|

Building |

Location |

Tenure |

Price Range (Average psf) |

Rental Range (psf pm) |

Implied Yield (%) |

Why Consider? |

|---|---|---|---|---|---|---|

|

Suntec City |

D01 |

Leasehold (99 yrs from 1989) |

S$3,311 |

S$5.70 - S$12.50 (avg. S$9.10) |

3.3 |

Integrated work-life experience, various sizes |

|

Samsung Hub (Office) |

D01 |

Leasehold (999 yrs from 1927) |

S$3,921 |

S$8.90 (avg.) |

2.7 |

Modern facilities, central location |

|

Prudential Tower |

D01 |

Leasehold (99 Yrs From 1996) |

S$3,402 |

S$7.40 (avg.) |

2.6 |

Established CBD location |

|

GB Building |

D01 |

Leasehold (99 Yrs From 1982) |

S$1,980 |

S$11.30 (avg.) |

6.9 |

High rental yield, established location |

|

Springleaf Tower |

D02 |

Leasehold (99 Yrs From 1996) |

S$2,550 |

S$7.80 (avg.) |

3.7 |

Good rental yield, various sizes |

|

SBF Center |

D01 |

Leasehold (99 Yrs From 2011) |

S$3,443 |

S$7.60 - S$9.60 (avg. S$8.60) |

3.0 |

Potential for future growth |

|

Oxley Tower (Office) |

D01 |

Freehold |

S$3,441 |

S$6.50 - S$6.70 (avg. S$6.60) |

2.3 |

Central location, various sizes |

|

Solitarie (Office) |

D01 |

Freehold |

S$4,111 |

S$4,130 - S$6,738 |

N/A |

High-end office space |

How Singapore's Office Market is Evolving in 2024: Investors Beware!

If you're considering purchasing a strata office, this article is for you.

Perhaps you're planning to use it for your own business, or you're looking to invest in a property that you can grow into as your business expands. But have you stopped to consider the potential risks associated with investing in the Singapore office market?

Investing in a strata office can offer a sense of security and stability, especially if you plan to operate in Singapore for the long term. However, there are also significant risks that you need to be aware of before making a purchase.

For instance, the cost of accommodating a large workforce can be high, and if your industry is dynamic, you may not be able to move quickly enough to adapt to changing circumstances. Renting may offer more flexibility in these situations.

On the other hand, if you're looking to rent out your strata office, you'll want to ensure that you're able to attract and retain tenants in a highly competitive market.

But before you make any decisions, it's important to understand the potential risks associated with investing in the Singapore office market. That's why I've put together this article, which outlines three key risks that every investor needs to know. By understanding these risks, you can make informed decisions and avoid costly mistakes.

So, if you're considering investing in a strata office in Singapore, keep reading to learn more about the potential risks and how to navigate them.

Now, let's cut to the chase!

The Singapore office market is undergoing a significant transformation in 2024. While modern office spaces with top-notch amenities remain desirable, investors need to be cautious and consider evolving trends before making a purchase.

Project Analysis: A Look at Key Buildings

Here's a detailed analysis of some prominent office buildings in Singapore:

Now, let's delve deeper into the data. What can those numbers tell us?

I know you want the best spot, the one that makes lots of money and keeps your finances safe in the future. But guess what?

The Singapore office market is full of options.

Sure, Suntec City offers the glitz and glam, a one-stop shop for your tenants with fancy waterfalls and all. But with prices down 14% from its peak, could there be a hidden catch?

Maybe some upcoming construction or a shift in tenant preferences towards more modern vibes.

Speaking of modern, Samsung Hub is right there in the heart of the action, boasting swanky facilities. The rent here might seem a tad lower than Suntec City, but vacancy rates are whisper-low, and the location is unbeatable.

Don't forget about the older buildings like Prudential Tower. It might not be brand new, but its good reputation and location in the CBD make it a reliable choice for investors who want to hold onto their property for a long time.

And getting a steady rental income is always a good thing, right?

And if you're eyeing a high return on investment, GB Building is your golden goose. With rents hovering around S$11 per square foot, that's some serious cash flow potential. Plus, its central location. is a draw for tenants.

The point is, there's a perfect fit out there for you, an investment that aligns with your goals and generates income for years to come.

But if you miss out on this data-driven approach, you might just end up grabbing the first office space that comes along, and let's face it, that could be a recipe for disaster.

RISK #1: Economic Fluctuations and Interest Rate Hikes

A slowing economy or rising interest rates can throw a wrench into anyone's investment plans. Businesses might delay expansion plans, impacting demand for office space. Additionally, higher borrowing costs could make financing an office space more expensive.

Mitigating this risk: Focus on buildings with a diversified tenant base. This way, you're not reliant on the success of any one industry. Look for properties with a strong track record of occupancy – a history of stability is a good indicator of future performance.

|

My Take: While economic headwinds are a concern, Singapore's pro-business environment and strategic location make it a relatively safe bet. But remember, diversification is key! |

RISK #2: The Rise of the Hybrid Workforce

The pandemic redefined how we work. Remote work is here to stay, and that means some companies might need less physical office space. This could lead to higher vacancy rates and potentially put downward pressure on rents.

Mitigating this risk: Look for buildings with flexible layouts that can adapt to a hybrid work model. Consider possible co-working spaces within larger developments, which cater to the needs of both established companies and smaller, flexible teams.

|

My Take: Don't just look at vacancy rates – dig deeper. Are there talks of big companies downsizing or moving out? Knowing what's coming down the pipeline can be a game-changer. |

RISK #3: Tax Implications: Personal vs. Company Ownership

If you own a property in your name, you will be liable for taxes on rental income, while if you own the property through a company, rental income is not taxed at the corporate level. However, there are risks associated with owning a property through a company if the business is a sole proprietorship.

Mitigating this risk: Keep separate bank accounts and credit cards for business and personal expenses, use accounting software to track expenses, hire an accountant for larger businesses, and digitally organize receipts and invoices.

|

My Take: If you're considering purchasing a property for your business, it's worth considering setting up a company to own it. By doing so, you can potentially reduce your income tax burden and protect your assets. |

Let's learn from others' mistakes. Here are some common pitfalls to steer clear of:

- Ignoring Location

Location is key, just like they always say. Don't get caught up in fancy names – think about who will be working there! Easy access for your tenants and staff is a must-have.

The heart of the city, the CBD, is still the top spot. Big names like GB Building and Springleaf Tower can bring in high rents.

But there are other options too!

Exciting things are happening in the suburbs, like one-north. Tech companies like SBF and Oxley Tower are setting up shop there, creating cool workspaces that attract talented people.

I can help you find the perfect spot, whether it's in the bustling center or a trendy up-and-coming area. Let's chat about what works best for you and your investment goals.

- Neglecting Due Diligence

Location and price are just the tip of the iceberg. Investigate potential hidden costs like maintenance fees and restrictions on renovations. Don't let these surprise you down the line.

- Going Solo

The Singapore office market can be intricate. Partner with an experienced realtor who can navigate legalities, negotiate deals, and provide invaluable market insights.

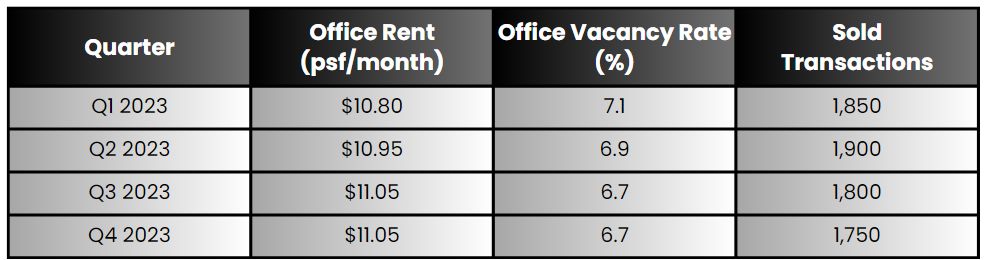

The Singapore office market has shown resilience and retained growth momentum despite market challenges.

- The Core CBD (Grade A) office rents increased by 1.7% y-o-y in 2023, outpacing the projected GDP growth of 1.0%.

- Limited supply, increasing back-to-office momentum, and steady absorption of shadow space have contributed to this growth.

- Net absorption for Core CBD (Grade A) was positive 0.10 million sq. ft. in 2023, marking the fourth consecutive year of positive absorption since 2019.

The vacancy rate of CBD Grade A offices dipped 0.4 of a percentage point (ppt) quarter-on-quarter (QoQ) to 6.7% in the fourth quarter of 2023.

However, vacancy levels have risen, and the market is still tight, with vacancy levels expected to remain tight this 2024 amidst economic headwinds. The largest development, IOI Central Boulevard Towers, comprising a Net Lettable Area (NLA) of 1.26 million sq ft, is coming online in the first half of 2024, which may impact vacancy rates and rental pressure.

Note: Data reflects trends observed in Q4 2023. Actual figures for Q1 2024 may vary.

The table above shows the approximate values for office rent, vacancy rate, and sold transactions in the Singapore office market as of Q4 2023.

As of Q4 2023, the average monthly rent for office spaces in the Core CBD (Grade A) is $11.05 psf, and the vacancy rate stands at 6.7%. The number of sold transactions has slightly decreased compared to the previous quarter, indicating a potential softening in the market.

However, the resilience of the market and the growing demand for quality office spaces and flexible workspaces suggest a positive outlook for the second half of 2024.

|

As of 27 March 2024 – Prime office rental in Singapore has continued its steady upward trajectory. According to the leading real estate services and investment firm, Core CBD (Grade A) rents maintained the consistent pace of growth observed over the past four quarters, rising 0.4% q-o-q in Q1 2024 to reach S$11.95 per square foot. This also marks the 12th consecutive quarter of growth, over which rents have hiked a total of 14.9% since 2021. |

FIRST UP, SUSTAINABILITY IS THE NEW COOL.

Tenants these days are looking for eco-friendly spaces, and buildings with green certifications, Solitaire for example. They not only save the planet, but they can also save you money on energy bills – win-win!

In a recent survey, MNCs prefer to lease buildings with green mark for image reasons.

SPEAKING OF MONEY, TECHNOLOGY IS KING.

Imagine buildings that practically run themselves! Smart features and seamless connections with proptech solutions are becoming the norm.

This means less maintenance fee in long run and a smoother experience for your tenants.

AND LASTLY, DON'T FORGET ABOUT HAPPY TENANTS!

Wellness is a big deal these days, and buildings that prioritize tenant well-being are in high demand. Think green spaces for relaxation, on-site fitness centers for those post-work workouts, and maybe even healthy food options to keep everyone energized.

These perks can make a huge difference in attracting and retaining top talent for your tenants, which means more money in your pocket!

|

|

By staying on top of these trends, you can make a smarter investment and future-proof your property.

Let me help you find a building that ticks all the boxes – sustainability, technology, and well-being. We can create a winning combination that will attract top tenants and keep your investment thriving!

So, interested in setting up your office in Singapore?

There are many reasons why companies choose Singapore – growing your business, reaching new markets, or maybe just finding a great place to work. This guide gave you some things to think about, but there's a lot more to consider.

The good news? I can help!

As your Singapore realtor, I know the market inside and out. I can help you find the perfect office space that fits your needs and budget. We can work together to make sure your Singapore investment is a success.

Ready to get started? Let's chat