Q3 Update: Why Are Singapore Shophouses Surging?

In Q2 2025, Singapore shophouses saw 5% more transactions than the last quarter, but the total sales value surged 179% to S$332.9 million.

If there's one takeaway:

Capital is moving back into shophouses because they’re scarce, hold long-term value, and the best ones rarely hit the open market.

Why Investors Are Buying Now

1. Momentum is back at the top end.

Q2 2025 saw S$332.9m transacted (+179% vs Q1), lifted by larger deals. Volume rose to 21 deals (+5% q/q).

2. H1 2025 held up well.

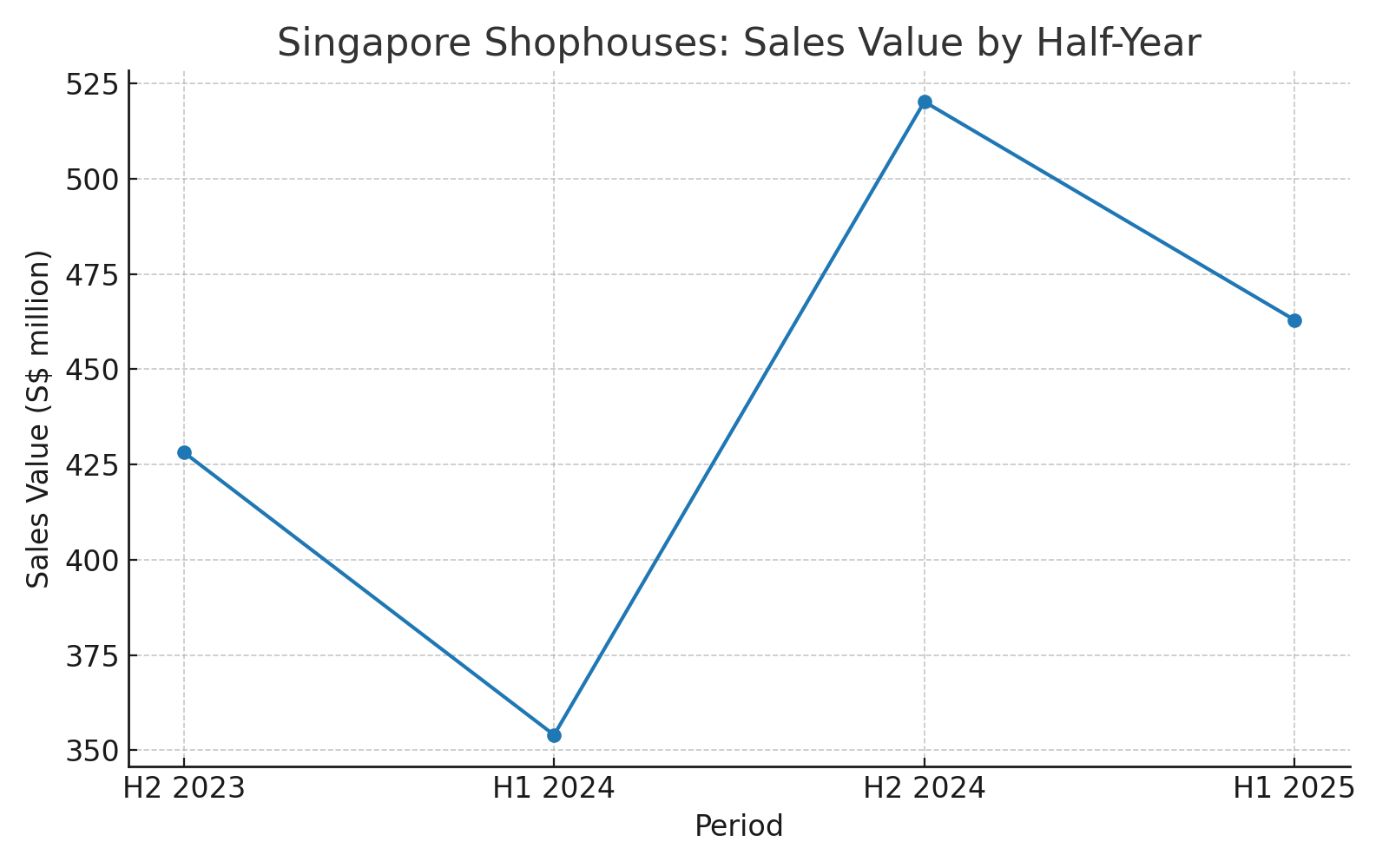

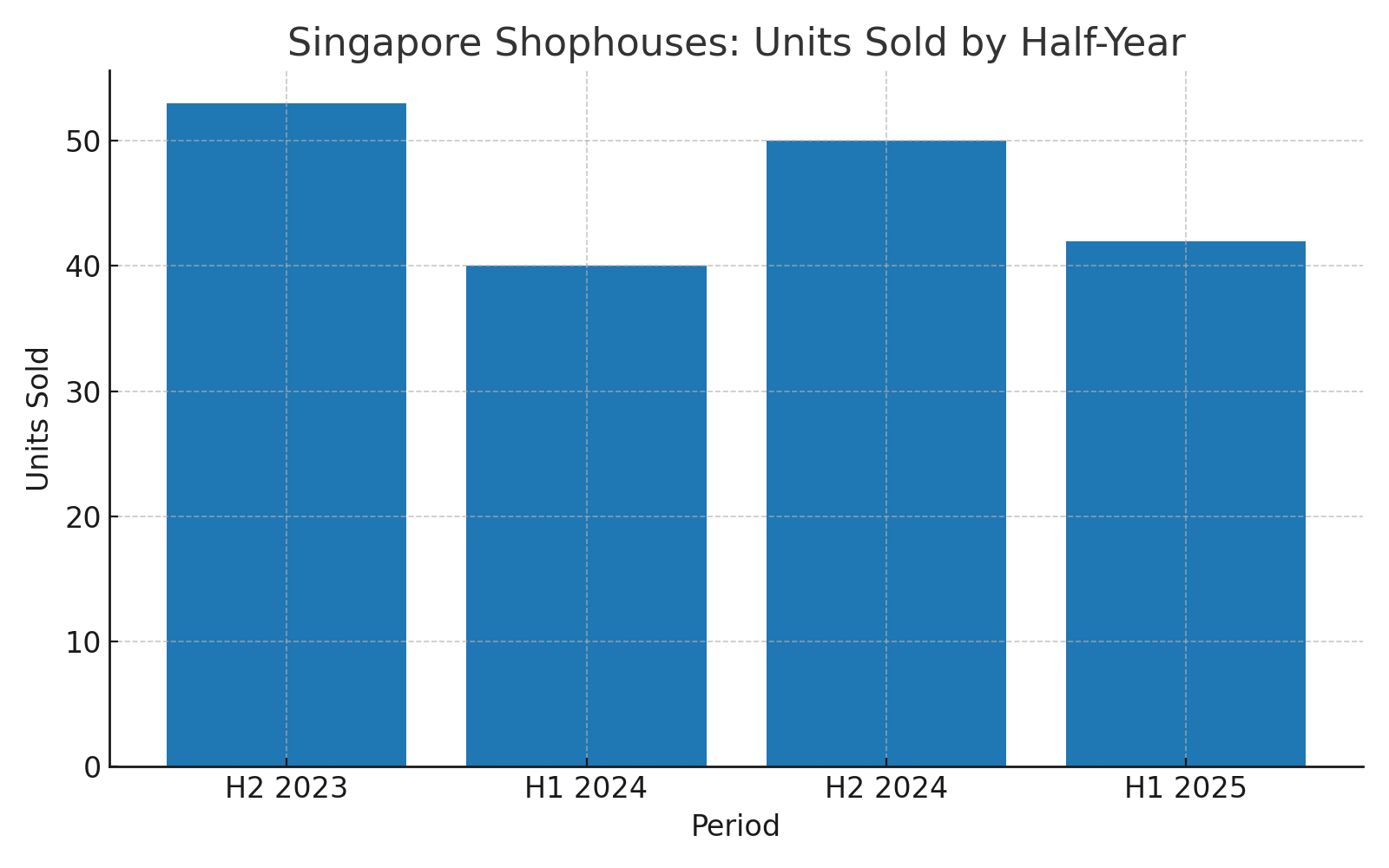

42 units changed hands for S$462.9m, just below H2 2024’s S$520.2m as buyers got pickier on pricing. Forecast for full-year 2025 is S$700m–S$800m, slightly softer than 2024’s S$947.8m, but values remain stable on prime assets.

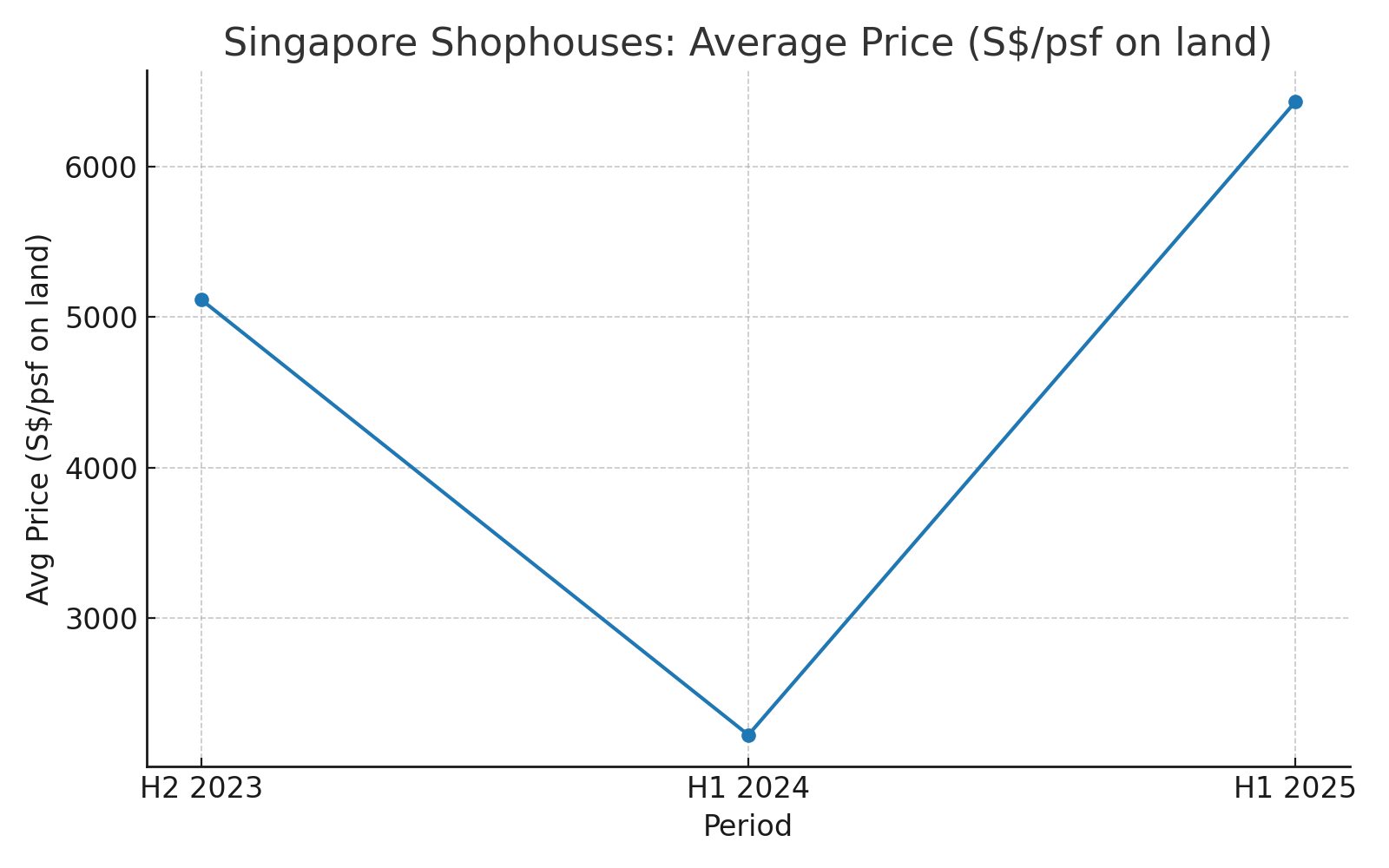

3. Prices are steady.

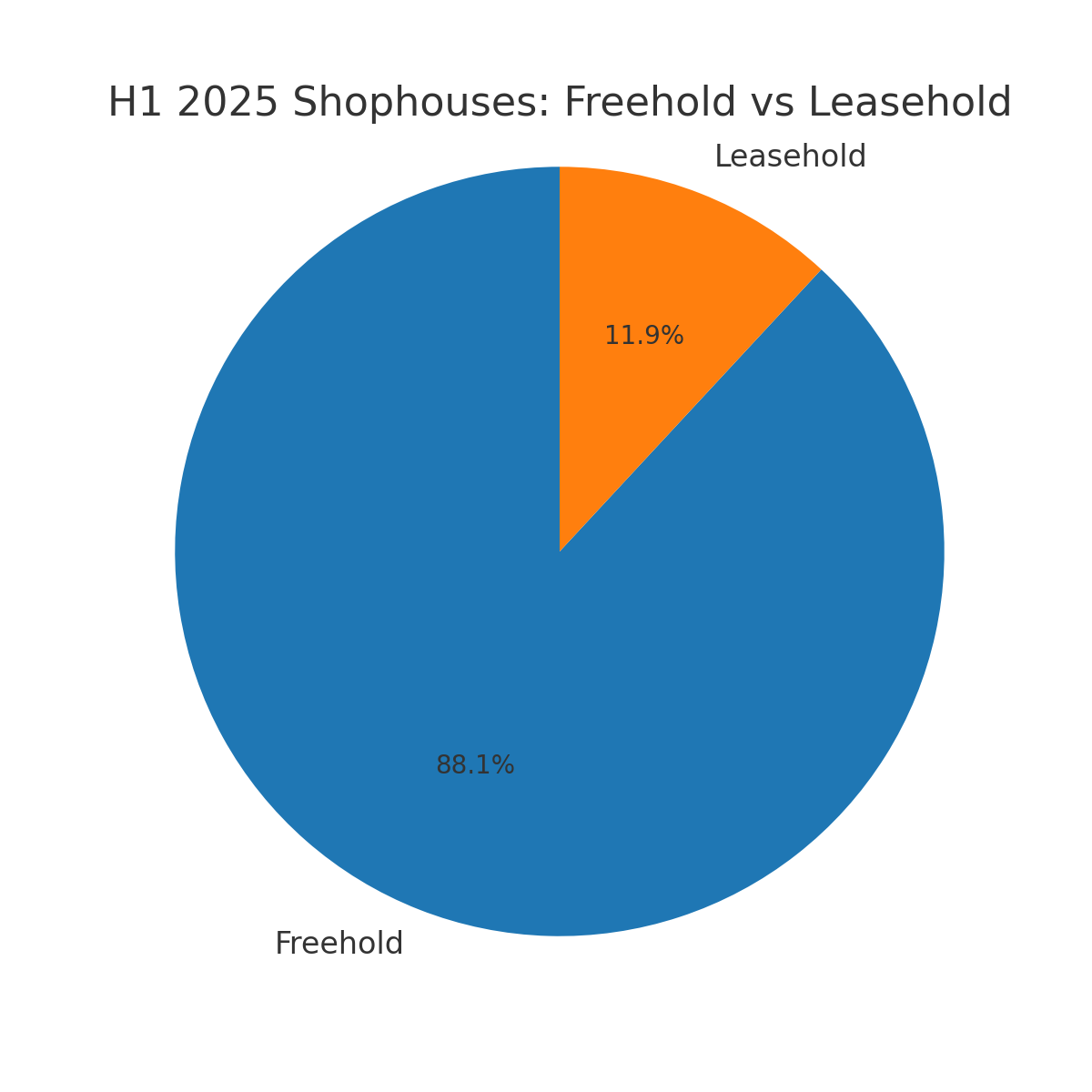

Average land $/psf edged up to S$6,431 in H1 2025 (from S$6,397 in H2 2024). Freehold remains dominant; 37 of 42 H1 2025 deals were freehold.

4. Supply is capped.

There are only 6,500 conserved shophouses in Singapore. No new supply will ever be created, making scarcity a permanent factor.

5. Policy advantage.

Commercial-zoned shophouses are not subject to ABSD (unlike residential). BSD tops out at 5% (vs 6% for residential). This remains a key advantage for foreign buyers.

From My Point of View

- Transaction drivers. A few large hotel-use and living-sector conversions pushed Q2 sales higher. Co-living and boutique hospitality were notable demand drivers, supported by strong tourism and business travel.

- Tenure mix. Freehold continues to dominate, but leasehold volume jumped sharply in H1 2025 on the back of several large trades.

- District trends. District 8 (Little India / Jalan Besar) remains highly active, supported by F&B clusters, boutique hotels, and good connectivity.

Sales Data (H2 2023-H1 2025)

- H2 2023: 53 units, S$428.2m.

- H1 2024: 40 units, S$354.0m (skewed by a few atypical deals).

- H2 2024: 50 units, S$520.2m.

- H1 2025: 42 units, S$462.9m; avg S$6,431 psf (land).

Sources: Business Times (H1 2025 tallies), SBR/EdgeProp (quarterly splits/price).

Sales value is rising, transactions remain stable, and prices are resilient.

- H2’23–H1’25 Sales Value (S$ m) — rising trend with Q2’25 spike.

- H2’23–H1’25 Units Sold — steady bands; demand intact

Avg $/psf (land) where reported — clear resilience into 2025

- H1’25 Tenure Mix — freehold dominance intact

Why the Market is Holding Up

Safe-haven demand + limited supply.

Family offices and ultra-high-net-worth investors continue to favor shophouses for wealth preservation.

Policy edge.

With residential ABSD rates as high as 60% for foreigners, shophouses offer a more tax-efficient entry point.

Hospitality recovery.

Boutique hotels and co-living conversions are performing well, with strong demand from tourists and business travelers.

Risk and Considerations

Pricing discipline.

Investors are resisting unrealistic asking prices. Deals close when pricing aligns with rental income and asset fundamentals.

Location quality.

Prime locations, corner lots, and wide frontages continue to command premiums. Secondary locations are harder to move.

Regulatory Compliance

URA conservation rules are strict. Due diligence on fire safety, rear extensions, and approved uses is essential before buying.

What To Buy Now

1) Migration / Own Use (business + Family office).

Commercial-zoned units near MRTs remain attractive — no ABSD, steady rental demand, and good exit flexibility.

2) High-Yield Focus

Corner units or dual-frontage properties with existing F&B approvals are lower-risk with faster lease-up potential.

3) High ROI (Value-Add Strategy).

Look for under-managed stock with a clear repositioning path — boutique hotels, co-living, or creative F&B concepts with proven operators.

Act Before the Next Wave of Deals

If you’re serious about securing a unit, now is the time to shortlist before the next round of transactions. With only 6,500 conserved shophouses in existence, opportunities are always limited.

Buy in the right locations, at the right prices, with the right exit strategy. I can help you. Let’s discuss which assets fit your investment goals.

Message me now!