|

District |

Areas |

|---|---|

|

10 |

Belmont Park, Bin Tong Park, Brizay Park, Bukit Sedap, Chatsworth Park, Cluny Hill, Cluny Park, Cornwall Gardens, Dalvey Estate, Ewart Park, First/Third Avenue, Ford Avenue, Fourth/Sixth Avenue, Gallop Road/Woollerton Park, Garlick Avenue, Holland Park, Holland Rise, Leedon Park, Maryland Estate, Nassim Road, Oei Tiong Ham Park, Queen Astrid Park, Rebecca Park, Ridley Park, Ridout Park, Victoria Park, White House Park. |

|

11 |

Camden Park, Bukit Tunggal, Swiss Club Road, Chee Hoon Avenue, Raffles Park, Caldecott Hill Estate, Eng Neo Avenue |

|

20 |

Windsor Park |

|

21 |

King Albert Park, Kilbum Estate, Binjai Park |

|

23 |

Chestnut Avenue |

Limited Edition Luxury: Is a Prime Good Class Bungalows (GCB) Worth It?

Good Class Bungalow (GCB) areas are the pinnacle of Singaporean real estate, offering unparalleled luxury, privacy, and exclusivity that sets them apart from the rest.

GCB has stood the test of time. In recent decades, fortunes have moved between the industries, one industry did well and the other slowed down as wealth moved between traditional to businesses that perform better.

Regardless of crisis or boom time, GCB prices on a 10-year average have never downtrend and consistently performed. If not for the ABSD intervention since 2011 property prices would have shot up.

These properties are subject to strict development guidelines set by the Urban Redevelopment Authority (URA), ensuring that their prestigious status remains intact.

But did you know that there's a subtle yet significant difference between a GCB and a landed property in a GCB area?

In this article, we'll dive into the details and help you make an informed decision about your investment.

What Exactly is a GCB Area and Why is it Special?

Good question! GCB stands for Good Class Bungalow.

Singapore's Good Class Bungalow (GCB) areas are the epitome of luxury living.

Singapore's land is very valuable and a finite resource. There's simply no more of it being made.

This scarcity is a major driver behind the consistent value appreciation of GCB properties. Owning a GCB isn't just about a luxurious home; it's an investment in a legacy asset that promises to retain and grow its value for generations to come.

In these areas, only detached homes with large plots of land are allowed, giving homeowners a lot of space and privacy.

This is different from the high-rise apartments that are common in many parts of Singapore.

Imagine hosting parties in your beautiful garden or enjoying quiet evenings under the stars. A GCB area offers a unique and luxurious lifestyle that is hard to find anywhere else.

But NOT all bungalows in Singapore are created equal.

A true GCB is a rare gem, defined by a meticulous set of criteria.

Understanding the Distinction:

PRIME GCB vs. Landed Properties

While both GCBs and landed properties within GCB enclaves reside in prestigious locations, a crucial distinction exists.

True GCBs possess both size and location qualifications.

- Only properties within the 39 gazetted Good Class Bungalow Areas (GCBAs) qualify.

These prestigious enclaves are nestled in prime districts like 10, 11, 20, 21, and 23, offering unparalleled convenience and exclusivity.

Think Orchard Road's buzz a stone's throw away, or the tranquility of Bukit Timah Hill at your doorstep.

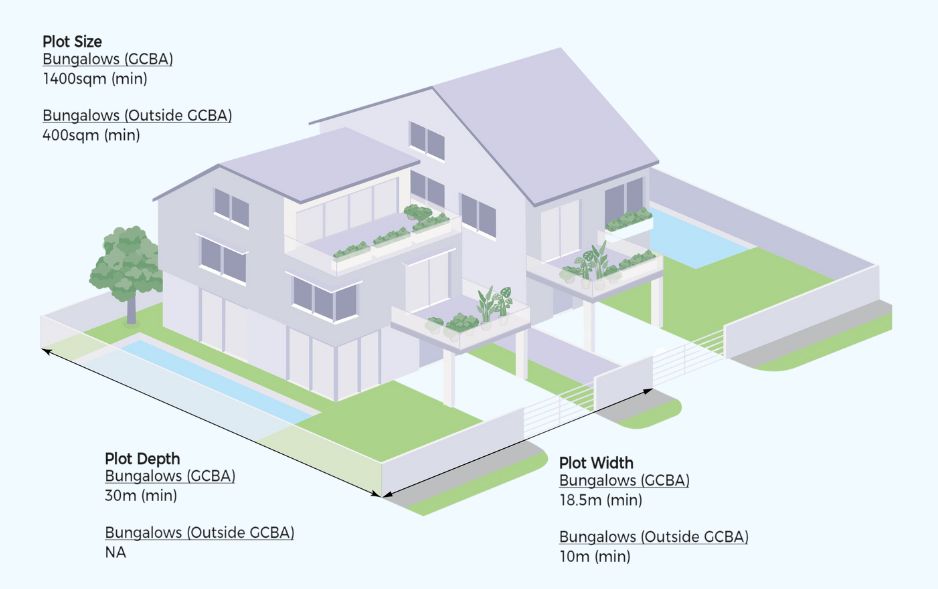

- While some landed properties boast impressive plots, a minimum land area of 1,400 square meters (approximately 15,070 square feet) is a prerequisite for a true GCB.

Landed properties, on the other hand, are defined as properties with land plots smaller than 1,400 square meters but located within designated GCB areas.

While they may not meet the strict criteria for GCBs, these properties still offer a taste of the GCB lifestyle and are highly coveted by those seeking a more affordable entry point into this exclusive market.

Investment Considerations: GCB vs. Landed Properties

Let's be honest, GCB properties come with a hefty price tag. This is a significant financial commitment, and one that shouldn't be taken lightly.

For investors seeking a taste of GCB grandeur, landed properties within GCB areas offer an attractive entry point.

Here are the 4 factors to consider when investing in a GCB or a landed property in a GCB area:

Foreign Investors: SILKROUTE to GCB Prestige

While direct ownership of a GCB is restricted for foreigners, there is only one route to own a GCB address excluding lease:

- Singapore Permanent Residency (PR): Obtaining Singapore PR opens doors to GCB ownership.

The Singapore Land Authority (SLA) considers applications on a case-by-case basis, typically favoring individuals with significant economic contributions to the nation.

This could include high-net-worth investors, entrepreneurs who create jobs, or those with exceptional talent.

|

For instance, British billionaire James Dyson, who moved to Singapore as a permanent resident (PR), was granted approval to purchase a GCB at 50 Cluny Road in Bukit Timah for $87 million in 2019. |

Other Notable GCB Purchases

Some celebrities and business leaders have successfully secured PR and subsequently purchased GCBs.

|

Mr. Zhang Yong, Founder of HaiDiLao steamboat chain: Mr. Zhang became an owner of a GCB at Gallop Road for a staggering $27 million. |

|

Stephen Riady, Executive Chairman of property developer OUE: Mr. Riady, secured a magnificent GCB on Nassim Road for a remarkable $95 million. |

|

Tony Tung, Singaporean Chairman of Winson Group: He purchased a prestigious Nassim Road GCB for a record-breaking $105.3 million. |

Imagine the unparalleled networking possibilities!

Residing in a GCB neighborhood connects you with successful individuals like these, fostering valuable partnerships and propelling your ventures to new heights.

The Benefits of Investing in a GCB or Landed Property in a GCB Area

- Prestige and exclusivity: GCBs and landed properties in GCB areas are a symbol of wealth, success, and social status, making them attractive to high-net-worth individuals and families.

-

Long-term value appreciation: These properties have historically demonstrated strong capital appreciation, making them a sound long-term investment.

- Scarcity and limited supply: With strict development guidelines and limited land available for GCBs, the supply of these properties is tightly controlled, ensuring that they remain a scarce and valuable asset.

- Rental potential: GCBs and landed properties in GCB areas can generate attractive rental income, particularly in areas with high demand from expatriates and high-net-worth individuals.

- Lifestyle benefits: Owning a GCB or landed property in a GCB area offers a luxurious lifestyle, with ample space, privacy, and access to top-tier amenities and schools.

The Challenges of Investing in GCBs and Landed Properties

While investing in GCBs and landed properties in GCB areas offers numerous benefits, there are also some challenges to consider:

GCB and Landed Property Market HISTORICAL PRICE AND RENTAL TRENDS

The Landed Property Trends

- Sales Volume: Fluctuated between 1,300 and 1,800 units annually from 2019 to 2023, with a surge in 2021 due to the pandemic.

- Prices: Despite lower sales in 2023, prices continued to rise on a per-square-foot basis:

Detached houses: +8.4% to S$1,699 psf

Semi-detached houses: +12.4% to S$1,678 psf

Terrace houses: +9.4% to S$1,888 psf

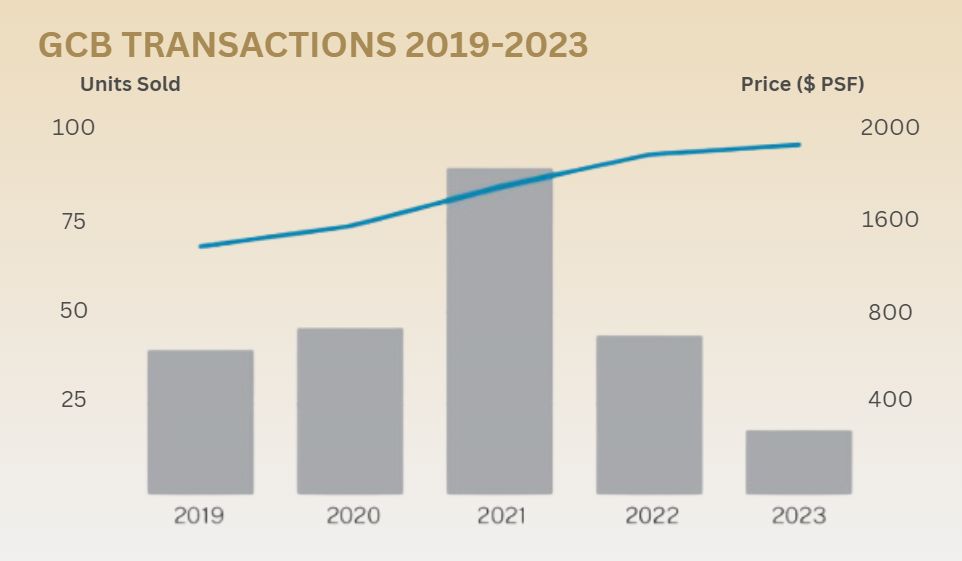

GCB Trends

- Sales Volume: 2023 witnessed the lowest sales volume (18 deals) since record-keeping began in 1996. Factors include:

-Global economic uncertainties

-Rising interest rates

-Cooling measures

-Money laundering crackdown

-High asking prices

- Prices:

Average price per square foot climbed 30% from 2020 to 2023 (S$1,477 psf to S$1,924 psf) despite lower sales volume, however, there have been some truly record-breaking sales that highlight the extreme value placed on these exclusive properties.

|

A wealthy Indonesian family acquired three adjoining bungalows on Nassim Road for a staggering S$206.7 million (approximately US$155 million). This translates to an eye-watering S$4,500 per square foot of land! This sale not only set a new record for Nassim Road, but for the entire GCB market in Singapore. |

- Rental Market:

-Previously saw exuberant rents with some exceeding S$100,000 per month.

-This trend stopped after the money laundering bust in 2023, leading to vacancies and a decline in asking rents (down 30% or more by Q4 2023).

|

FUTURE OUTLOOK Supply and Demand: The limited supply of GCBs and high demand from high-net-worth individuals and families are likely to maintain the exclusivity and value of these properties in the long term.

|

Million-Dollar Deals: Inside Singapore's Booming Market for Luxury GCBs and Landed Properties

The market for GCBs and landed properties in GCB areas has been buzzing with activity lately.

|

A remarkable transaction when a bungalow behind Four Seasons Park was sold for a staggering S$32.5 million to Cai Jun, the wife of serial biopharma entrepreneur Huang Zhenhua. This sale showcased the continued strong demand for these exclusive properties. |

|

Another near Raffles Town Club fetched S$24.9 million, and a soon-to-be-completed GCB in Sixth Avenue transacted at S$27.5 million. |

But that was just the tip of the iceberg.

|

Another three adjoining old freehold bungalows in Chancery Hill Road/Dyson Road fetched an impressive S$1,900 psf on the 32,148 sq ft of land designated for two-storey mixed landed housing. The proceeds of this S$61.1 million sale went to charities designated by the owner, demonstrating the immense value of these properties. |

|

Another notable transaction occurred in Dalkeith Road, off Dunearn Road, where an old bungalow changed hands for S$24.88 million or S$2,500 psf on the land area of 9,953 sq ft. This regular-shaped plot in one of the most prime bungalow areas in District 11 outside of GCB Areas was purchased by Melissa Shen, a former lawyer who set up her own fashion label, Ms Soignee. |

|

In the Fourth/Sixth Avenue GCB Area, property developer Platform Property is selling a new bungalow under construction for S$27.5 million or S$2,985 psf on the land area of 9,214 sq ft. This two-storey bungalow with a basement and attic features a 15-meter lap pool, five ensuite bedrooms, and eight car parking spaces in the basement. The buyer is Lau Teck Sien, an independent director on the board of the manager of BHG Retail Reit. |

This demonstrates the resilience and desirability of these properties in the current market.

Own a Legacy: Live Like Singapore's Elite in a Limited-Edition GCB

GCBs and landed properties in GCB areas are more than just homes; they're limited-edition statements of luxury and success.

These architectural gems offer unparalleled privacy, space, and a lifestyle unlike any other. With discerning buyers and a strictly controlled supply, you can be confident your property's value will only climb. But the best ones move fast.

Don't miss out on the opportunity to own a piece of Singapore's most prestigious real estate!

Contact me today for a personalized consultation and let's discuss how you can own a part of Singapore's elite property landscape.

Talk to you soon!