Can You Really Afford a Landed Property in Singapore?

Do you believe landed properties are only for millionaires and old-money families?

Because if you do, you’re seeing the big picture and you're probably missing one of the best wealth-building opportunities in Singapore right now.

I’ve been getting calls from savvy investors asking the same thing:

“Josh, is now a good time to buy landed? Can I even afford one?”

My answer?

If you’ve got solid and steady income, smart financing, and long-term vision, yes, you can. And if you don’t move soon, you might find yourself priced out for good.

The landed property market in Singapore is unlike any other asset class in the world. The rules are different, the supply is fixed, and the appreciation over decades is jaw-dropping.

o, let’s talk facts, about where to look, what you’ll get, and what you’ll lose if you wait.

Where Are The Hotspots for Landed Homes?

If you’re serious about entering this market, these districts are the ones to watch:

- Districts 10 & 11 – Holland, Bukit Timah, Newton, Novena. Prestigious, well-connected, and home to top schools and elite communities.

- District 15 – Katong, Joo Chiat, Telok Kurau. Heritage charm meets modern living, perfect for families who want East-side lifestyle.

- District 19 – Serangoon Gardens, Kovan. Family-friendly enclaves with great upside potential.

- District 20 – Thomson area. Strong demand thanks to MRT connectivity and nearby nature.

- District 21 & 23 – Upper Bukit Timah, Binjai Park, Chestnut Avenue. Quiet, green, and often with bigger plots for better value.

Yes, we’re talking about real money here, but we’re also talking about assets that never go out of demand. Some of these areas see 6–8% annual appreciation in value, and the best deals? They’re gone before they ever appear online.

What’s the Typical Size?

Let’s make sure you know what you're getting:

- Terrace house: Typically 2,000 sq ft built-up, land 1,600–1,800 sq ft

- Semi-detached: 3,500 sq ft built-up, land 2,500–4,000 sq ft

- Detached: 5,000+ sq ft built-up, land 5,000–7,000 sq ft

- GCB: Minimum land size of 15,069 sq ft per URA guidelines. Most are 20,000–30,000 sq ft, some even larger.

You’re not just buying a house, you’re buying land, one of Singapore’s rarest commodities. And it’s protected by strict URA zoning rules, which means your asset can only get scarcer.

Why Landed Properties Are So Special

Here's what I tell every client:

" When you buy a condo, you’re buying a lifestyle. When you buy a landed, you’re buying a legacy. "

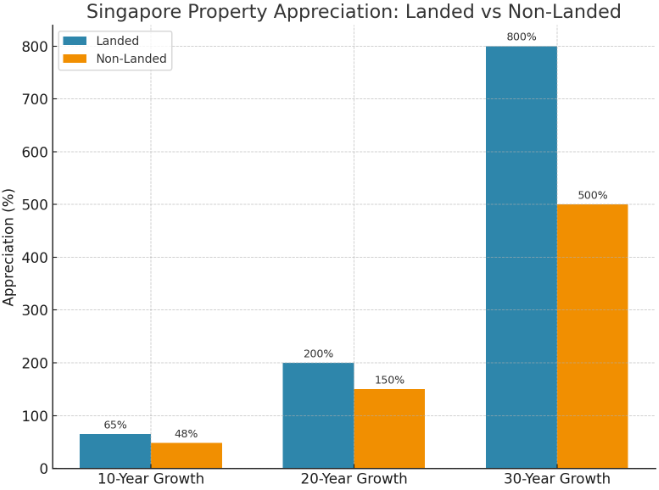

Landed homes and especially GCBs have consistently outperformed the broader market. Here’s the proof:

- 10-year price growth: Landed properties appreciated 65%, while private non-landed properties appreciated 48%

- 20-year growth: Many plots have tripled in value, with key districts seeing even higher multiples

- 30-year gain: Some properties bought for S$1M in the 90s now sell for S$8–10M.

No other real estate class here offers this mix of control, privacy, and capital upside. Plus, let’s be real, it’s a status symbol.

The Big Question: Can You Afford One?

You don’t need to be a billionaire. You just need:

- Combined household income of S$25K–35K/month for terraces/semi-Ds, and S$60K–80K/month for GCBs.

- Strong CPF and liquid assets

- Willingness to put in 25% down payment (S$10M on a S$40M GCB)

- The right mortgage broker and tax advisor (I've got the contacts)

At current interest rates (2.4%–2.75% fixed), a S$5M terrace could mean monthly repayments of about S$15K–18K, while a S$30M GCB is around S$100K/month.

It’s not cheap, but it’s doable—especially if you think in terms of generational wealth, not just living space.

Here’s What You Risk If You Wait

1. Supply is fixed. Only 73,000 landed homes in Singapore, and URA isn't building more. Once they’re gone, they’re gone.

2. Global demand is rising. Wealthy families from China, India, Indonesia, and even Europe are already buying here for stability.

3. Inflation will eat your cash. Every year you wait, your capital could be compounding instead of shrinking

I have access to:

- Off-market landed listings

- Motivated sellers

- Undervalued plots with long-term upside

Some of the best landed deals never hit PropertyGuru or 99.co. They go to people like you who ask the right questions early.

Don’t Be The One Who Says “I Should Have Bought Back Then

Blink and you’ll miss it. The landed market doesn’t wait.

If you’ve read this far, you’re probably already in the top 10% who get it. Grow your wealth, secure your legacy, and get in before the next price wave hits.

Message us now! Let’s make this move before someone else does.