|

Project |

Location (District) |

Average/Key Price PSF |

Notes |

|---|---|---|---|

|

Hillhaven |

D23 |

$2,120 psf |

Sold out in <2 years; last units transacted up to $3.01m (4-bed) |

|

The Botany at Dairy Farm |

D23 |

$2,147 psf |

Strong suburban performance before 2026 |

|

Altura |

D23 |

$1,491 psf |

Sold nearly all units, showing strong demand across different price points |

|

The Myst |

D23 |

Median $2,044 psf |

Near sell-out despite market slowdown |

If Demand Is Weak, Why Did This District 23 Condo Sell Out So Fast?

If you have been following Singapore property news lately, you might be confused.

On paper, analysts are talking about “slowing demand”. Headlines say sales volume is down and price growth has eased. And yet, one **District 23 condo quietly sold out in under two years at around $2,120 psf on average, even without buyers lining up around the block.

If demand truly is weak, why did buyers still show up and pay up?

In this article, let's understand how money actually moves when markets turn selective, and more importantly, what smart investors do next.

The Real Data Behind “Weaker Demand” in Singapore

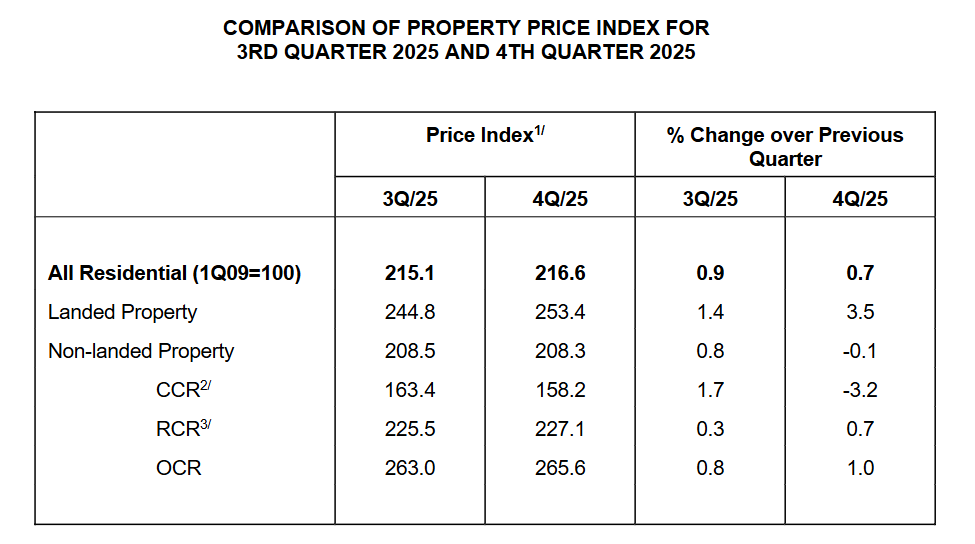

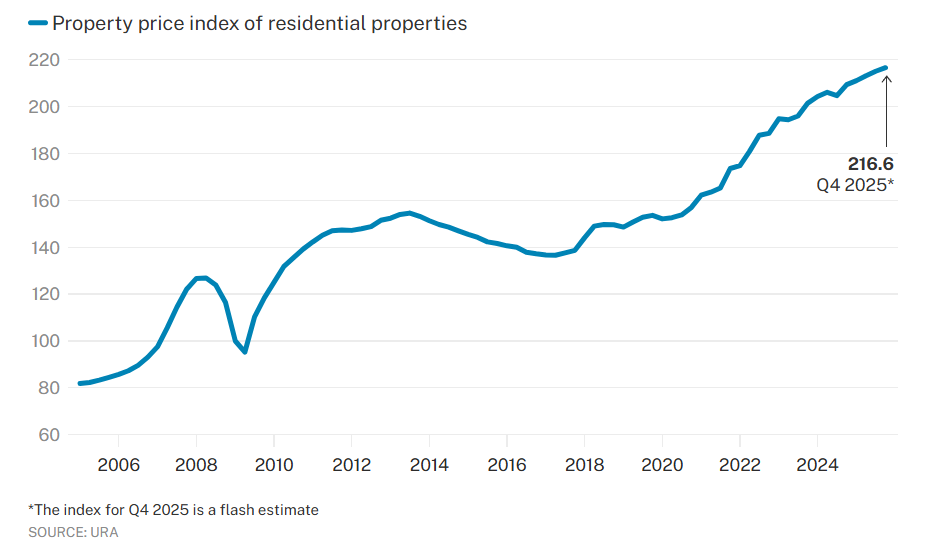

Source: URA

- Singapore private home prices rose 3.4% in 2025 — the slowest annual growth since 2020.

- Q4 2025 saw prices climb just 0.7% quarter-on-quarter.

- By comparison, prices grew 6.8% in 2023 and 8.6% in 2022.

- Growth is trending downward, but it hasn’t turned negative. Demand is moderating, not collapsing.

Meanwhile, public housing (HDB) resale prices increased by 2.9% in 2025, also slower than in previous years.

Transaction volumes tell the same story: HDB resale volumes fell almost 10% year-on-year, and Q4 sales were down nearly 19% compared with the previous year.

Taken together, these figures show a cooling market compared with the frantic growth of the pandemic years.

But here’s what the headlines aren’t telling you…

“Weak Demand” Means Selective and Smarter Demand

When I say the market is selective, data backs it up:

- Over 10,600 new private homes were sold in 2025, a four-year high.

- Some segments, like suburban condos and larger flats, are attracting serious interest.

- Premium resale flats and certain HDB segments continue to see million-dollar transactions, even as volumes slow.

Singapore Projects That Defy “Weak Demand” With Strong Sales

Key Takeaways from These Numbers

- Select segments still command strong demand, especially new launches with good location and pricing (e.g., Hillhaven, The Botany).

- Prices remain respectable even where markets are slowing, suburban OCR condos still fetched $1,490–$2,100+ psf.

- Sell-out speed matters more than headline price; some projects moved nearly all units before completion, showing real buyer commitment.

- These results help explain why “weak demand” doesn’t mean buyers disappeared — they’re just choosing differently.

How the District 23 Sell-out Defies the Narrative

It succeeded because it answered the right questions that today’s buyer actually asks:

- Location that matches real life

District 23 (Bukit Panjang / Choa Chu Kang) isn’t Orchard Road, but it ticks the boxes for families and upgraders looking for space, accessibility, and value relative to CCR prices.

This is organic demand. When buyers are cautious, they default to places that feel safe, familiar, and livable.

- Pricing that feels fair

At around $2,120 psf, buyers didn’t feel they overpaid relative to resale and future value — even if headline growth was slower. - Design and living quality that matters

Practical layouts, useful space, and amenity access matter far more to serious buyers today than “status.”

In a selective market, this combination wins deals.

If your mindset is still: “I’ll wait until the market fully recovers.” Then you’re already too late. Great opportunities never wait.

The Investor’s Dilemma: Stagnation vs Opportunity

I’ve been in this industry long enough to see the same cycles repeat.

The people who do well are rarely the loudest.

They’re usually the ones who take time to think clearly, ask better questions, and move before certainty feels comfortable.

If you’re still reading, it tells me something. You’re trying to make a considered decision.

So here’s the honest question I ask many of my clients:

Is your capital working hard enough where it is today?

Singapore property still holds value — there’s no question about that. But value alone doesn’t always lead to meaningful growth.

If most of your portfolio sits in standard Singapore condo units, it’s normal to feel unsure about the next step. Many investors I speak to aren’t lacking interest; they’re lacking clarity on where to go next and how to begin.

That’s where a second opinion often helps.

Across Australia, we’re seeing clear signals:

- National house prices rose 8.6% in 2025

- Perth (+15.9%), Darwin (+18.9%), and Brisbane (+14.5%) outperformed expectations

- Melbourne and Sydney remain steady, with fundamentals pointing toward further growth in 2026

These numbers don’t mean everyone should rush overseas. They simply mean opportunities exist, if you know how to assess them properly.

If You’re Unsure Where to Start, Let’s Talk

If you’re feeling undecided, unsure where to start, or just want to check your options, you don’t need to figure it out alone. Let me help you.

Message us now!