|

Methodical Entry Point |

|---|

|

Let's face it, perfectly timing the market is close to impossible. But that doesn't mean we can't be strategic! By understanding market cycles and historical data, we can identify trends and make informed decisions. For example, if District 15 experiences a period of rapid development, with new infrastructure projects or prestigious schools on the horizon, we can anticipate an increase in rental demand. This is the perfect time to consider a well-priced leasehold property, because as the area flourishes, so will your potential rental yield. Or let’s say you're looking at a leasehold condo with a remaining lease of 75 years. Ideally, you want to enter the market during a period of stable or slightly declining prices. This allows you to secure the property at a good value and potentially benefit from future market upswings during your ownership period. |

Freehold vs. Leasehold: The Truth Investors MUST Know!

IF YOU'RE LOOKING TO INVEST IN DISTRICT 15 AND ARE ALREADY CONSIDERING LEASEHOLD PROPERTY, READ THIS BEFORE YOU DO.

While leasehold properties might seem tempting with their initial affordability, especially for first-time investors, there's a crucial truth you need to understand before committing.

In the short run, leasehold may seem like a good option but don't forget that freehold is king. Don’t buy in unless you have an exit strategy.

Sounds harsh? That's the reality of countless investors who opt for seemingly "cheaper" leasehold properties. They get lured in by a lower initial price, only to face a depreciating asset and the potential stress of relocation later.

But what if I told you there’s an optimized option?

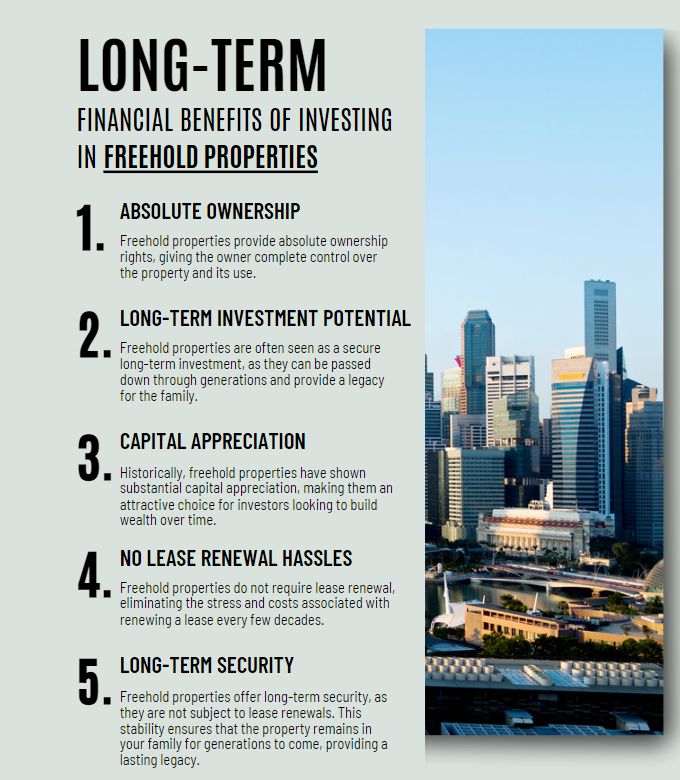

If you buy freehold, you can own the property outright, ensuring long-term wealth creation and the ability to pass it down to your loved ones.

Leasehold properties can still be part of a diversified portfolio, but maximizing capital retention requires entry strategies: timing, location, comparables, and opportunity.

Are you adopting these crucial entry strategies? If not, you're potentially missing out on maximizing your return on investment.

As your realtor, transparency is key. I do represent leasehold properties as well, but my job is to empower you, with knowledge.

Let's delve deeper into the freehold vs. leasehold debate, specifically focusing on the lucrative opportunities D15 presents.

Leasehold Entry Strategies for Savvy Investors

|

Location, Location, Location |

|---|

|

Not all leaseholds are created equal. District 15 boasts a variety of high-demand locations, and selecting the right micro-market can significantly impact your investment's performance. Consider proximity to transportation hubs, prestigious schools, or upcoming infrastructure projects. These factors contribute to sustained rental demand, a key element in capital retention with leasehold properties. Let's take a hypothetical example. Imagine you're considering two leasehold properties in D15. One is located near a bustling commercial area, while the other is situated in a quieter neighborhood. While the quieter neighborhood might offer a more relaxed living environment, the property near the commercial area is likely to attract higher rental yields due to its proximity to amenities and job opportunities. By prioritizing location and its impact on rental income, you can maximize your capital retention with a leasehold property. |

|

The Power of Comparables |

|---|

|

Don't be fooled by flashy marketing materials. Before committing to a leasehold property, scrutinize comparable properties, both freehold and leasehold, in the vicinity. Analyze factors like unit size, age, amenities, and most importantly, leasehold tenure remaining. This meticulous research ensures you secure a leasehold property priced competitively within the market, minimizing potential capital depreciation as the lease term progresses. For instance, I recently helped a young couple who were interested in a leasehold apartment. They found a unit they liked, but upon closer inspection, we discovered several similar-sized units in nearby buildings with a longer remaining lease term listed for a slightly lower price. By meticulously comparing available properties, we were able to negotiate a better deal for my clients, ensuring they obtained a leasehold unit with a good remaining lease at a competitive price point. |

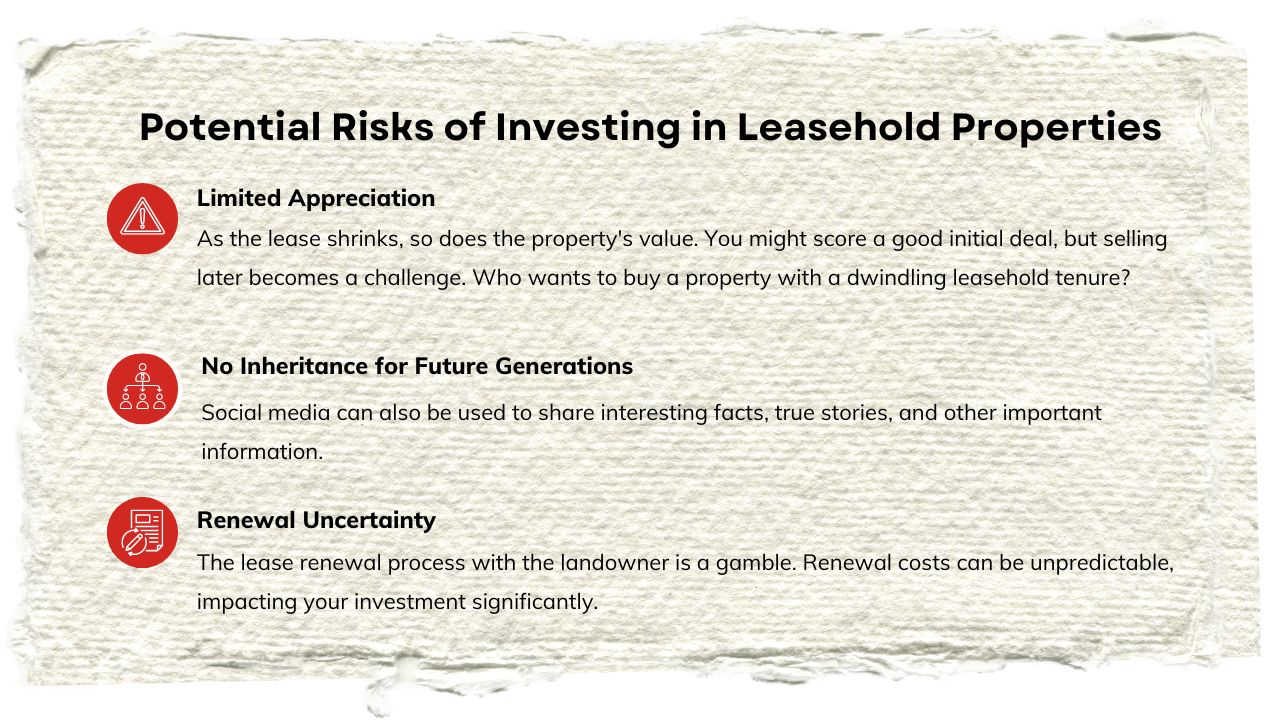

Leasehold Properties: Affordable Now, But at What Cost to Your Future?

It's no secret that leasehold properties often come with a lower price tag, making them an attractive option for first-time investors or those working with a tighter budget.

But the truth is, you're not truly investing in your future.

Leasehold properties grant you ownership for a fixed period, typically 99 years or less.

While some leasehold properties, especially those with very long leases (like 999 years), might seem like a decent option, they still lose value as the lease shortens.

This means that after the lease expires, the property and the land it sits on revert back to the state, leaving you and your heirs with nothing.

|

Let's face it, why invest in something that can't be passed down to your children or grandchildren? Imagine the frustration – you build equity, but it disappears at the lease's end. And forget appreciating your property's value – leasehold properties depreciate as the lease shrinks. Not exactly a recipe for long-term wealth creation, is it? |

The Freehold Freedom: Building a Legacy in D15

This is where freehold properties in D15 come in.

With a freehold purchase, you own the land and the building – a timeless asset. It's a true investment, one that can be passed on for generations. Property values in D15 are known to rise steadily, making freehold a fantastic option for building long-term wealth.

|

Imagine the security of knowing your investment will only become more valuable with time. |

Thinking Beyond the Price Tag: Understanding the D15 Market

1. A Haven of Convenience and Tranquility

District 15 is a prime spot. Also known as the East Coast and Marine Parade area, is one of the most sought-after residential neighborhoods in Singapore. This vibrant community offers a perfect blend of urban convenience and tranquil living, making it an ideal destination for families and investors alike.

2. Convenience at Your Doorstep

Residents of District 15 enjoy easy access to top-notch schools, shopping centers, and recreational facilities, ensuring that daily needs are met with ease. From the bustling streets of Joo Chiat Road to the serene surroundings of East Coast Park, the area offers a unique balance of urban excitement and natural beauty.

3. A Strong Education System

The area is particularly attractive to families, as it boasts a strong education system with renowned institutions such as Tanjong Katong Primary School and Tanjong Katong Girls' School. These schools are known for their excellent academic performance, extracurricular activities, and nurturing environments, providing parents with peace of mind knowing their children are receiving a world-class education right in their own backyard.

4. A Hub of Cultural and Culinary Delights

District 15 is also a melting pot of cultures, with a diverse range of cuisines and traditions on display. From the vibrant streets of Joo Chiat Road to the historic Katong neighborhood, residents can indulge in a wide variety of international flavors and experiences.

5. A Perfect Blend of Urban and Nature

The area's unique blend of urban and natural environments makes it an attractive destination for those seeking a balance between convenience and tranquility. Residents can enjoy the bustling streets of the city while still having access to the serene surroundings of East Coast Park, which offers a range of recreational activities and stunning views of the Singapore Strait.

Freehold in District 15?

Amber park: A Smart Investment

PROJECT DETAILS:

|

Name of Project |

Amber Park |

|

Location |

16 - 18 Amber Gardens, District 15, Singapore |

|

Development |

Three 21-storey towers with 592 units (from 1-bedroom to 6-bedroom penthouses) |

|

Unit Mix |

1 to 6 Bedroom Units with Various Layouts |

|

Developer |

City Developments Limited (CDL) and Hong Leong Group |

|

Architect |

SCDA Architects Pte. Ltd. |

|

TOP |

2024 |

|

Unique Selling Points |

|

Amber Park is a luxury freehold condominium development that's poised to redefine the concept of oceanfront living. Nestled in the coveted District 15 (East Coast/Marine Parade area), this exceptional property boasts a range of features that will leave you awestruck.

Unparalleled Facilities and Amenities

Imagine stepping into a world where your every desire is catered to.

Amber Park's expansive 32,500 sq ft rooftop "Stratosphere" deck is a true game-changer, featuring a 600m jogging track, a gym, gourmet dining areas, and a yoga deck – all with breathtaking views of the Singapore Strait.

And that's just the tip of the iceberg.

With a leisure pool, lagoon cove, kids' lagoon pool, hydrotherapy pool, BBQ pavilion, and more, Amber Park offers an unrivaled lifestyle experience.

Exceptional Design and Architecture

Amber Park's architectural prowess is a testament to the visionary minds behind it.

Designed by the renowned SCDA Architects, the development's n-shaped design maximizes sea views from every unit, while the organic shapes of the pools and landscaping create a serene, natural ambiance.

The showflat itself is a masterpiece, showcasing the development's commitment to redefining oceanfront living.

Unbeatable Location and Connectivity

Amber Park's prime location in District 15 puts you at the heart of Singapore's vibrant East Coast enclave.

With the upcoming Tanjong Katong MRT station just a 3-minute walk away, you'll enjoy seamless connectivity to the rest of the city. And with the East Coast Park, renowned food centers, and a plethora of shopping and dining options nearby, you'll never be far from the pulse of the city.

Amber Park is a stunning freehold development in D15., but the most valuable aspect?

Freehold ownership.

Comparison of resale with

new launched properties

|

Feature |

Amber Park |

Tembusu Grand |

Grand Dunman |

Emerald of Katong |

|---|---|---|---|---|

|

Address |

16 Amber Gardens East Coast / Marine Parade East Coast (D15-16). |

369 Tanjong Katong Road East Coast / Marine Parade East Coast (D15-16). |

2 Dunman Road East Coast / Marine Parade East Coast (D15-16). |

29 Jalan Tembusu East Coast / Marine Parade . |

|

Tenure |

Freehold |

99-year Leasehold |

99-year Leasehold |

99-year Leasehold |

|

Estimated TOP |

Completed in 2024 |

2028 |

2028 |

2028 |

|

Developer |

CDL & Hong Leong Group |

Developed by CDL and MCL Land |

MCC Land |

Sim Lian Group |

|

Number of Units |

592 |

638 |

1008 |

846 |

|

Unit Mix |

1-bedroom + Study to 6-bedroom Penthouses |

Studio to 5-bedroom |

Studio to 5-bedroom |

Studio to 5-bedroom |

Distance to MRT

|

Feature |

Amber Park |

Tembusu Grand |

Grand Dunman |

Emerald of Katong |

|---|---|---|---|---|

|

Tanjong Katong MRT |

274m |

1.4km |

2.2km |

1.5km |

|

Dakota MRT Station |

1.44 km |

1.5km |

0.6km |

1.5km |

|

Mountbatten MRT Station |

1.94 km |

2.4km |

2.4km |

2.3km |

Price Insights

|

Property Project |

Sale Price |

Current PSF |

Estimated repayment loan amount |

Floor Size |

|---|---|---|---|---|

|

Amber Park (1BR) |

S$ 1,399,000 |

S$ 2,890.50 |

S$ 5,009 / mo. |

484 sqft. |

|

Tembusu Grand (1BR) |

S$ 1,329,000 |

S$ 2,521.82 |

S$ 4,758 / mo. |

527 sqft. |

|

Grand Dunman (1BR) |

S$ 1,504,000 |

S$ 2,739.53 |

S$ 5,385 / mo. |

549 sqft. |

|

Emerald of Katong (1BR) |

S$ 1,030,000 |

S$ 1,976.97 |

S$ 3,688 / mo. |

521 sqft. |

|

Amber Park (2BR) |

S$ 2,250,000 |

S$ 3,028.26 |

S$ 8,056 / mo. |

743 sqft. |

|

Tembusu Grand (2BR) |

S$ 1,932,000 |

S$ 2,600.27 |

S$ 6,917 / mo. |

743 sqft. |

|

Grand Dunman (2BR) |

S$ 1,124,000 |

S$ 2,047.36 |

S$ 4,024 / mo |

549 sqft. |

|

Emerald of Katong (2BR) |

S$ 1,300,000 |

S$ 1,830.99 |

S$ 4,654 / mo. |

710 sqft. |

|

Amber Park (3BR) |

S$ 2,780,000 |

$ 2,935.59 |

S$ 9,954 / mo. |

947 sqft. |

|

Tembusu Grand (3BR) |

S$ 2,185,000 |

S$ 2,207.07 |

S$ 7,823 / mo. |

990 sqft. |

|

Grand Dunman (3BR) |

S$ 2,539,000 |

S$ 2,406.64 |

S$ 9,091 / mo. |

1,055 sqft. |

|

Emerald of Katong (3BR) |

S$ 2,037,000 |

S$ 2,199.78 |

S$ 7,293 / mo. |

926 sqft. |

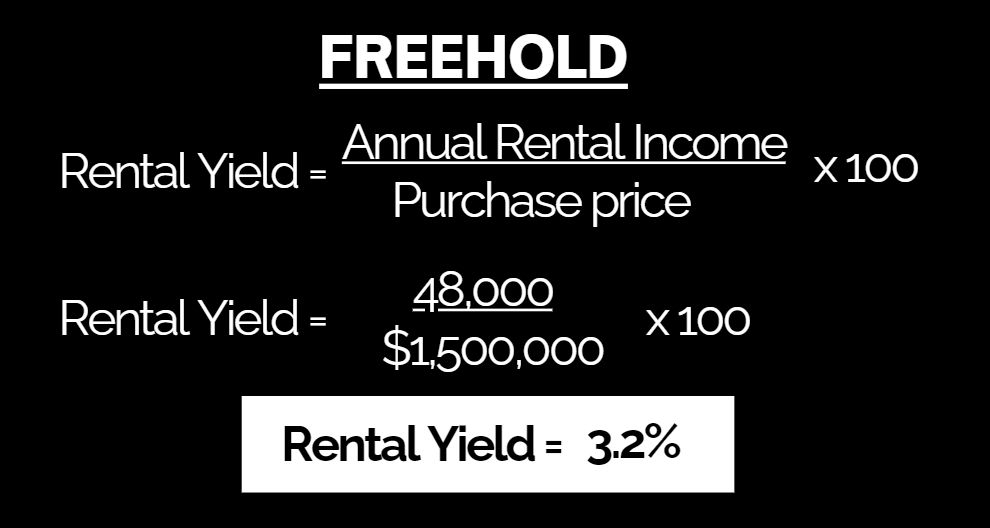

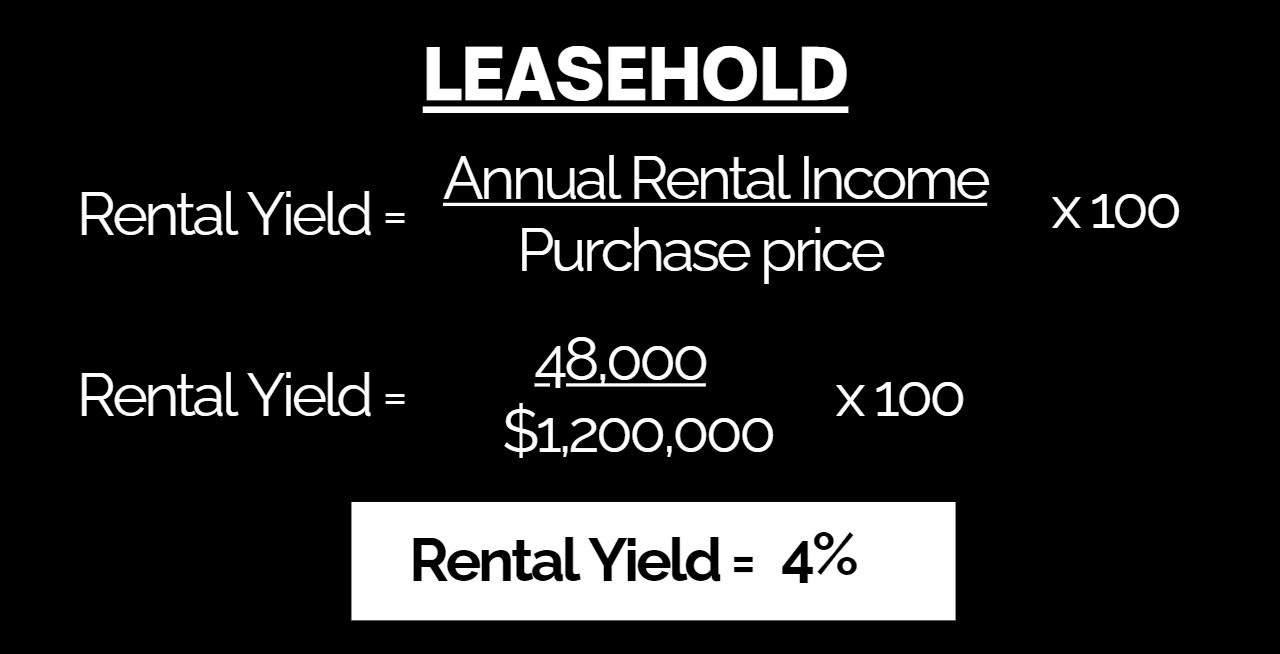

Rental Yield Comparison between Freehold and Leasehold Properties

Freehold properties in District 15 generally have a lower rental yield compared to leasehold properties. This is because freehold properties tend to be more expensive, which means the rental income is spread over a higher purchase price. Leasehold properties, on the other hand, are often cheaper, resulting in a higher rental yield.

Example:

Let's consider an example of a freehold property in District 15 with a purchase price of $1.5 million and a monthly rental income of $4,000. The rental yield would be:

In contrast, a leasehold property in the same area with a purchase price of $1.2 million and a monthly rental income of $4,000 would have a higher rental yield:

1. Lower upfront costs

Leasehold properties typically require a lower initial investment, as the leaseholder is only paying for the right to use the property for a fixed period of time.

This allows for a higher rental yield when calculated as annual rental income divided by property cost.

2. Rental demand

Leasehold properties typically require a lower initial investment, as the leaseholder is only paying for the right to use the property for a fixed period of time.

This allows for a higher rental yield when calculated as annual rental income divided by property cost.

2. Affordability

Leasehold properties are generally more affordable compared to freehold properties. This makes them accessible to a wider range of buyers and investors.

However, it's important to note that while leasehold properties can offer higher rental yields in the short term, they also come with significant risks, such as the potential for the property's value to decrease as the lease term gets closer to expiration.

5 Key Factors to Consider When Choosing Between Freehold and Leasehold Properties

1. Financial Situation

Freehold properties often require a higher upfront investment, while leasehold properties are more affordable initially.

2. Investment Goals

Freehold properties are ideal for long-term investors seeking stability and potential capital appreciation, while leasehold properties are better suited for those looking for a higher return on investment in the short term.

3. Personal Preferences

Freehold properties offer absolute ownership and control, while leasehold properties provide a lower upfront cost and shared maintenance responsibilities.

4. Risk Tolerance

Freehold properties come with the risk of property depreciation, while leasehold properties have the risk of lease expiration and limited control.

5. Location

Freehold properties are often available in prime locations, while leasehold properties may be more accessible in less desirable areas.

|

Ultimately, the choice between freehold and leasehold properties depends on individual circumstances and priorities. It is crucial to conduct thorough research, consult with real estate experts, and consider long-term goals before making an investment decision. |

Freehold or Leasehold?

The Choice is Yours

There's no one-size-fits-all answer when it comes to freehold vs. leasehold properties. As your realtor, my goal is to empower you to make informed decisions based on your unique goals.

- Seeking high rental yields and have a budget-conscious approach? Leasehold properties are ideal for short-term investors or those with a limited budget. They tend to offer higher rental yields due to lower entry prices. However, capital appreciation is capped by the lease expiration.

- Investing for long-term capital appreciation and a permanent legacy? Freehold properties are perfect for long-term investors seeking capital appreciation and a permanent legacy. While the initial cost might be higher, freehold properties offer greater freedom and peace of mind.

Remember, every investment has its pros and cons. The key to a successful property investment lies in your exit strategy!

Want to explore your options and unlock the secrets to a winning exit strategy?

Contact me now!