|

PROS |

CONS |

||

|---|---|---|---|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

Property Market: Is it A GOOD TIME TO INVEST IN CCR?

Are you considering buying property in Singapore's Core Central Region (CCR)? With recent data showing a drop in ticket sizes for CCR condos by 20.5% in just five months, it's important to consider whether CCR properties are still worth buying.

This prime district is located in the heart of Singapore and is home to iconic landmarks, business amenities, and recreational destinations. Properties in the CCR are generally considered to be high-end and luxurious, with premium prices to match.

However, it is essential to note that the Rest of Central Region (RCR) and the Outside Central Region (OCR) also offer attractive investment opportunities, with lower prices and proximity to the CBD.

I know what you are thinking. With uncertainty is it risky to enter?

In this article, we'll explore the current state of the CCR property market and whether it's still a good idea to invest in this prime district. We'll also take a look at the Rest of Central Region (RCR) and Outside Central Region (OCR) to see if they offer better investment opportunities.

Join me as we explore the allure of Singapore's CCR, RCR, and OCR and discover the investment opportunities that await!

Understanding CCR, RCR, and OCR

The Singapore property market is divided into three regions: The CCR, or Core Central Region, is the most prime and expensive region in Singapore. It includes districts 9, 10, and 11, as well as the Downtown Core Planning Area and Sentosa. The OCR, or Outside Central Region, includes the suburbs and areas outside of the CCR and RCR. The RCR, or Rest of Central Region, is the region between the CCR and OCR, and includes districts 3, 4, 5, and 7 to 8.

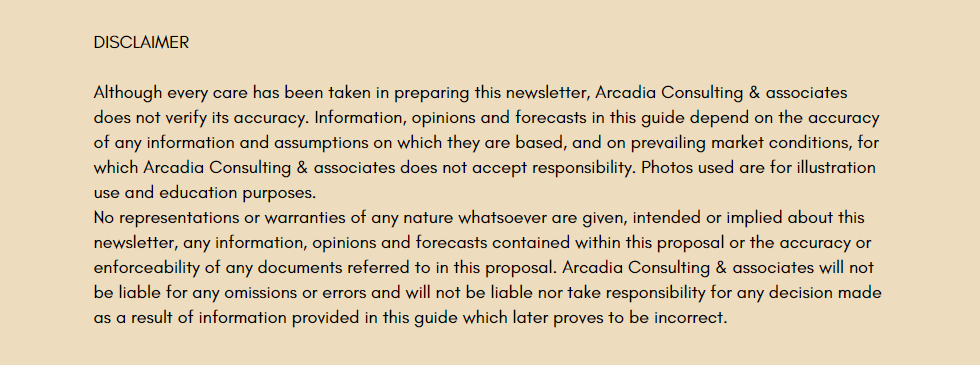

A Comparative Analysis of Property Market Outlook in OCR,

RCR, and CCR

Price Gap Analysis

- Since 2004, prices have increased substantially in the RCR and OCR; more so than the CCR.

-

The median price gap between CCR and RCR homes has narrowed to 14.9% from the 10-year average of 42.7% as of 2022. This is a significant decrease from the previous years, indicating that the RCR is becoming more competitive with the CCR in terms of pricing.

-

In March 2022, the gap in median transaction prices between CCR and RCR homes had narrowed from 32.6% in February to 20.3%.

-

As of March 2023, the price gap has further narrowed to 28.69% between CCR and RCR.

- This could be due to the "new normal" in the property market, which includes a shift towards smaller units and lower prices.

Rising Prices in RCR

- In the Rest of Central Region (RCR), property prices soared by a huge 17.72% (11.54% inflation-adjusted) in Q1 2023 from the previous year.

- It is important to consider the rising prices in the RCR when making investment decisions in the CCR.

Narrowing Price Gap Between CCR and RCR

The narrowing price gap between CCR and RCR properties could be a sign that the CCR is undervalued at the moment. However, it is important to consider the current state of the luxury residential sales market in Singapore, which has seen a decline in sales but stable prices

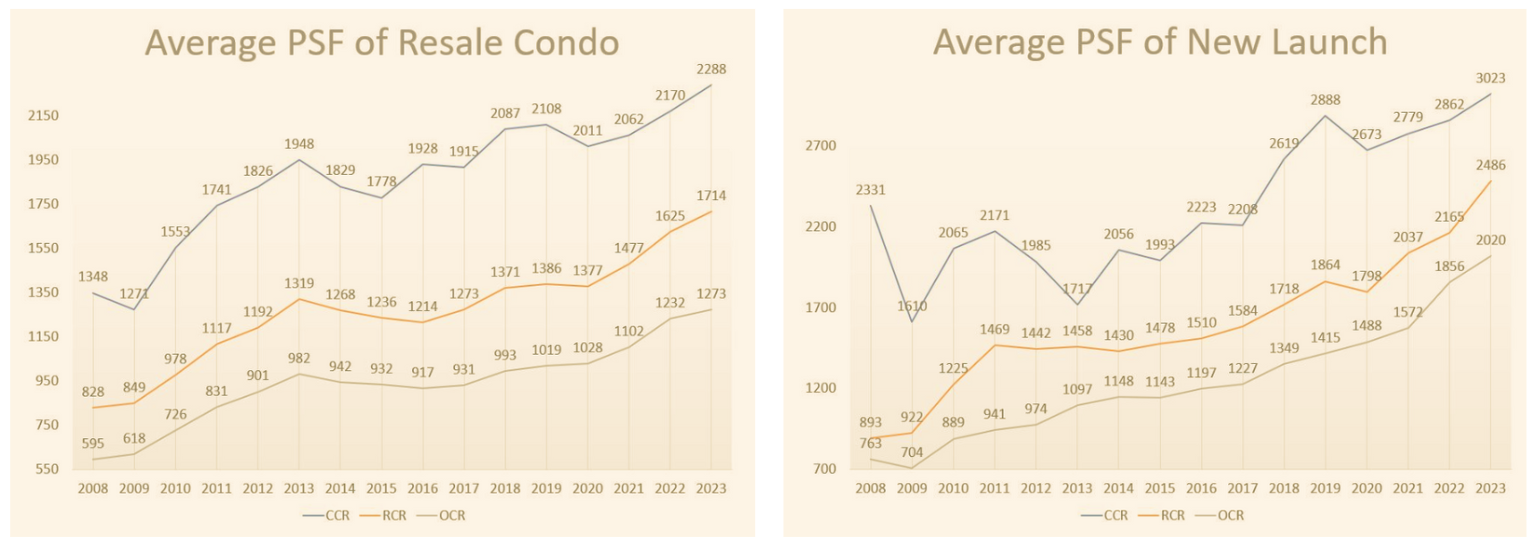

Current State of the CCR Property Market

Ticket Sizes of CCR Condos Drop 20.5% in 5 Months

- According to recent reports, the ticket sizes of CCR condos have dropped by 20.5% in the past five months. This means that the prices of CCR condos have become more affordable, making them more accessible to a wider range of buyers.

This trend is expected to continue, making the CCR property market more attractive to investors.

Development Launches and Take-up

- 613 uncompleted residential projects were launched for sale in Q1 2022, a 73% decrease from Q4 2021.

- Most units were launched in RCR region, followed by OCR and CCR.

- 1,825 units were sold in Q1 2022, a 39.5% decrease from the previous quarter.

Reasons for the Narrowing Price Gap

- Higher taxes and pandemic restrictions

- A year-on-year growth in home sales and new launch numbers in Q1 2022,

- Buyers still snapping up new condos at rising prices despite property cooling measures and economic uncertainties.

- Additionally, the CCR property market is evolving with remarkable market growth history.

Overall, the CCR property market is still a viable investment option as of September 2023. As the long-term repricing potential of Core Central Region condominiums might just surprise us 5 years later.

Property Types in CCR

- Condominiums

Condominiums are the most common type of property in the CCR. They are high-rise buildings that offer residents a range of amenities such as swimming pools, gyms, and 24-hour security. Condominiums in the CCR are known for their exclusivity, luxury, and prestige, and are highly sought after by investors and homebuyers.

- Landed Properties

Landed properties in the CCR are rare and highly exclusive. They include bungalows, semi-detached houses, and terrace houses. These properties offer residents more space and privacy than condominiums but are also more expensive.

- Commercial Spaces

Commercial spaces in the CCR include office buildings, retail spaces, and mixed-use developments. These properties are highly sought after by businesses due to their prime location and proximity to the CBD. Commercial spaces in the CCR are also known for their exclusivity and high rental yields.

Pros and Cons of Investing in CCR

Investing in the Core Central Region (CCR) of Singapore can offer several advantages, but there are also potential drawbacks to consider. Here are some of the pros and cons of investing in the CCR:

A Closer Look at Land Betterment Charges

The Singapore Land Authority (SLA) announced a revision in the Land Betterment Charge (LBC) rates, effective from the 1st of September 2023 to the 29th of February 2024.

For Use Groups A (Commercial) and C (Hotel/Hospital), the LBC rates have increased, while rates for Use Group B2 (Residential, non-landed) have decreased.

For Use Groups B1 (Residential, landed), D (Industrial), E (Place of Worship / Civic and Community Institution), and three other Use Groups F, G, and H, rates remain unchanged.

Particularly noteworthy changes include:

-

Use Group A (Commercial): LBC rates rose by an average of 0.4%. 12 sectors experienced rate increases between 3% to 4%, while the remaining 106 sectors maintained their existing rates.

-

Use Group B2 (Residential, non-landed): LBC rates dropped by an average of 3%. 111 sectors saw decreases between 3% to 11% in their LBC rates, while 7 sectors saw no change.

- Use Group C (Hotel/Hospital): LBC rates climbed by an average of 3%. 116 sectors witnessed rate augmentation between 3% to 5%, with the other two sectors experiencing no changes.

LBC Rates Summary

% average change over the previous revision

So what does this mean to investors?

The cut in LBC rates could be seen as a positive development. It could make en bloc deals more attractive to developers, leading to an increase in the supply of properties for sale. This, in turn, could put downward pressure on prices, benefiting buyers.

However, it is important to note that the en bloc market still faces several challenges, so it is too early to predict how the cut in LBC rates will impact prices.

The revision of LBC rates does not necessarily indicate a drop in value or demand but rather reflects the government's policies and efforts to manage the property market in Singapore.

Therefore, it is essential for investors to consider all the costs associated with their investment, including land betterment charges, to make an informed decision.

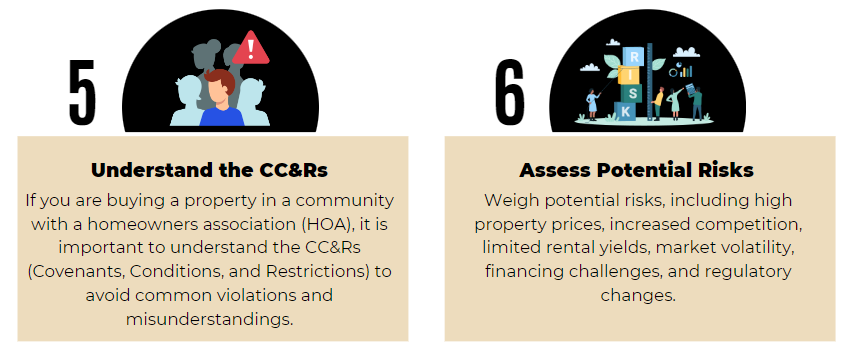

Practical Tips for Investors in the CCR

If you are considering buying property in the Core Central Region (CCR) of Singapore, here are some practical tips and advice to keep in mind:

Overall, buying property in the CCR can be a lucrative investment opportunity, but it is important to do your research and consult with a real estate professional before making any investment decisions.

The question of whether it's still a good idea to buy in the CCR property market is met with intrigue and potential. The market is dynamic, and opportunities exist for the discerning investor. However, one must exercise caution, conduct thorough research, and seek expert advice.

For those looking beyond the CCR, the OCR and RCR regions offer their own unique appeals. Each region has a story to tell, and the market is ever-evolving.

So, what's your next move?

The market is stabilizing, and prices may not continue to drop at the same rate. Invest in the CCR property market today and take advantage of the undervalued prices!