|

Fixed-Rate Loans |

Floating or Variable Rate Loans |

|---|---|

|

These loans have a constant interest rate for the initial few years, providing borrowers with stability and predictability in their monthly repayments. |

These loans have an interest rate that is pegged to an index, such as SIBOR, SORA, or a fixed deposit rate. They may offer lower initial interest rates compared to fixed-rate loans, making them suitable for borrowers who are optimistic about interest rate movements. |

Mortgage Interest Rates in Singapore: What Homebuyers Need to Know in 2024

The highest point of interest in Singapore in recent years reached 4.50%.

If you’ve been monitoring the real estate market in Singapore, you are likely aware of the recent fluctuations in mortgage interest rates.

But what does this mean for those planning to buy a home in Singapore in 2024 now that interest rates are trending down?

The current state of the housing market and how interest rates are affecting it are essential factors to consider.

In this article, we'll delve into the 2024 outlook for mortgage rates in Singapore, exploring the potential for rate decreases, the impact of global economic shifts, and the best home loan options available. Get ready to uncover the insights you need to make informed decisions as a savvy consumer.

2 MAIN TYPES OF HOME LOANS IN SINGAPORE

The choice between these types of loans depends on the borrower's preference for interest rate stability and their outlook on interest rate movements.

There are different home loan packages available for specific types of properties and they may have varying interest rates and features tailored to the specific property type. It's important for prospective borrowers to consider their eligibility, loan-to-value ratio, total debt servicing ratio, and other factors before choosing a home loan in Singapore.

Private Mortgage: What You Should Know Before You Borrow

When purchasing a private or landed property in Singapore, you have the option to finance your mortgage through banks or other financial institutions.

Depending on your risk tolerance and monthly installment budget, you can choose from a variety of home loan interest rates and packages.

For private properties that are still under construction, such as condos or landed properties, it is advisable to select a bank loan without a lock-in period or one that allows one time conversion upon collection of keys.

This allows you the flexibility to reprice or refinance to a lower interest rate once the property is completed.

On the other hand,

if you are buying a completed or resale private property,

there are competitive home

loans available

with fixed or floating interest rates from major banks

in Singapore.

|

It's important to note that HDB does not provide loans to private properties. |

Current Singapore Home Loan Rates:

Fixed vs. Floating

The table below presents the average fixed-rate and floating interest rates for 10 years in Singapore mortgage loan, with the current economic outlook added.

|

Loan Type |

Fixed Rates |

Banks |

Floating Rates |

Banks |

Economic Outlook |

|---|---|---|---|---|---|

|

Private Properties |

3%-4.5% |

SCB, HLF, OCBC |

4%-4.3% |

DBS, BOC, SCB |

Potential decrease |

|

Refinancing |

3%-4.7% |

HSBC, HLF, SCB, OCBC |

2.6%-4.4% |

SCB, BOC, DBS |

Potential decrease |

|

Buildings Under Construction |

4.3% |

DBS |

3.8%-4.3% |

HLF, SCB, HSBC |

Potential decrease |

The data indicates that for each loan type, the floating interest rates are generally lower than the fixed interest rates. While the current trend suggests a decrease in long-term interest rates, the economic outlook indicates a potential reversal of this trend in the near future.

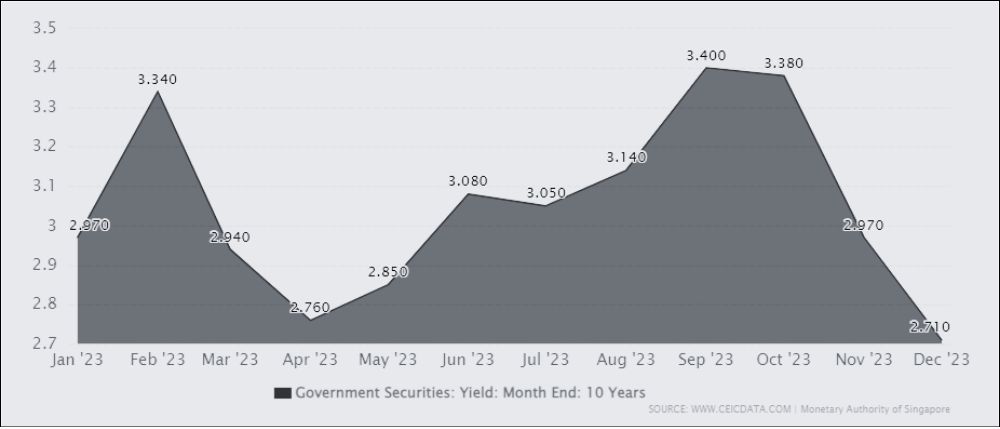

Singapore's Long Term Interest Rate from Jun 1998 to Dec 2023

|

LAST |

PREVIOUS |

MIN |

MAX |

UNIT |

FREQUENCY |

RANGE |

|

|---|---|---|---|---|---|---|---|

|

2.71 (Dec. 2023) |

2.97 (Nov. 2023) |

0.81 (Oct.2020) |

|

% pa |

monthly |

June 1998-Dec. 2023 |

The Singapore Long Term Interest Rate, specifically the Singapore Government Securities: Yield: Month End: 10 Years, was reported at 2.71% pa in Dec 2023, compared with 2.97% pa in the previous month.

However, the Singapore Average Overnight Interest Rate was last recorded at 3.79 percent and is expected to trend around 2.40 percent in 2025.

This indicates a potential decrease in interest rates in the long term.

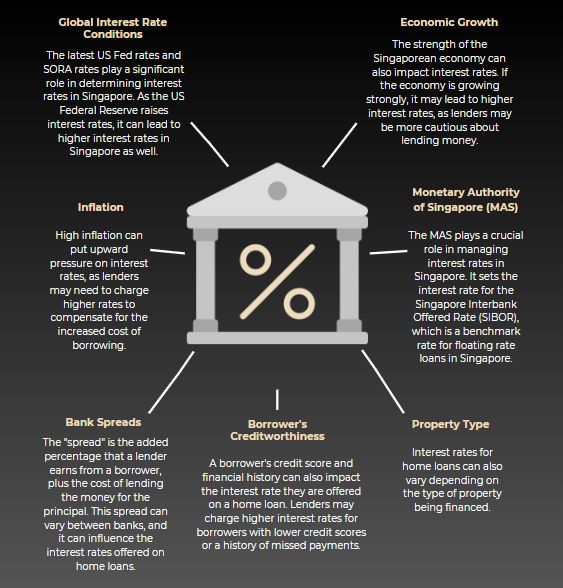

7 Factors Influencing Current Interest Rates

6 Tips to Prepare for Changes in Interest Rates in Singapore

1. Refinance into a Fixed-Rate Mortgage

If your current mortgage has a lock-in period that is about to expire, consider refinancing into a fixed-rate mortgage to lock in a lower interest rate for a longer period.

2. Consider a Shorter- Term Loan

Shorter-term loans typically have lower interest rates compared to longer-term loans. If you can afford higher monthly payments, a shorter-term loan may be a better option.

3 Research your Preferred Lender and Loan Options Early

Shop around for the best home loan rates and terms before making a decision. This can help you find the most suitable loan for your needs.

4. Maintain a Good Credit Score

A higher credit score can help you secure a better interest rate on your home loan. Make sure to pay all your bills on time and avoid taking on excessive debt.

5. Consider Alternative Financing Options

If interest rates are rising, you may want to explore alternative financing options, such as using your Central Provident Fund (CPF) savings.

6. Work with a Reliable

and Trusted Realtor

A realtor can help you navigate the complex process of buying or selling a home, provide valuable insights into the local market, negotiate on your behalf, help you save time and money by finding the best deals and guiding you through the paperwork.

By working with a realtor, you can have peace of mind knowing that you have an expert on your side who is looking out for your best interests.

Are you ready to make the biggest purchase of your lifetime?

With the current bank interest rates for mortgages in Singapore, now is the perfect time to take the leap into homeownership.

If you’re looking to buy a property, start viewing now while the pool of listings remains ample.

Don't miss out on the chance to take advantage of lower rates before competition rises!

What are you waiting for?

Contact us now as market conditions are subject to changes.