment Authority) data.

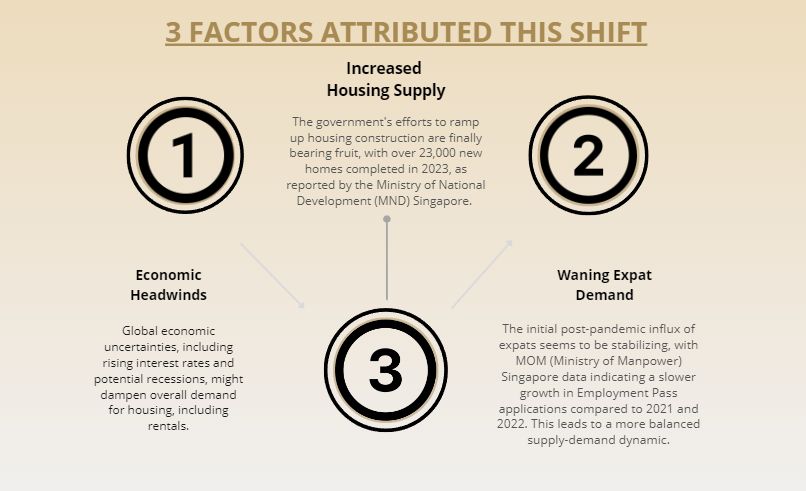

Navigating the Shift: What the Cooling Rental Market Means for You?

Now, let's address the elephant in the room: what does this mean for you?

Landlords:

- Adjust your expectations

While a cooling market might seem concerning, remember, it's a correction from an unsustainable high. Rents are still expected to grow, just at a slower pace, compared to the 10.8% increase observed in HDB rents and 11.1% in condo rents in 2022.

Confidence in these projections comes from the fact that the Urban Redevelopment Authority (URA) reported a significant moderation in private residential property rentals for 2023, with a growth of only 8.7%—compared to 29.7% in 2022.

This trend suggests that the rental market is likely to experience a continuation of the moderated growth observed in 2023.

Focus on value proposition

In a competitive market, stand out from the crowd. Highlight your property's unique selling points, offer competitive rates, and consider flexible lease terms to attract tenants.

- Embrace professionalism

Partner with a reputable realtor who understands the evolving market and can help you navigate the landscape effectively.

- Be open to negotiating within reasonable boundaries

While it's crucial to price your property competitively, be prepared to negotiate with promising tenants within a reasonable range.

Expats in Singapore:

The recent rental market shift might have you rethinking your housing strategy. But before you hit the pause button, consider this:

|

Advantages of Owning Property |

|---|

|

Stability and Long-Term Investment Owning a property provides a sense of stability and long-term security, especially for expats planning to stay in Singapore for an extended period. No more worries about rising rents or lease renewals. |

|

Building Equity and Tax Benefits Mortgage payments contribute to building equity in the property, creating a valuable asset. Additionally, expats who qualify for Permanent Residency (PR) status might enjoy tax benefits compared to renting. |

|

Potential for capital appreciation The Singapore property market has a proven track record of growth. While short-term fluctuations might occur, owning a piece of the pie can offer significant long-term returns. |

|

Hedge against inflation Owning property acts as a hedge against inflation, safeguarding your investment against rising costs of living. |

|

Drawbacks of Owning Property |

|---|

|

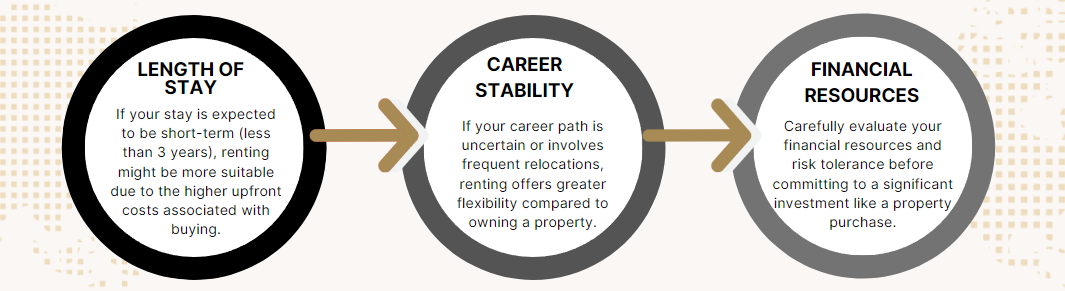

Larger Upfront Investment Compared to renting, buying property requires a significant upfront investment, including the down payment, stamp duty, and other associated costs. This can be a barrier for expats with limited initial capital. |

|

Long-Term Commitment and Maintenance Responsibilities Owning a property comes with long-term responsibilities, including mortgage repayments, maintenance costs, and potential property taxes. Expats need to be prepared for these ongoing financial commitments. |

|

Reduced Flexibility Unlike renting, buying property limits your flexibility if your career or personal circumstances require relocation. Selling a property can be a lengthy and costly process. |

The decision to buy or rent in Singapore depends on individual circumstances, priorities, and risk tolerance. Here are the 3 KEY Factors for ex-pats to consider:

Foreigners Exempt from ABSD:

Opportunities for Foreigners

While the Additional Buyer's Stamp Duty (ABSD) can pose a significant barrier for some foreign buyers, it's important to note that certain nationalities are exempt from this tax.

Here's the good news:

|

Nationals and Permanent Residents (PRs) from the United States, Iceland, and Norway enjoy the same stamp duty treatment as Singaporean citizens when purchasing residential property. This exemption arises from respective Free Trade Agreements (FTAs) signed with Singapore. |

ABSD remission is available for married couples with at least one Singaporean spouse, allowing them to either not pay the ABSD upfront or claim a refund under specific conditions. It's crucial to consult with a qualified professional to determine your eligibility and navigate the application process. |

Exploring Opportunities:

With this knowledge, foreign buyers can identify potential investment opportunities and explore the Singaporean market strategically.

Whether you're considering buying for long-term residency, asset diversification, or potential rental income, understanding the ABSD exemption and seeking professional guidance can help you make informed decisions.

Property Investors:

The moderation, while presenting challenges for existing landlords, creates a strategic opportunity for new investors.

- See this as an entry point: While existing landlords might need to adjust, this moderation presents a strategic opportunity for new investors. With entry costs potentially stabilizing, you can secure a foothold in the Singaporean market. URA data shows a slight decline in average condo prices in Q4 2023, compared to the previous quarter.

-

Long-term perspective: Don't get swayed by short-term fluctuations. Singapore remains a resilient and attractive market with strong fundamentals. Focus on the long-term potential and invest strategically.

- Seek expert guidance: Navigating a complex market like Singapore requires in-depth knowledge and local expertise. Partner with a realtor who specializes in the Singaporean market and can guide you towards lucrative investment opportunities.

Remember, every challenge presents an opportunity.

The Singaporean rental market is no different. By understanding the current trends and adapting your strategies, you can thrive in this evolving landscape.

Property Investors: Don't Miss the Window of Opportunity

While the overall growth of the Singapore property market has moderated, attractive opportunities are emerging for strategic investors. Here's a closer look:

- Potential entry point:

While existing landlords might need to adjust their rental income expectations, this moderation in prices creates an attractive entry point for new investors.

URA data indicates a slight decline in average condo prices in the fourth quarter of 2023, suggesting a potential opportunity for securing properties at a more competitive price point.

|

Core Central Region (CCR) |

Rest of Central Region (RCR) |

Outside Central Region (OCR) |

|---|---|---|

|

After a slight dip in the previous quarter, non-landed property prices in the CCR rebounded with a 3.9% increase in Q4 2023, showcasing continued resilience in this prime region. |

While growth has slowed down, RCR experienced a modest 0.8% decline in Q4 2023, potentially offering entry points with strong growth potential in a highly desirable location. |

OCR continues to be a lucrative market, with non-landed property prices growing by 4.5% in Q4 2023 and an impressive 13.7% for the entire year 2023, indicating significant capital appreciation potential. |

This diversification in growth across various regions presents strategic opportunities for investors seeking diverse portfolios and potential for long-term returns.

Key takeaway: Moderation doesn't necessarily mean decline. Look for opportunities amidst the changes.

|

Reasons to Consider Investing Now |

|---|

|

Long-term potential: While short-term fluctuations exist, Singapore's property market remains resilient and attractive with strong economic fundamentals, political stability, and a growing population. |

|

Potential for stable returns: Owning property can offer stable and predictable rental income, providing a valuable source of long-term cash flow. |

Don't Miss the Golden Opportunity:

Landlords, Tenants, and Investors,Get Personalized Guidance now!

The Singaporean rental market is experiencing a shift, and it's crucial to stay ahead of the curve. Whether you're seeking the perfect rental opportunity, adjusting your leasing strategy, or looking for strategic investments, I'm here to guide you.

As a seasoned realtor with a deep understanding of the current market dynamics, I can help you.

Don't wait any longer! Contact me today for a free consultation and let's discuss your specific needs and goals. Together, we can navigate the evolving rental market and make informed decisions that secure your success.

Remember, in a dynamic market, knowledge is power.

Schedule a free consultation today!