|

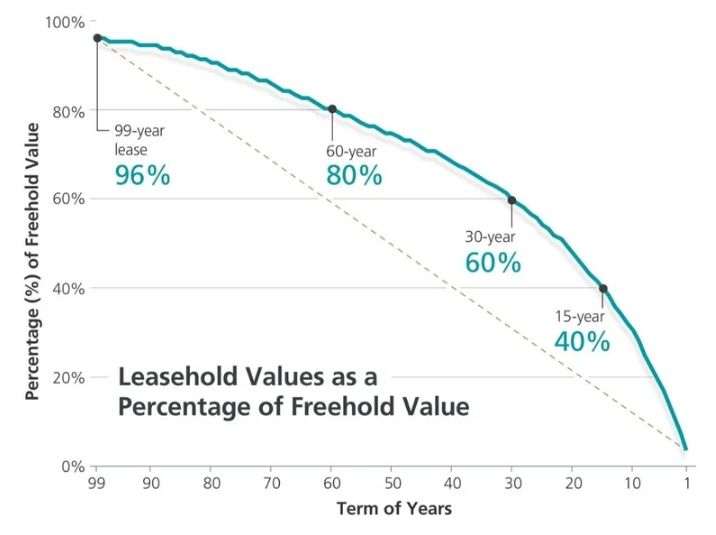

This depreciation is not linear; it accelerates as the lease term decreases, which can lead to concerns about long-term value retention. Potential buyers and investors often perceive older leasehold properties as less desirable, which can further exacerbate depreciation. |

Leasehold Properties in Singapore: Are They Worth The Risk?

The choice between leasehold and freehold properties often sparks intense debate.

For many potential investors, particularly those eyeing older leasehold developments, a big question arises:

Are Leasehold properties worth your time and money?

You may find yourself weighing the merits of leasehold properties, especially the older 99-year leasehold types. With rental gains potentially offsetting declining values, understanding market trends and data is crucial in making an informed decision.

This article delves into the current state of the Singapore property market, the challenges facing aging leasehold properties, and the implications for property owners and investors.

Let me guide you through the nuances of investing in leasehold properties, especially the aging 99-year leasehold types, so you can make the best decision for your future.

Understanding Leasehold Properties

Leasehold properties in Singapore typically come with a predetermined lease term of 99 years. Once the lease expires, ownership reverts back to the state unless extended, often at a cost determined by the Singapore Land Authority (SLA).

While this structure may sound daunting, leasehold properties offer unique advantages that can appeal to savvy investors.

Depreciation and Market Perception

The value of leasehold properties typically begins to decline significantly around the 70th year of the lease, following a pattern known as the "Bala’s curve" in real estate.

This perception can create a cycle where declining values lead to reduced demand, making it challenging to sell or refinance these properties.

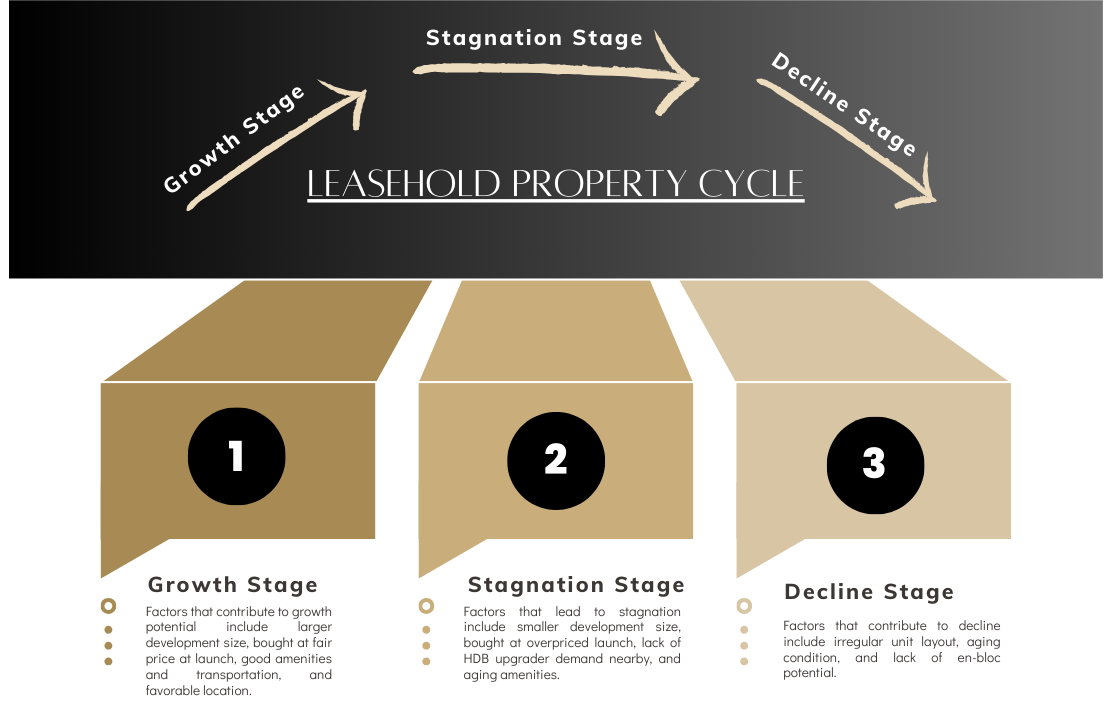

The 3 Stages of a Singapore 99-Year Leasehold Property Investment Life Cycle

Market Stability and Recent Trends

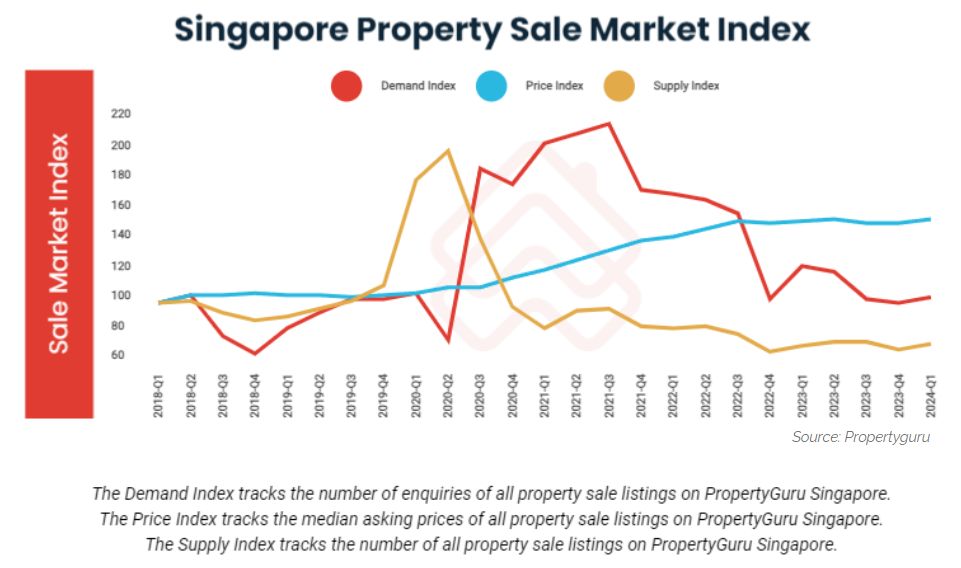

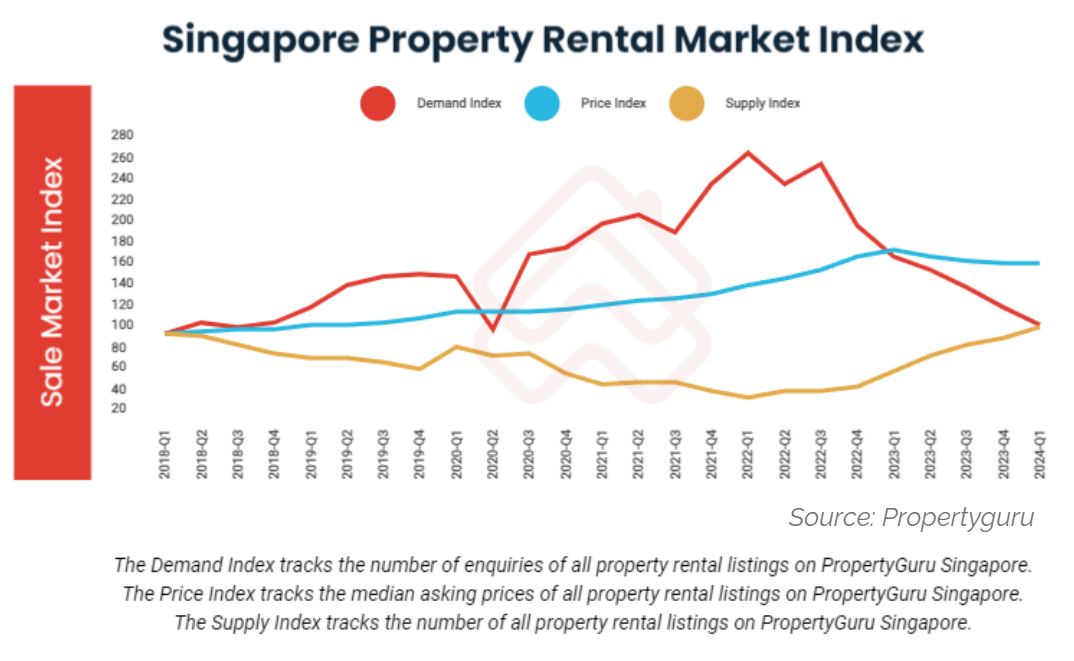

As of Q1 2024, the Singapore residential market has shown signs of stability, with both demand and asking prices maintaining levels similar to those observed in late 2023.

The Singapore Property Sale Demand Index for residential homes saw a moderate increase of 2.9%, while the median asking prices experienced a year-on-year (YoY) increase of 1.0% in Q1 2024. This indicates a cautious yet steady market amid global uncertainties.

However, the rental market is cooling, with a 13.5% decrease in demand leading to a decline in the Property Rental Price Index for the fourth consecutive quarter.

This cooling rental market is influenced by several factors, including the completion of new housing projects that have introduced additional supply into the market.

In 2023, Singapore saw the highest number of completions since 2016, with over 21,284 new private homes, which has further alleviated rental demand pressures.

The Appeal of Rental Gains

One of the most compelling arguments for investing in older leasehold properties is the potential for rental income. Despite the gradual depreciation of property values as they approach the end of their lease terms, many older leasehold properties continue to generate attractive rental yields.

This is particularly advantageous for investors focused on cash flow, as rental income can offset the declining property values.

Examples of Leasehold Property Performance

Successful Investments

- Park West

Developed by City Development Limited (CDL), one of Singapore's largest property developers, Park West was completed in 1986 and consists of 432 residential units across 16 floors.

Over the past 10 years, the property has demonstrated:

- Average rental yield of approximately 3.41%

- Average price of S$849 per square foot

- Capital gains of 3.74% for 2-bedroom units

Residents enjoy access to a range of nearby amenities, educational institutions, and medical facilities like clinics and pharmacies.

Park West has maintained its value. Its proximity to public transportation and major expressways, the wide range of recreational facilities and 24-hour security, and being developed by CDL, a well-respected name in the industry, contribute to Park West's reputation as a desirable living option.

- Glentrees

Completed in 2005 and developed by Leonie Court Pte Ltd, a subsidiary of CapitaLand Residential, Glentrees consists of 176 units spread across 9 blocks.

This unique development is designed with garden enthusiasts in mind, featuring private enclosed spaces, open terraces, and themed gardens that enhance the living experience.

Key metrics for this successful investment include:

- Average rental yield: Approximately 5.03%

- Average selling price: S$ 1,821/sqft

- Average rental price: S$ 3.56 psf pm

- Capital gains for 2-bedroom units: 3.01%

Residents enjoy access to several amenities, including:

- Clubhouse

- Fitness corner

- Jacuzzi

- Lap pool

- Playground

- 24-hour security

Situated in a desirable residential neighborhood, Glentrees is conveniently located near Dover MRT station and several reputable schools. The area is also well-served by shopping and dining options, making it an attractive choice for families and individuals.

Strong rental yield, unique design and amenities, and strategic location—these elements collectively demonstrate how Glentrees exemplifies successful leasehold property performance, making it a noteworthy investment in Singapore's real estate landscape.

- Kerrisdale

Kerrisdale is located at 36 Sturdee Road in the Kallang area. Completed in 2005, it consists of 3 blocks with a total of 481 units ranging from 2 to 5 bedrooms.

Key metrics for this successful investment include:

- Average rental yield: Approximately 3.8%

- Average selling price: S$ 1,529.5/sqft

- Average rental price: S$ 4.5 psf pm

- Capital gains for 2-bedroom units: 2.58%

- The development offers a range of facilities, including BBQ pits, a clubhouse, gymnasium, jacuzzi, parking, playground, security, swimming pool, and wading pool

Kerrisdale's spacious units and excellent facilities have made it a popular choice among young couples and investors, attracted by its prime location.

The strong rental yield, selling price, and capital gains demonstrate Kerrisdale's success as a leasehold property investment in Singapore's competitive real estate market.

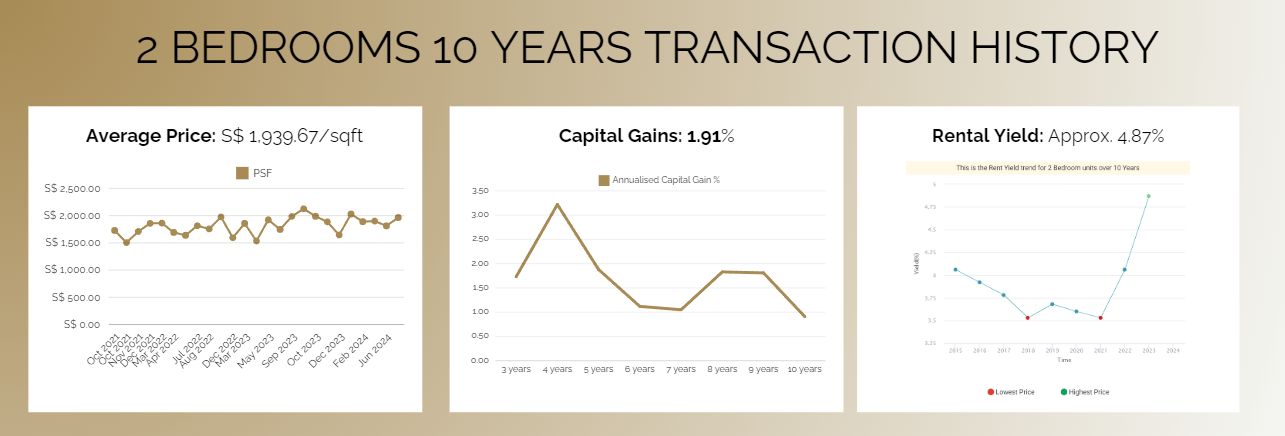

- Icon

Completed in 2007, Icon is located at 10 Gopeng Street in the Downtown Core area. The development consists of 1 block with a maximum of 46 floors, offering a total of 646 units. It was developed by Lucky Pinnacle Pte Ltd, part of the renowned Far East Organization.

Key metrics for this successful investment include:

- Average rental yield: Approximately 4.87%

- Average selling price: S$ 1,939.67/sqft

- Average rental price: S$ 4.5 psf pm

- Capital gains for 2-bedroom units: 1.91%

Facilities

Icon offers a range of facilities for its residents, including:

- BBQ area

- Clubhouse

- Gym

- Hydrotherapy pool

- Jacuzzi

- Jet pool

- Lap pool

- Open terrace

- Playground

- Reflective pool

- Sauna

- Security services

- Steam room

- Tennis court

- Wading pool

Icon primarily features 1 and 2-bedroom units, with floor plans ranging from 936 to 1,249 square feet. This diversity caters to the needs of various homebuyers and investors.

Icon's prime location is a significant factor in its success. It is situated just a 2-minute walk from Tanjong Pagar MRT station, providing convenient access to the rest of Singapore.

The surrounding neighborhood is bustling with various amenities and services, adding to the appeal of the development.

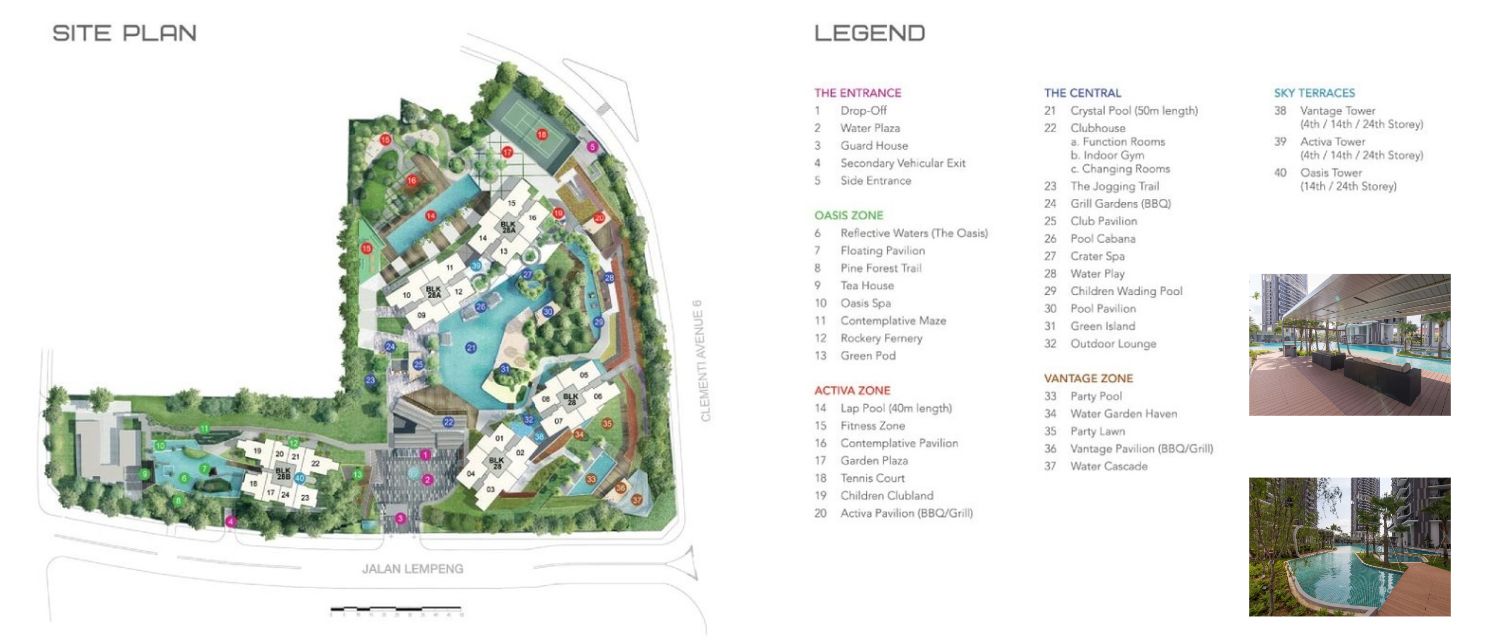

- The Trilinq

The Trilinq, a condominium development located in Clementi, Singapore, has proven to be a successful investment for those focused on rental yields and capital appreciation.

Over the past 10 years, the property has demonstrated:

- Average rental yield of approximately 3.64%

- Average price of S$1,743 per square foot

- Capital gains of 2.5% for 2-bedroom units

The Trilinq is situated in a prime location, just a short walk from the Clementi MRT station and Clementi Town Centre. It offers easy access to a wide range of amenities and public transportation.

Additionally, it is only one MRT stop away from the Jurong Gateway district, which is being developed into Singapore's second Central Business District, further enhancing its appeal for both residents and investors.

- Reflections at Keppel Bay:

Reflections at Keppel Bay is a luxury waterfront residential development located in Keppel Bay, Singapore. Completed in 2011, it offers 1,129 units across six distinctive curved glass towers and 11 low-rise villa apartment blocks.

Over the past 10 years, the property has demonstrated:

- Average rental yield of approximately 4.07%

- Average price of S$ 1,796.55/sqft

- Capital gains of 0.29% for 2-bedroom units

This performance exemplifies the resilience and potential of leasehold properties as successful investment opportunities, despite the challenges typically associated with leasehold developments.

- It was designed by renowned architect Daniel Libeskind, known for projects like the World Trade Center Memorial masterplan

- The complex offers panoramic views of Mount Faber, Sentosa Island, and the golf course

- Reflections at Keppel Bay has won numerous awards, including the FIABCI Prix d'Excellence Award (Residential High-Rise) in 2013 and the BCA Universal Design Mark Platinum Award in 2013.

Location and Amenities:

- Reflections at Keppel Bay is located along Keppel Bay View, off Telok Blangah Road

- It is within walking distance to HarbourFront Centre and VivoCity shopping malls, and a free shuttle bus is provided for residents to VivoCity

- The nearest MRT station is Telok Blangah MRT station

- Nearby amenities include childcare centers, a grocery store, and kindergartens

Leasehold vs. Freehold: Understanding the Dynamics

I've observed the growing interest in leasehold properties among investors. While these properties typically offer lower purchase prices compared to freehold options, they also come with unique challenges as they approach the end of their lease terms.

While leasehold properties offer lower entry costs, they also come with the risk of declining values as the lease term approaches its end.

Freehold properties, on the other hand, provide the security of perpetual ownership but typically require a higher initial investment.

When considering a leasehold property, it's crucial to carefully evaluate the remaining lease term, the property's condition, and its potential for capital appreciation and rental income.

Properties in prime locations with strong rental demand and the potential for lease extensions or en-bloc redevelopment may offer better long-term prospects.

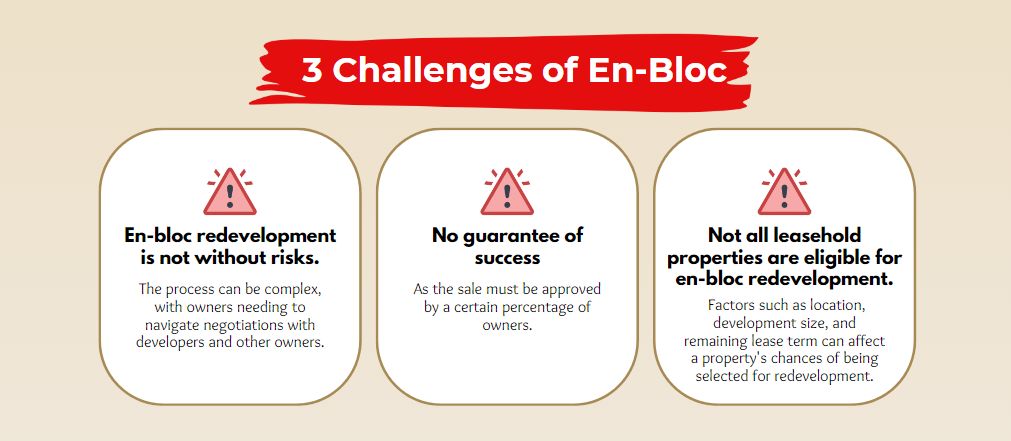

En-Bloc Redevelopment: Opportunities and Risks

En-bloc redevelopment can significantly impact the value of leasehold properties, particularly those in prime locations or with significant remaining lease terms.

When a development is successfully en-bloc'd, property owners receive a premium above the current market value, which can offset the impact of a shortening lease.

Therefore, understanding the potential for en-bloc redevelopment is crucial when considering an investment in older leasehold properties.

Weighing the Risks and Rewards

Investing in older leasehold properties requires a careful assessment of your investment goals and risk tolerance.

If your primary objective is to generate steady rental income, older leasehold properties can be a suitable choice, provided they are located in desirable areas with strong rental demand and are well-managed. These properties often offer higher rental yields compared to newer developments, which can be appealing for investors focused on cash flow.

On the other hand, if you are looking for long-term capital appreciation, newer properties with longer leases may offer better prospects. The potential for higher rental yields in older leasehold properties can be appealing, but it is crucial to consider the implications of accelerating depreciation as the lease term approaches its end.

Properties Facing En-Bloc Challenges

Pine Grove

Pine Grove is currently facing challenges in its collective sale attempts, marking its fifth effort to secure a buyer with a proposed sale price of S$1.95 billion.

The property, located in Ulu Pandan, has a significant history of previous unsuccessful bids dating back to 2008, with prior attempts in 2011 and 2019.

The current bid reflects a calculated land rate of approximately S$1,440 per square foot, but there is flexibility with a potential reserve price of S$1.78 billion, which would lower the land rate to about S$1,341 per square foot.

Neptune Court

Neptune Court has faced significant challenges in pursuing an en-bloc sale due to its unique ownership structure and the complexities surrounding its leasehold status. The land on which Neptune Court is built is owned by the Ministry of Finance, which requires residents to privatize the estate before they can collectively sell it.

Previous attempts at privatization have failed to garner the necessary consent from unit owners, with only about 52% supporting the effort, falling short of the 75% required for approval.

Residents have expressed dissatisfaction with the privatization process, feeling neglected by the government regarding their concerns and the valuation of their properties.

This ongoing struggle has led to frustration among the community, particularly among older residents who are eager for a resolution

Mandarin Gardens

Mandarin Gardens has also encountered difficulties in its en-bloc sale attempts. Similar to Neptune Court, it faces challenges related to owner consensus and market conditions.

The property has been on the radar for collective sales, but the lack of a strong majority among owners has hindered progress.

Additionally, the broader real estate market dynamics, including rising interest rates and economic uncertainties, have made potential buyers more cautious.

This has resulted in developers being less willing to engage in collective sales, impacting properties like Mandarin Gardens that may not meet the revised expectations for pricing and profitability.

Transform Hesitation into Action: Contact Me Now!

By now, you may be feeling overwhelmed by the complexities of leasehold investments. I completely understand, and that’s why I’m here to offer you personalized guidance tailored specifically to your unique goals and circumstances.

Whether you're aiming for steady rental returns or seeking a property for personal use, I can help you navigate the market and find the best opportunities that align with your vision.

Additionally, if you’re looking for a more secure investment option, I have access to a range of freehold projects that can provide you with peace of mind and long-term stability.

Don’t let hesitation hold you back from seizing the opportunity to invest in one of the world’s most dynamic real estate markets. Let’s connect and discuss how I can assist you in achieving your investment aspirations.

Contact Me Today!