IS IT A GOOD TIME TO ENTER MARINA BAY DISTRICT 1?

The Singapore Marina Bay area.

This iconic bayfront has captured the hearts of visitors and investors alike, Boasting unparalleled sophistication and a thriving economic landscape. With its rich history dating back to 1969, the area has undergone a significant transformation, becoming a leading financial center, a civic space, and a community playground for all.

The Marina Bay area has some of Singapore's most luxurious properties. These developments have contributed to the area's growth and put it on the map for global investors.

However, the recent real estate market in District 1 is experiencing a drop with property prices reflecting the area's desirability.

Is this something we should look at closely?

And if now is the right time to invest in the Marina Bay area?

That's what we'll explore in this article, taking into the economic landscape, the real estate market, gap opportunities, the regulatory environment, and potential challenges and risks.

By the end of this journey, you'll clearly understand whether the Marina Bay area is a good investment opportunity.

So, let's dive in and discover if the Marina Bay area is a good time to invest in!

Singapore

Economic Landscape

The Marina Bay area has been a significant contributor to Singapore's GDP, with projects like Marina Bay Sands generating billions of dollars in tourist revenue and creating thousands of jobs.

Singapore GDP Growth Rate (3years)

The government's vision for the Marina Bay area has been instrumental in its transformation into a leading financial center, a civic space, and a community playground for all.

The Urban Redevelopment Authority (URA) has played a crucial role in shaping the area into Singapore's new downtown for the 21st century.

The development of Marina Bay was designed to integrate luxury hotels, shopping centers, and public spaces, creating a modern and vibrant cityscape.

Investors can benefit from the area's strong economic foundations and the government's commitment to maintaining a favorable business environment.

The Marina Bay area's thriving economy, state-of-the-art infrastructure, and attractive real estate market make it an appealing destination for global investors

SINGAPORE REAL ESTATE MARKET

The real estate market in the Marina Bay area is experiencing a drop in prices reflecting the area's desirability. Likely due to the foreigner demand impact from ABSD increase. However, the demand-supply dynamics are favorable, and upcoming Greater Southern Waterfront (GSW) projects are set to further elevate the market's allure.

These incoming developments are not only reshaping the physical landscape of Marina Bay but also laying the foundation for a thriving business and real estate ecosystem. The area's evolution into a leading financial center and a vibrant civic space is a testament to its potential for long-term growth and prosperity.

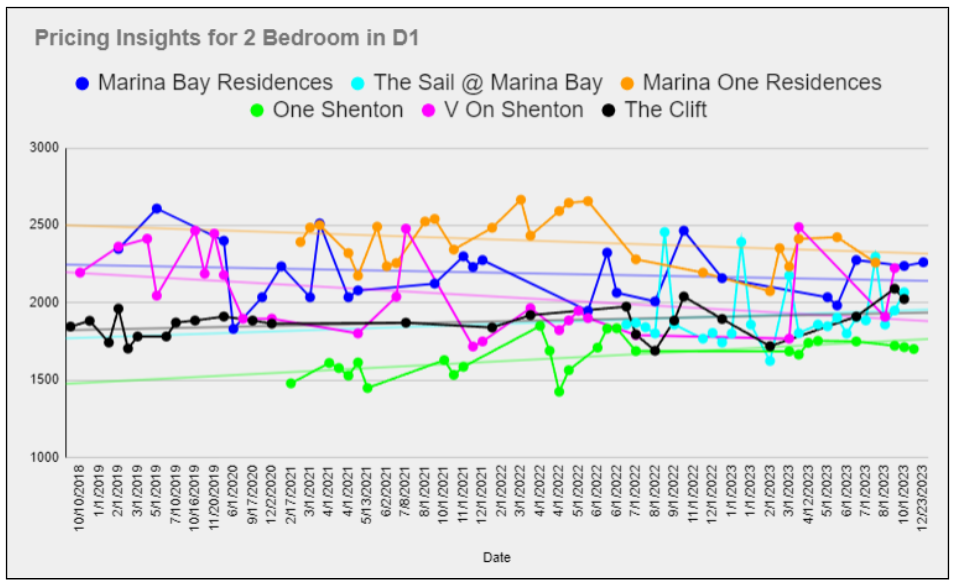

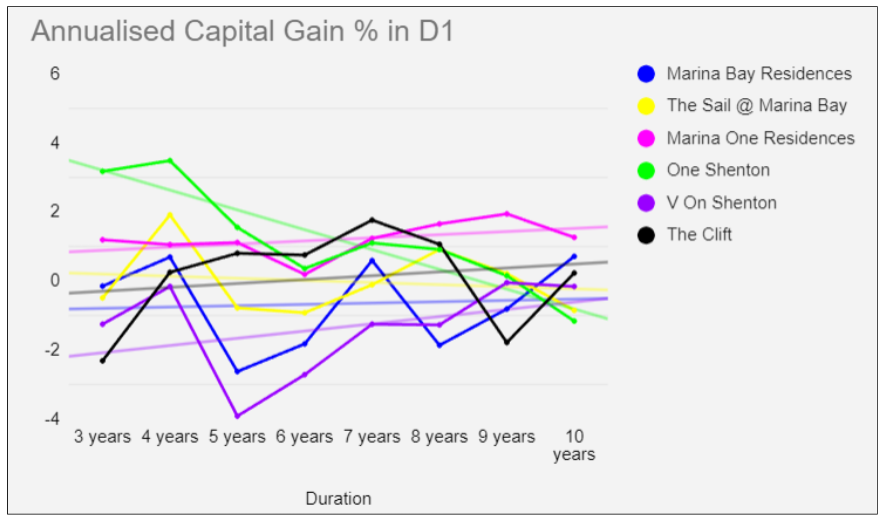

D1 Comparison of Prices and Trends

The 6 key developments in District 1, Singapore, namely Marina Bay Residences, The Sail @ Marina Bay, Marina One Residences, One Shenton, V On Shenton, and The Clift, offer unique value propositions for real estate investors. Here's an analysis of the pricing insights and trends across these developments to showcase the opportunities and identify good deals.

Based on the data above, it is clear that the psf price for the six key developments in District 1 varies significantly.

Marina Bay Residences and Marina One Residences have the highest psf prices, while The Sail @ Marina Bay and The Clift have relatively lower psf prices. V on Shenton and One Shenton have psf prices that fall in between.

It is worth noting that the psf prices for some of these developments have been falling in recent months, making it a good time to enter the market. (provided its within the strike zone).

Market Entry Timing: The Good Deals

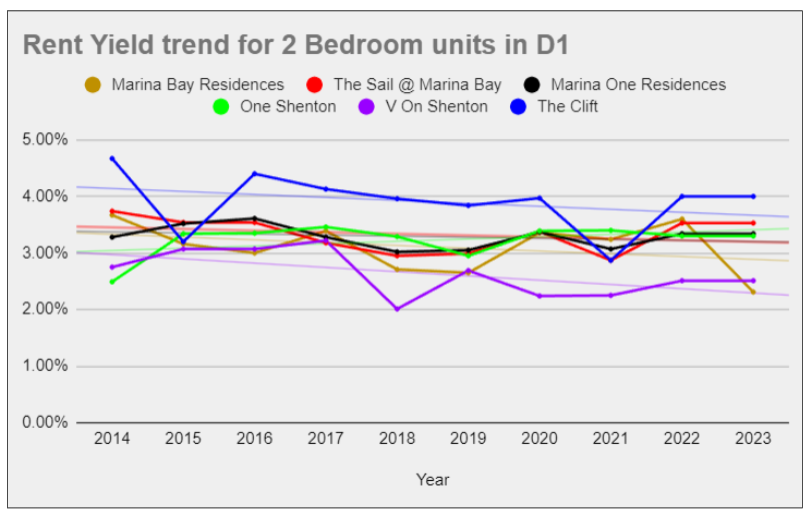

When considering the "good deals" among the listed properties, it's important to analyze various factors such as the current price per square foot (psf), rental yield, and capital gain over the past years.

- The current prices (psf) for these developments range from S$1,825 to S$2,914 psf.

- The average psf for a 2-bedroom unit ranges from S$1,709 to S$2,292.17.

- The capital gain over the past 8 years ranges from -1.15% to 1.27%, while the rental yield ranges from 2.31% to 4%.

Based on the data below,

Marina Bay Residences has the highest psf.

One Shenton has the lowest psf.

The Clift has the highest rental yield.

The capital gain over the past 8 years is positive for most developments, except for One Shenton.

In terms of good deals, Marina Bay Residences and Marina One Residences current prices are lower than their launched prices, making them a potential good deal for buyers.

Additionally, Marina One Residences has a positive capital gain and a rental yield of 3.34%, making it a good investment opportunity.

The Clift is another option worth considering, showing a positive 4% in terms of rental yield. This could be an attractive option for investors seeking stable rental income.

Challenges and Risks

While the opportunities are abundant, it's essential to acknowledge the potential challenges and risks, such as market saturation and competition. A balanced approach to risk assessment is crucial for informed decision-making.

By carefully considering these challenges and risks, global property investors can make informed decisions about their investment strategies in the Marina Bay area. It is essential to conduct thorough due diligence, stay updated on market trends, and seek professional advice to navigate these factors effectively.

5 Reasons to Invest in the Singapore Marina Bay Area

Explore Prime Investment Opportunities in Marina Bay Area with Expert Insights

So, is it a good time to enter the Marina Bay area?

The answer is yes. The Marina Bay area in Singapore is a location that should not be overlooked. With its thriving economy, a ready pool of tenants, excellent connectivity, and prestigious location making it an attractive reason to invest, The Marina Bay area offers the potential for substantial long-term growth.

However, investing in the Marina Bay area comes with its own set of challenges and risks. It is crucial to have a complete understanding of the market dynamics (the right price to enter) and long-term potential before making any investment decisions. That's where I come in.

If you are a property investor seeking a prime investment opportunity, I invite you for a one on one consultation. By leveraging my expertise and gaining valuable insights, you can make informed investment decisions that align with your aspirations and objectives.

The clock is ticking, and the potential for lucrative returns awaits. Contact me now to explore these investment opportunities and gain a competitive edge in the market.