|

Property Details |

Transaction Date |

Price (S$) |

Size (sq ft) |

Price per sq ft (S$) |

|---|---|---|---|---|

|

Tanjong Pagar Conservation Area 61 Tras St Shop house |

26-Jul-24 |

$10.200M |

1618 |

$6,304 |

|

Blair Plain Conservation Area 36 Blair Rd Shop house |

18-Jun-24 |

$5.300M |

1492 |

$3,552 |

|

Boat Quay Conservation Area 8 Circular Rd Shop house |

11-Jun-24 |

$12.280M |

1188 |

$10,337 |

|

Telok Ayer Conservation Area 182 Telok Ayer St Shop house |

28-May-24 |

$16.500M |

1429 |

$11,547 |

|

Sixth Avenue 8 Sixth Ave Shop house |

21-Mar-24 |

$13.800M |

2451 |

$5,630 |

|

Kreta Ayer Conservation Area 31 Pagoda St Shop house |

13-Mar-24 |

$19.000M |

1310 |

$14,504 |

|

Kreta Ayer Conservation Area 35 Mosque St Shop house |

6-Mar-24 |

$15.930M |

1202 |

$13,253 |

|

Tanjong Pagar Conservation Area 24 Tanjong Pagar Rd Shop house |

23-Jan-24 |

$9.500M |

1752 |

$5,422 |

PRIME ASSETS LONG TERM STRATEGY

As Asia's financial and business hub, Singapore has always been a magnet for commercial real estate investment. While the first half of 2024 saw a slowdown in overall sales due to high interest rates and government cooling measures, the market is now showing signs of recovery.

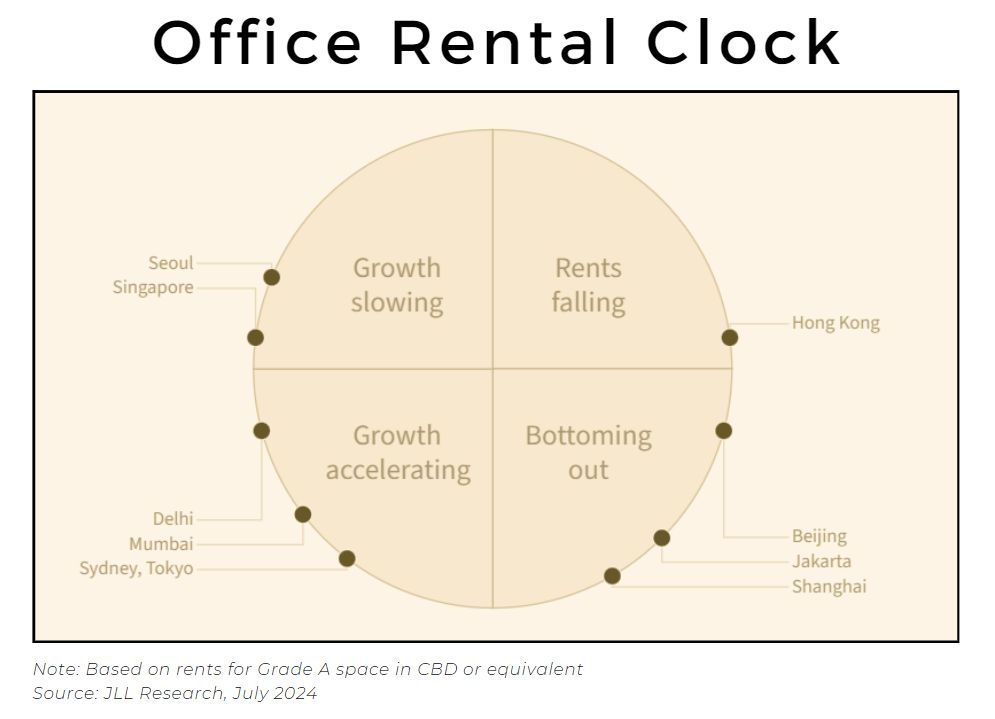

Rents in Singapore's prime office market have increased by 1.3% in the first half of 2024, signaling a stabilizing trend. This growth was accompanied by a rise in vacancy rates, particularly in the Central Business District (CBD), where Grade A office vacancies increased to 5.4% in Q2 2024, up from 3.6% in Q1.

In the Raffles Place/Marina Bay precinct specifically, occupancy is slightly higher at 95.0%, down from 95.6% in Q1 2024.

This overall occupancy trend indicates a stable demand for office space, despite with some pressures from increased supply and changing tenant dynamics in the market.

Additionally, Singapore has emerged as a leader in the Asia-Pacific region for commercial real estate investments, with an incredible 462% increase in investment volume in the fourth quarter of 2023, totaling USD 4.1 billion.

This surge marks the best quarterly performance in five years, well above the average of USD 2.5 billion.

Join us as we explore the reasons behind this comeback, the charm of shophouses, and the potential of prime locations like Suntec City.

Let’s discover how you can take advantage of Singapore's booming commercial property market and secure your financial future.

The Resurgence of Demand: What's Driving It?

We are witnessing a resurgence in demand for prime commercial assets. Watch out for 2025! Cycle moving towards Growth Acceleration.

This revival is not a temporary blip, but rather a reflection of several key factors that are reshaping the market and presenting exciting opportunities for savvy investors.

Shophouse sales surged in Q1 2024 as these deep-pocketed investors sought out unique assets with strong potential for capital appreciation.

The appeal of shophouses lies in their historical charm, prime locations, and the ability to add value through refurbishment and strategic tenant placement. With limited supply and growing interest, shophouses are poised to deliver impressive returns to those who act now.

But it's not just shophouses that are attracting attention. Strata offices, particularly in prime locations like the Central Business District, are also experiencing a surge in demand.

As the economy rebounds and businesses regain confidence, the need for high-quality office space is on the rise, with rents expected to rise by 3-5% this year.

Investors who secure strata office units in sought-after developments will benefit from stable rental income and the potential for capital gains as the market continues to strengthen.

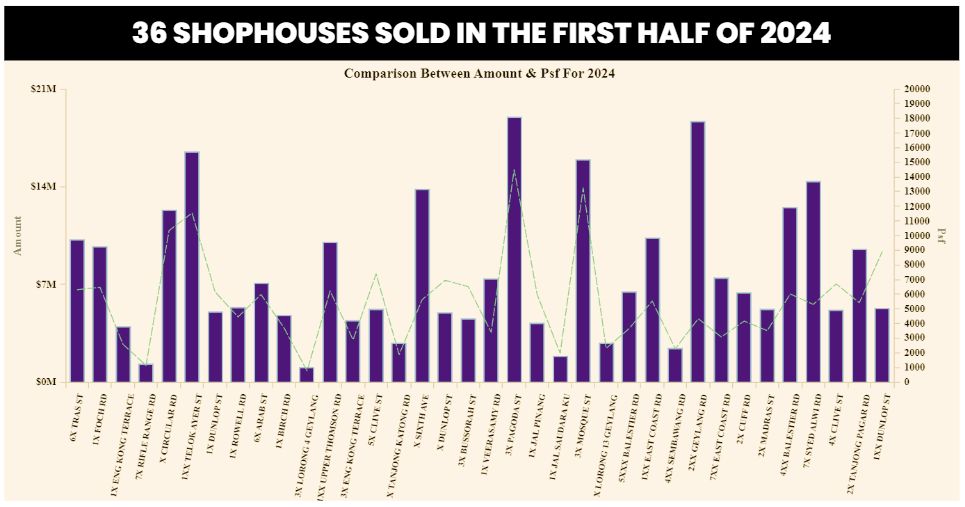

Current Movement in Shophouse Transactions

The shophouse market in Singapore is currently experiencing a complex landscape marked by fluctuating transaction volumes and prices.

In the first half of 2024, there were only 36 shophouses sold, totaling approximately S$341.7 million, a significant decline of 53.3% in transaction volume compared to the same period in 2023.

This slowdown contrasts sharply with the market's peak in 2021, which saw around 245 transactions valued at S$1.8 billion.

- Market Dynamics:

- The decline in activity is attributed to a combination of factors, including high interest rates, cautious buyer sentiment, and a mismatch between seller expectations and buyer willingness to pay.

- Most sellers are not under pressure to sell and are holding out for prices that reflect previous market peaks.

In fact, I wrote an article two months ago titled "Singapore's Shophouse Market Heats Up: Why Now Might Be the Best Time to Hold?" that tailored specifically for sellers, emphasizing the current market conditions and the potential benefits of holding onto their assets.

This perspective remains relevant as sellers continue to seek prices that align with historical highs.

Notable Transactions for Shophouses in CCR

Shophouse prices have shown variability, with freehold units generally commanding higher prices. Recent notable transactions include:

- 61 Tras Street, Tanjong Pagar Conservation Area - Sold for S$10.2 million, this property exemplifies the premium prices associated with well-located shophouses, priced at S$6,304 per square foot.

- 182 Telok Ayer Street - This shophouse fetched S$16.5 million, highlighting the desirability of the Telok Ayer area, known for its vibrant dining scene and proximity to the Central Business District (CBD).

- 31 Pagoda Street, Kreta Ayer Conservation Area - Another significant sale at S$19 million, underscoring the high demand for shophouses in culturally rich neighborhoods.

For the whole SIngapore, the average unit price for freehold shophouses reached S$5,566 per square foot, reflecting a 27.1% increase from the previous quarter.

- Investors should particularly focus on areas with high transaction volumes and historical significance, such as Tanjong Pagar, Boat Quay, and Kreta Ayer.

These locations not only offer potential for capital appreciation but also attract a diverse range of tenants, particularly in the F&B sector, which has shown strong demand for unique commercial spaces.

|

While the overall market has cooled, the transactions are not entirely stagnant. The ongoing interest from high-net-worth individuals and boutique developers indicates a potential for stabilization. |

Strata Offices vs. Shophouses: Which Investment is Right for You?

As a realtor, I often encounter potential investors weighing the merits of strata offices versus shophouses. Each property type offers unique advantages, and your financial situation will play a crucial role in determining which investment aligns best with your goals. Let's break it down.

Strata Offices: The Low-Budget Option

If you’re working with a limited budget, strata offices can be a compelling choice. Recent transactions indicate that you can find units starting from as low as $600,000 for a small office at Havelock2, priced at $1,572 per square foot. This makes strata offices accessible for first-time investors or those looking to diversify their portfolios without committing to high capital outlays.

- Average Budget for Strata Offices: Low-end: $600,000 (Havelock2)

- Mid-range: $1.5 million to $3 million (International Plaza, The Central)

- High-end: $5 million and above (SBF Center, Suntec City)

- Strata offices are particularly appealing for small and medium-sized enterprises (SMEs) and startups looking to establish a presence in Singapore’s bustling business landscape.

- The flexibility of strata office ownership means you can benefit from shared amenities and lower maintenance costs, making it an attractive option for those seeking a more hands-off investment.

Shophouses: The High-Budget Choice

For those with a higher budget, shophouses are an attractive investment avenue. These assets not only provide potential for capital appreciation but also allow for mixed-use opportunities, combining commercial and residential aspects.

Recent sales show that shophouses can command prices ranging from $5.3 million for assets in areas like Blair Plain to over $19 million for prime locations in Kreta Ayer.

- Average Budget for Shophouses: Low-end: $5.3 million (Blair Plain)

- Mid-range: $10 million to $15 million (Tanjong Pagar, River Valley)

- High-end: $16 million and above (Telok Ayer, Kreta Ayer)

- Shophouses are particularly appealing due to their heritage value and the unique character they bring to urban spaces. They are often located in vibrant neighborhoods, making them attractive to both tenants and buyers.

- They can be repurposed for various uses, from restaurants and cafes to boutique shops and co-working spaces, making them incredibly adaptable to changing market demands.

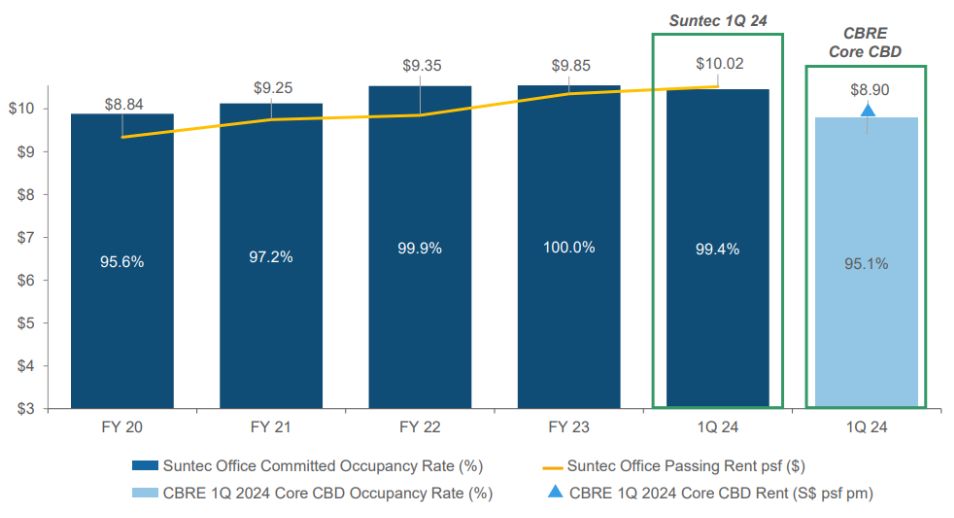

Suntec City: A Prime Investment

If you are considering a strategic investment in strata offices, one key locations that are driving momentum is Suntec City - a strata-titled commercial development.

Situated in the heart of the Downtown Core, this iconic mixed-use development has not only maintained its status as a premier business hub but has also seen significant interest from investors and tenants alike.

|

Suntec City Details |

Description |

|---|---|

|

Property Type |

Leasehold (99 yrs from 1989) commercial property completed in 1995 |

|

Components |

Five office towers- Large retail mall- Convention centre |

|

Land Area |

116,954 sqm |

|

Gross Floor Area |

479,510 sqm |

|

Investor Appeal |

Prime location in Singapore's CBD- Excellent connectivity via multiple MRT stations- Availability of amenities like car parks and drop-off points |

A full strata office floor in Suntec City Tower 1 is currently being marketed for sale. The indicative price is S$42.8 million, which translates to S$3,553 per square foot based on the total strata floor area of 12,045 square feet. (DM if interested)

Occupancy and Rent Continue to Outperform Market

Suntec City: One Year Transactions

|

Date |

Unit |

Price (S$) |

Price (psf) |

Size (sq ft) |

|---|---|---|---|---|

|

Jun -24 |

#36-XX |

16,000,000 |

3,311 |

4,833 |

|

Jun -24 |

#22-XX |

15,292,000 |

3,200 |

4,779 |

|

May -24 |

#38-XX |

5,300,000 |

3,817 |

1,389 |

|

Mar -24 |

#37-XX |

8,088,000 |

3,684 |

2,196 |

|

Dec 23, 2023 |

#null-XX |

36,226,000 |

3,513 |

10,312 |

|

Dec 23, 2023 |

#36-XX |

7,300,000 |

3,324 |

2,196 |

|

Dec 23, 2023 |

#16-XX |

14,575,000 |

3,050 |

4,779 |

|

Nov 23, 2023 |

#37-XX |

8,200,000 |

3,511 |

2,336 |

|

Jul 23, 2023 |

#19-XX |

11,612,000 |

3,100 |

3,746 |

|

Jun 23, 2023 |

#31-XX |

13,797,000 |

3,400 |

4,058 |

- This transaction history over the year highlights the consistent demand for strata office units at Suntec City. With prices averaging from S$3,391 psf with the highest being S$3,817 psf, you can see a clear trend of stable interest and appreciation in value.

- The variety of unit sizes and price points further emphasizes the appeal of Suntec City as a prime investment destination in Singapore's commercial real estate market.

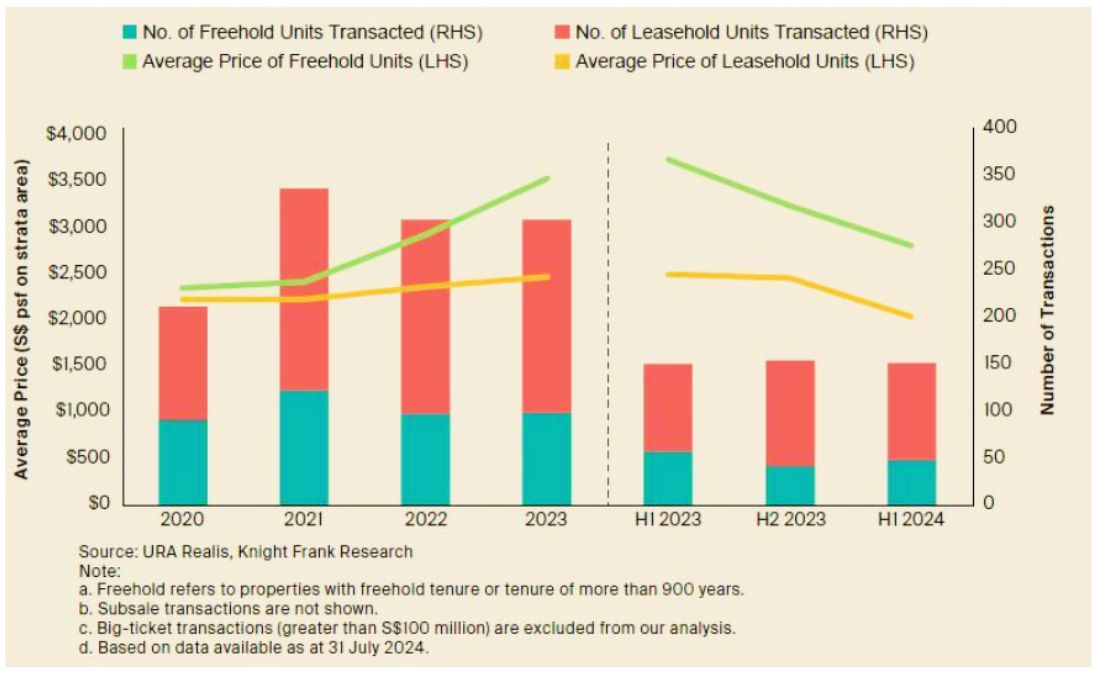

Strata Office Units Transaction Volume and Average Prices

The strata office market in Singapore has demonstrated resilience despite a decline in prices. In the first half of 2024, there were 154 strata office transactions, a slight decrease from 156 transactions in the second half of 2023.

This stability in transaction volume reflects continued interest from investors, even as the average price per square foot fell by 20.1% to S$2,190 compared to S$2,740 in the previous half-year.

Notable Strata Office Transactions in CCR

|

Date |

Address |

Unit |

Price |

Sqft |

PSF |

|---|---|---|---|---|---|

|

13-Aug-24 |

International Plaza 10 Anson Rd Office |

#19-06 |

$1.861M |

979 |

$1,901 |

|

17-Jul-24 |

Sbf Center Robinson Rd Office |

#13-070809 |

$5.825M |

1970 |

$2,957 |

|

17-Jul-24 |

The Central 8 Eu Tong Sen St Office |

#20-99 |

$2.200M |

872 |

$2,523 |

|

1-Jul-24 |

Sbf Center 160 Robinson Rd Office |

#25-06 |

$2.640M |

753 |

$3,506 |

|

27-Jun-24 |

International Plaza 10 Anson Rd Office |

#13-13 |

$1.614M |

937 |

$1,723 |

|

21-Jun-24 |

International Plaza 10 Anson Rd Office |

#22-01 |

$1000K |

474 |

$2,110 |

|

18-Jun-24 |

International Plaza 10 Anson Rd Office |

#33-06 |

$4.361M |

2357 |

$1,850 |

|

23-May-24 |

The Central 8 Eu Tong Sen St Office |

#17-90 |

$4.082M |

1206 |

$3,385 |

|

23-May-24 |

The Central 8 Eu Tong Sen St Office |

#17-89 |

$4.918M |

1453 |

$3,385 |

|

2-May-24 |

International Plaza 10 Anson Rd Office |

#18-02 |

$890K |

463 |

$1,922 |

|

26-Apr-24 |

International Plaza 10 Anson Rd Office |

#33-18 |

$380K |

161 |

$2,360 |

|

19-Jan-24 |

Gb Building Cecil St Office |

#08-01020304 |

$10.742M |

5425 |

$1,980 |

|

8-Dec-23 |

The Central 8 Eu Tong Sen St Office |

#16-81 |

$3.800M |

1216 |

$3,125 |

|

29-Nov-23 |

Sbf Center 160 Robinson Rd Office |

#12-02 |

$2.599M |

732 |

$3,550 |

|

29-Nov-23 |

Sbf Center 160 Robinson Rd Office |

#12-04 |

$2.673M |

753 |

$3,550 |

|

29-Nov-23 |

Sbf Center 160 Robinson Rd Office |

#12-03 |

$2.673M |

753 |

$3,550 |

|

18-Oct-23 |

Sbf Center 160 Robinson Rd Office |

#14-05 |

$2.550M |

754 |

$3,382 |

|

8-Aug-23 |

The Central 6 Eu Tong Sen St Office |

#07-13 |

$1.833M |

646 |

$2,837 |

|

4-Aug-23 |

The Central 8 Eu Tong Sen St Office |

#24-88 |

$1.800M |

646 |

$2,786 |

|

2-Aug-23 |

International Plaza 10 Anson Rd Office |

#17-02 |

$1.050M |

463 |

$2,268 |

- The average price per square foot for strata offices in the CBD ranges from $2,700 to $3,700, depending on the location and amenities.

- The Downtown Core Planning Area attracted the most buyers, accounting for 47 transactions with a combined value of S$190.1 million.

- Despite the challenges posed by high interest rates and price corrections, the strata office market is expected to remain active and projected to reach the total sales value of S$1 billion for the entirety of 2024.

Capitalize on Opportunity: The Time to Invest in Shophouses and Strata Offices is Now!

As the market evolves, the potential for capital appreciation and rental income is significant.

Be ahead of the herd. Recently we are in talks with more parties especially interest from Asian countries. 小弟中文还行

Whether you are considering a shophouse with historical charm or a modern strata office in a bustling business hub, the time to invest is now.

Don’t miss out on the chance to secure in Singapore’s thriving commercial real estate landscape.

Take advantage of this pivotal moment!

Contact us now!