|

Region |

Avg PSF (2015) |

Avg PSF (2025) |

% Change |

Key Redevelopment Influence |

|---|---|---|---|---|

|

Central (Core Region) |

$1,950 |

$2,780 |

+42% |

Tanjong Pagar, Outram, GSW phase 1 launches |

|

Rest of Central Region |

$1,350 |

$2,250 |

+66% |

Turf City, Tanglin Halt, Holland Village renewal |

|

Outside Central Region |

$980 |

$1,750 |

+78% |

Hougang / Serangoon area revaluation ahead of PLAB redev |

Singapore 2030 Opportunities

For years, “prime” in Singapore meant Orchard, River Valley, and Newton.

But the Singapore I walk through today is no longer defined by a few expensive postal codes.

The country’s next wave of wealth creation is unfolding quietly — in once-overlooked neighbourhoods now at the heart of our 2030 plan.

This article is the first of a 3-part series exploring Singapore 2030 Opportunities — where the next wave of growth begins.

In Part 1, we’ll dive into Redevelopment Areas That Will Redefine Prime Living.

Coming next, Part 2 will explore how mature estates are being rejuvenated, and Part 3 will take you through where Singapore is expanding next.

If you’ve ever wondered “Where’s the next Orchard, or the next Holland Village?” — this series is for you.

Singapore 2030: Redevelopment Areas That Will Redefine Prime Living

You’ve probably noticed it too — the city is changing faster than ever.

As someone who has walked through showflats, talked to developers, and watched old neighbourhoods transform over the years, I can tell you this: Singapore’s next wave of growth isn’t about new land — it’s about giving old land a new life.

The government’s long-term plan is clear: by 2030, redevelopment will shape how and where we live, work, and invest.

And for Singaporean upgraders and investors, understanding where this transformation is happening can mean getting in before the next wave of price movements.

Why Redevelopment Is the Real Story Behind Singapore 2030

Many think “new launches” mean new land — but look closer.

Most major projects today stand on the footprints of yesterday’s landmarks.

This shift isn’t random. It’s the result of Singapore’s Concept Plan and Master Plan 2030, designed to recycle land efficiently and keep value circulating across regions.

When you see names like Turf City, Tanglin Halt, or Paya Lebar Air Base, you’re not just seeing redevelopment projects — you’re looking at the next generation of prime living.

Redevelopment zones are land reimagined. They outperform because:

- They unlock new land supply in a land-scarce city without needing reclamation.

- They redraw economic and transport catchments.

- They carry first-mover advantage — early investors capture upside before zoning and infrastructure fully mature.

- Their scale allows for mixed uses (residential, commercial, green space), creating synergy value.

1. Paya Lebar Air Base — 800 ha of Opportunity

I remember when this announcement first came out — many of us in the industry knew it would be huge.

Once home to military aircraft, this 800-hectare site will eventually host new housing, parks, and commercial spaces stretching from Hougang to Punggol.

The relocation of the airbase (target 2030) will also lift building-height restrictions, unlocking value for surrounding estates like Serangoon Gardens, Defu, and Hougang.

As of 2025, early land studies suggest a potential 150,000 new homes could emerge here over the next 20 years — roughly three new towns’ worth of space.

For those who think “there’s no land left in Singapore,” this will prove otherwise.

Why It’s a Game Change

- This is likely to be one of the largest single redevelopment zones in Singapore’s history.

- It sits between established towns (Hougang, Bedok, Tampines) — thus bridging fringe and inner zones.

- As infrastructure (roads, MRT, transit links) develops, peripheral areas will appreciate earlier.

- The heritage + identity angle means parts of the site (old runway, hangars) may be reused as cultural / public space — adding uniqueness premium.

- Its scale pushes capital flows: new retail, services, business nodes will follow — raising land value in adjoining precincts.

2. Greater Southern Waterfront — Singapore’s New Coastal CBD

This is one project that still gives me goosebumps when clients ask, “Josh, where’s the next prime area after Orchard?”

I always say — look south.

Covering 30 km of coastline, the Greater Southern Waterfront (GSW) is redefining the concept of city living by bringing waterfront homes, offices, and leisure right to the edge of the CBD.

With Keppel Club’s redevelopment and the Labrador Tower office node already under construction, you can see the momentum building.

Developments like The Reef at King’s Dock and Skywaters Residences near Tanjong Pagar are already benchmarks — but the real story is what comes after: new residential plots, park connectors, and green boulevards that will stretch all the way to Sentosa.

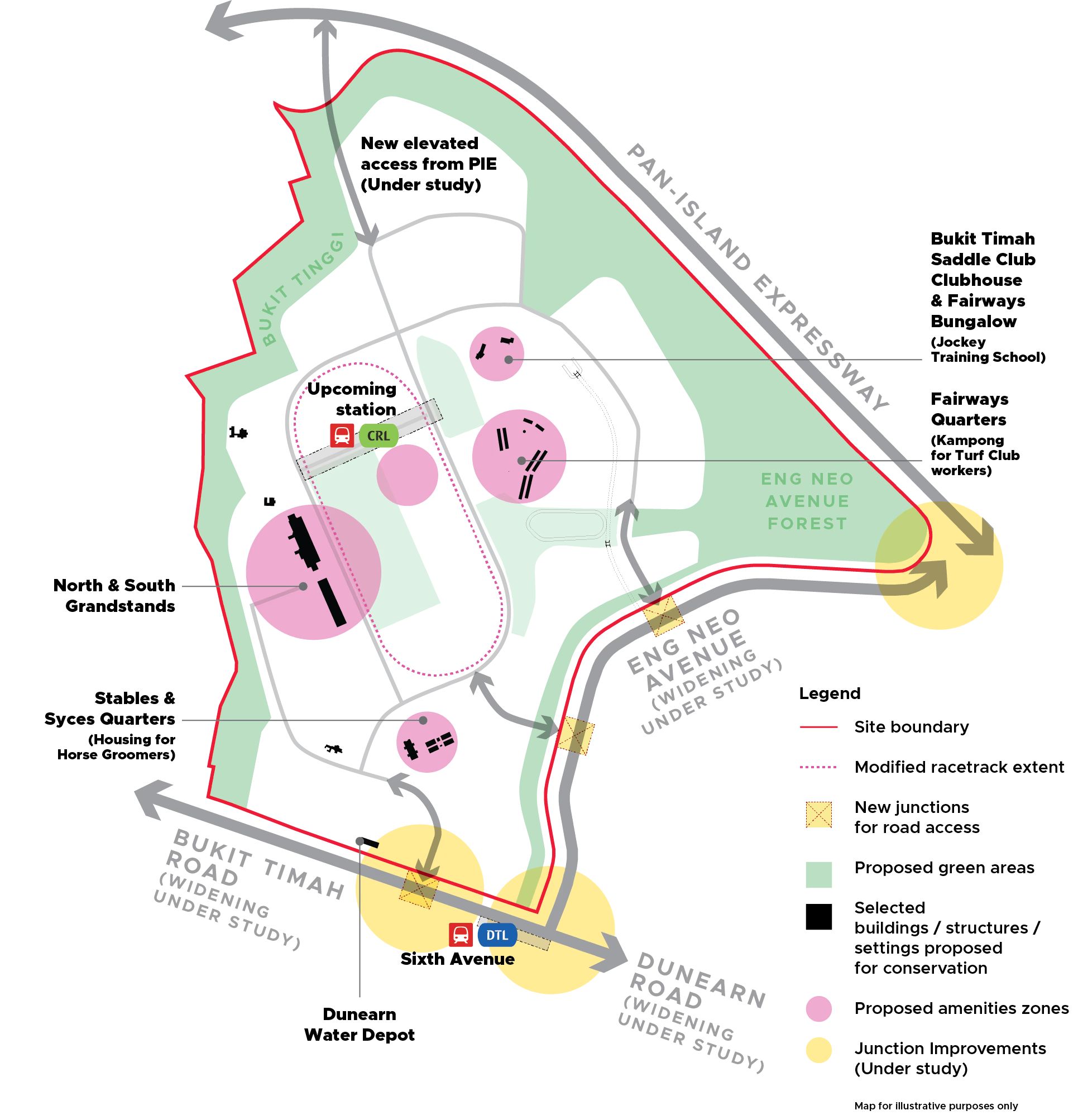

3. Turf City (Bukit Timah) — A Luxury Neighbourhood Reimagined

If you’ve ever driven past Turf City recently, you’d have seen the massive changes.

Once an equestrian and retail hub, the 141-hectare site will be redeveloped into a premium residential enclave with new parks, schools, and transport links.

It sits between the upcoming Sixth Avenue MRT and King Albert Park MRT, both on the Downtown Line.

- The Singapore Turf Club (Kranji) racecourse will be returned to the state by 2027; its land is slated for redevelopment.

- In Bukit Timah / Turf City, developers are planning 15,000 to 20,000 new homes (public + private) in the next few decades.

- The first GLS plot in Turf City recently drew 9 bids (Frasers consortium bid S$491.5 million or S$1,410 psf ppr).

- Heritage conservation is baked into the plans: 22 buildings (including grandstands) may be conserved within the future estate.

- The site is expected to connect to MRT (e.g. Downtown Line, potential Cross Island Line) in future phases, improving access.

URA plans to preserve some of the old greenery and low-rise feel — which means this could become the Holland Village 2.0 that many upgraders have been waiting for.

For investors, that means potential strong resale demand from families looking for central, green living without the D9 price tag.

Why Turf City Matters

- This is central location revival — a chance to introduce new mass housing in a traditionally private-luxury zone.

- Because central land is rare, this redevelopment injects core-volume supply into the market.

- Adjoining precincts (e.g. Sixth Avenue, Methodist Girls’ School, Binjai Park) may see spillover value uplift.

- Its high visibility and developer competition mean the site will command premium pricing and strong execution.

4. Tanglin Halt — Queenstown’s Grand Rebirth

Queenstown is a name that resonates with history. I still remember showing older resale flats there — they had charm, but the years showed.

Now, Tanglin Halt is being rebuilt from the ground up.

About 3,400 old HDB flats are being replaced with new precincts, community plazas, and commercial hubs, while the iconic Commonwealth Drive Market will be reimagined as a heritage node.

For long-time owners who received SERS offers, this transformation is bittersweet — but for the next generation of homeowners, this is one of Singapore’s most central public housing redevelopments.

The Quiet Rise of Redeveloped Land Values (2015 – 2025)

Source: URA Realis, Resale Transactions Q3 2025

What This Means for Singaporean Upgraders and Investors

Singapore’s next phase of appreciation won’t just come from “new launches” — it’ll come from redeveloped land, where transport, lifestyle, and infrastructure converge.

And because foreign ABSD (60%) has cooled overseas demand, it’s now mainly Singaporean upgraders and local investors driving this next wave.

If you’re looking for growth potential and liveability, these are the pockets worth watching closely.

When OCR prices edge near $3,000 psf, history tells us the CCR & RCR markets follow soon after.

That’s the cycle. And redevelopment areas — though they begin as dusty construction zones — often end up setting the next benchmark for “prime.”

Places like Tanglin Halt or Turf City may not look exciting today, but by 2030, they’ll represent what Orchard was in the ’90s: the symbol of modern Singapore living.

When you’re ready, let’s walk through which of these precincts aligns best with your goals — whether it’s upgrading your family home, diversifying your portfolio, or buying into Singapore’s next era of growth.