|

Project |

Tenure |

Avg PSF |

Completion |

Units |

|---|---|---|---|---|

|

Upperhouse |

99 yrs |

$2,917 avg |

2029 |

~301 |

|

Klimt Cairnhill |

Freehold |

$3,380–$5,500 |

2023 |

138 |

|

19 Nassim |

99 yrs |

~$3,400 avg |

2024 |

101 |

|

Cuscaden Reserve |

99 yrs |

~$3,100 avg |

2023 |

192 |

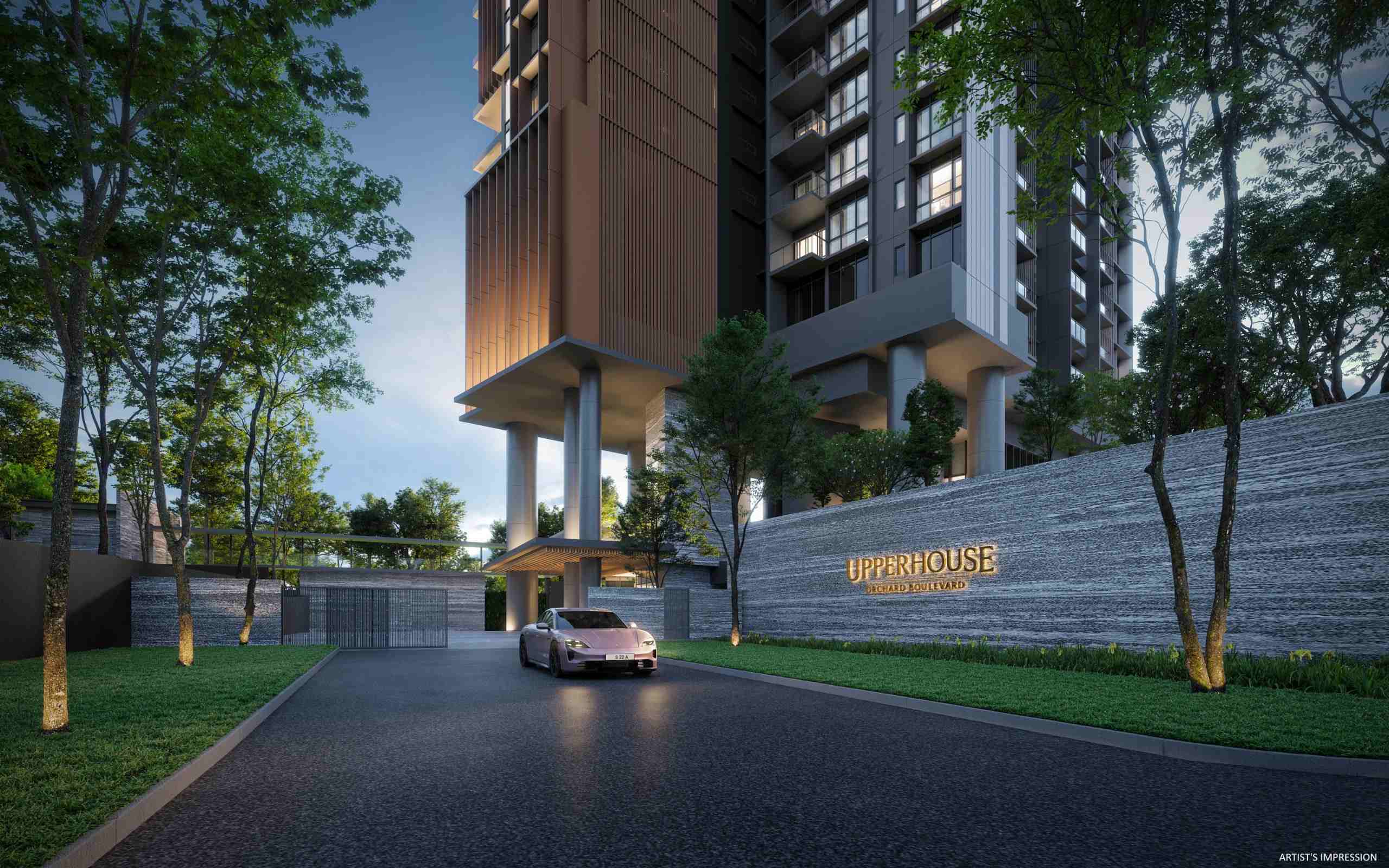

Is This Orchard’s Last $2,900 PSF Launch?

Orchard launches today are few and far between. And when one comes up below $3,000 PSF, it deserves your full attention.

The one I’m watching?

Upperhouse at Orchard Boulevard — launching officially on July 12, 2025.

This review is for serious buyers. I’ll walk you through everything — the good, the great, and the things to consider.

Why Upperhouse Is a Big Deal (Location, Location, Location)

Upperhouse sits at 22 Orchard Boulevard District 10— a street lined with embassies, international schools and elite condos like Four Seasons and St. Regis. This is an ultra-prime location where projects often command $4,000–$5,000+ PSF.

You’re literally next to Orchard Boulevard MRT, with easy walks to:

- Tanglin Mall, Camden Medical, Forum, and ION Orchard

- Diplomatic zones and five-star hotels

- ISS International School and Overseas Family School

If I could sum up Orchard Boulevard in one line:

“It’s where old money, new wealth, and global elites quietly coexist.”

And this kind of real estate isn’t being built anymore — the land’s already spoken for.

Who’s Behind It: UOL & Singapore Land Group (Massive Green Flag)

If you’ve ever walked past The Nassim, MeyerHouse, or any of the Pan Pacific Hotels, you’ve seen their work.

UOL doesn’t just build condos, they build timeless legacies. So yes — in terms of developer credibility, this is a green flag.

This gives me, and many of my clients, massive confidence.

What’s the Product Like?

Upperhouse is a 35-storey, single tower with 280–301 units, offering all bedroom types from 1+Study to 4-Bedrooms.

Here’s what stood out to me when I visited the showroom and reviewed the plans:

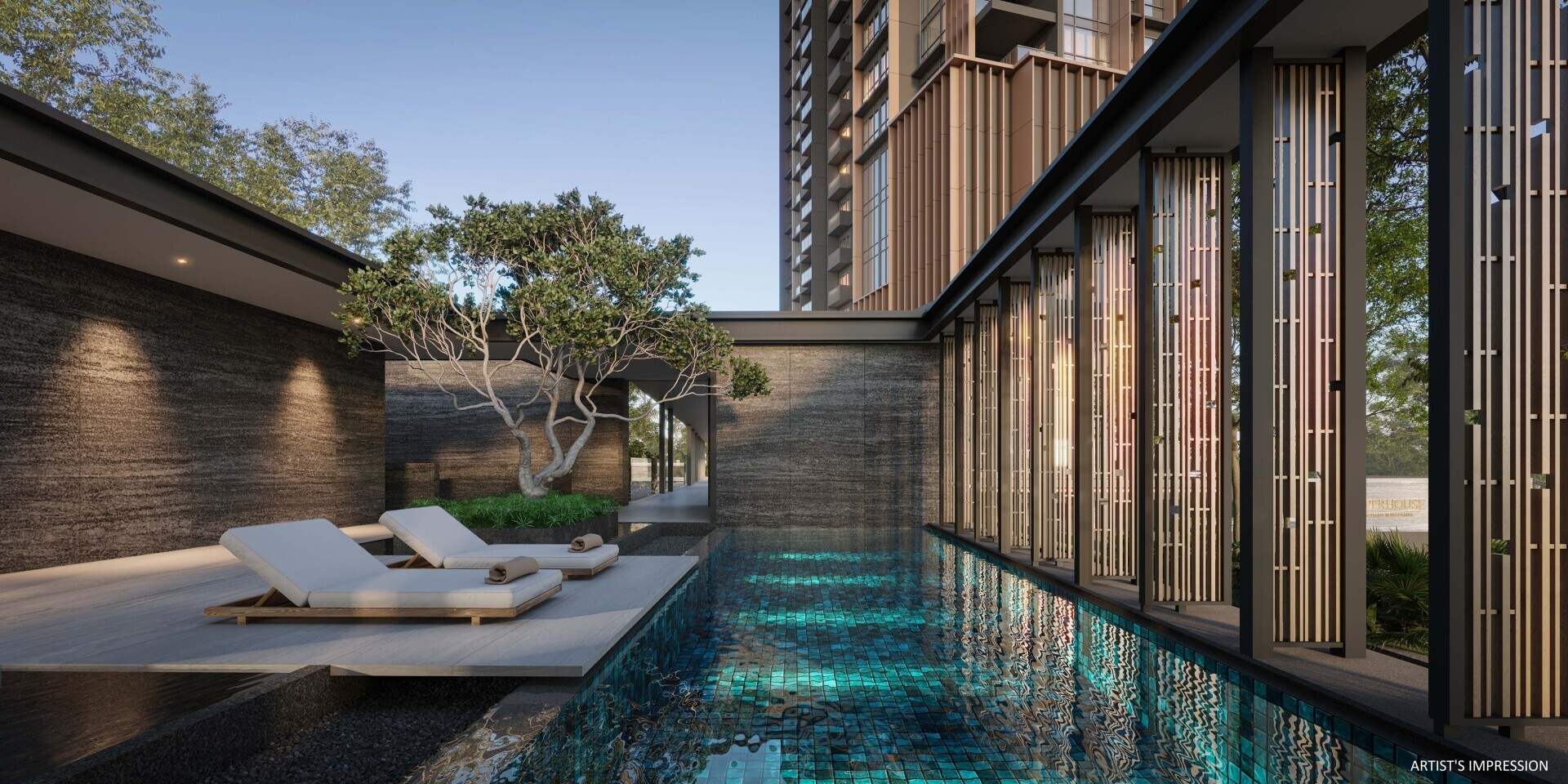

What I Really Like:

- Private lift access (for selected larger units)

- Swiss appliances and Italian cabinetry — elegant, durable, premium

- Interiors by Massone Ong — designed to evoke calm, light, and luxurious restraint

- Infinity pool, hydro spa, fully equipped gym and wellness spa, sky gardens and landscaped communal areas, exclusive clubhouse and private dining pavilions, etc — real wellness, not just gimmicks

- Thoughtful, modern layouts that actually work for tenants and owners

- 4-bedroom stacks enjoy unblocked greenery and skyline views

It’s not loud. It’s not flashy. It’s the kind of place that makes you exhale the moment you walk in.

And let me add this —monthly maintenance fees are only ~S$680/month — unheard of for District 10 luxury of this standard.

This makes it not just beautiful, but practical too.

But Let Me Be Real With You…

- It’s 99-year leasehold — not freehold

- Completion is in 2029 — not for urgent movers

But that’s why it’s priced this way.

You’re paying 2025 prices for a 2029 Orchard asset — that’s strategic buying.

And from a macro view?

Singapore’s luxury market is stable, Orchard has long-term value, and CCR supply is shrinking. This is one of the last few new plots in the area.

Let’s Talk Numbers (Updated June 25, 2025)

Now stack that next to W Residences:

- 1-Bedroom: From $2.1xM | 570 sqft | ~$3,8xx psf

- 2-Bedroom: From $2.8xM | 710 sqft | ~$3,9xx psf

- 3-Bedroom: From $5.4xM | 1,195 sqft | ~$4,5xx psf

- 4-Bedroom: From $13.xM | 2,250 sqft | ~$5,800 – $6,000 psf

- 5-Bedroom: From $16M | 2,809 sqft | ~$5,700 psf

- Penthouses: Price upon request

Upperhouse is the best value proposition in the CCR today. Period.

You’re entering Orchard from just $1.5M for a one-bedroom, with PSFs averaging around $2,917. That’s prime D10 pricing before the next wave of premium launches kick in.

What About Rental Returns?

Expected rental income (based on market trends):

- 1BR: ~$6,000/month

- 3BR: ~$10,000–$13,000/month

Estimated gross rental yield: 2.5% to 3.5%. Let’s be upfront — that’s not considered high compared to the ideal 5%+ many investors aim for.

But that’s not the point here.

The strength of this project is in its prime location and low early entry prices. You’re buying into Orchard while it still starts under S$3,000 PSF. That’s the real upside.

With demand from medical, diplomatic, finance, and global families, this is easy to rent out. You’re not chasing tenants — they’re coming to you.

So… Why Is It Still Available?

Because smart buyers move when the crowd is distracted.

In 2025, the market is selective — but when sentiment shifts, it shifts fast.

The best stacks? They’re still here — for now. But remember, the next time Orchard launches a new condo, you’ll probably be looking at $3,800–$4,000 PSF minimum.

So, if you’re thinking of entering Orchard at a reasonable price — this is probably your last chance for the next decade.

It’s easy to wait. But it’s the early buyers who always win.

Let’s Talk — Before the Launch Begins

Singapore will always have Orchard. But not everyone will have Upperhouse.

Let’s make it yours. Message us now!