|

Unit Type |

Past Avg Size |

2026 Avg Size |

Estimated Price (Quantum) |

|---|---|---|---|

|

1BR |

450-400 sq ft |

420 - 460 sq ft |

$1.1M - $1.3M |

|

2BR |

650-700 sq ft |

600 - 660 sq ft |

$1.6M -$1.9M |

|

3BR |

1,000- 1,100 sq ft |

850 - 950 sq ft |

$2.2M - $2.5M |

Singapore New Launches Fall 29% in 2026

If developers pull back… and buyers wake up later… who wins?

It’s a confronting question. But it’s the question every investor should be asking today.

Because right now, quietly and without much noise, Singapore is entering one of the rarest supply moments we’ve seen in years:

New private-condo launches (excluding ECs) are expected to fall from 26 projects in 2025 to just 17 projects in 2026 — a sharp 29% drop in new launch volume.

Most people will skim that and move on.

But if you’ve been in the market long enough, or if you’ve missed opportunities before, you’ll know that when developers slow down, and buyers only realise later…

The winners are always the buyers who moved early, during the quiet moments.

And 2026 is shaping up to be exactly that kind of moment.

What does this mean?

The next wave of buyers will face fierce competition, fewer choices, and rising prices, all because they waited too long to act.

Most people will only realize it when they see fewer choices, tighter competition, and rising prices.

Most people will look back and say, “I should have moved earlier.”

If you’re planning to invest, upgrade, buy for your children, or prepare for rental yield, this supply shift matters more than most people think.

Macro Trend: Fewer Launches, Shrinking Supply

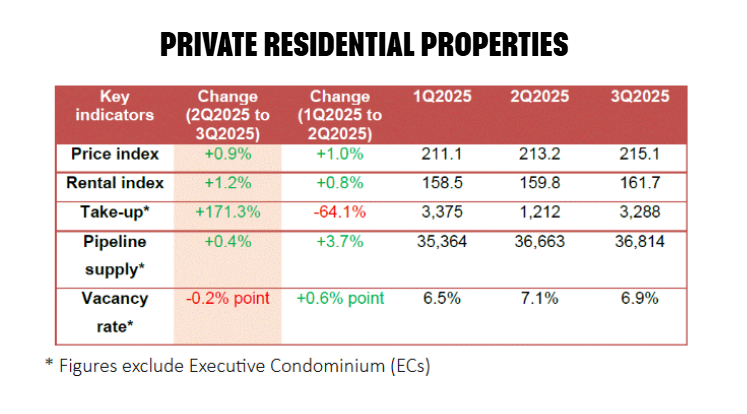

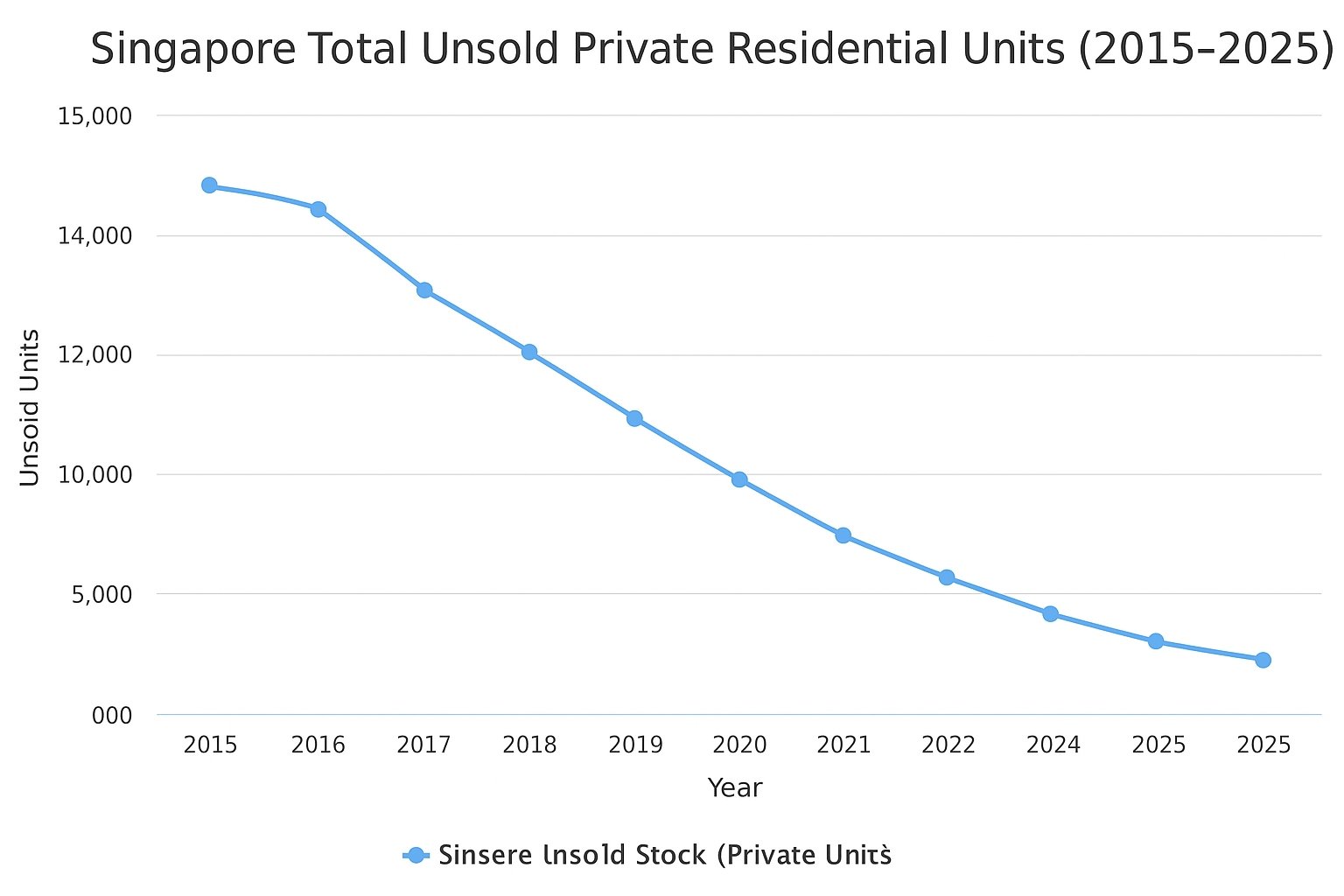

- As of the end of Q3 2025, there were 36,814 uncompleted private residential units (excluding ECs) in the pipeline, but only 17,029 units remained unsold.

- That unsold inventory is among the lowest seen in recent quarters, signalling that many units have already been absorbed.

- Completions remain modest: 3,010 private residential units (including ECs) were completed in Q3 2025; the total for the first three quarters is 5,978 units.

- At the same time, demand cycles are showing recovery: in 9 M 2025, developers sold 7,875 new homes (excluding ECs), already exceeding full-year 2022–2024 sales.

In simple terms, inventory is tightening, but demand is real.

Why This 29% Drop Matters More Than You Think

The truth is in the data.

fewer units → fewer choices → fewer opportunities.

And that raises a crucial point many buyers overlook:

When new supply drops but demand stays steady, prices don’t fall; competition does.

Singapore’s new launch pipeline drops from 11,430 private residential units in 2025 to just 8,113 in 2026, a significant squeeze.

Add to this the “TOP-heavy” years of 2025 to 2027, when 16,000+ units complete and hit the resale market, and you have a balancing act. But the resale market won’t fully relieve demand, especially with:

- Foreign student numbers bouncing back to 90% of pre-pandemic levels

- Rents have been climbing for 16 consecutive quarters before stabilizing

Singapore is not oversupplied — it’s undersupplied, smartly and steadily.

Remember, Singapore never floods the market with homes.

When supply tightens here, it tightens fast and stays tight. And that brings us to the most misunderstood part of this story.

Source: Urban Redevelopment Authority (URA), REALIS, developer disclosures, and market-wide estimates

Why 2026 Will NOT Be a Buyer’s Market

A slower economy doesn’t mean cheaper property in Singapore. Here, affordability drives Singapore demand, not market mood.

Here’s what’s fueling demand:

-

More families are buying in anticipation of the 2027–2028 school planning

-

More expats returning with reinstated housing allowances

-

More HDB Minimum Occupation Period (MOP) unlocking upgraders

-

Lower interest rates expected to ease in 2025-2026 → more purchasing power

-

Developers are launching fewer “big family units” but lowering total ticket sizes

Key point:

Yes, the overall price is “cheaper”, but the PSF is higher because the unit is smaller — and buyers accept it because the total quantum fits their budget.

The Great Unit-Size Shift in 2026

Forget the idea of falling prices. Developers aren’t dropping prices; they’re shrinking unit sizes.

Buyers don’t care about 100 sq ft less. They care whether the bank can finance it and whether they can start their family plan next year.

Projects will continue to sell well.

Why?

Because developers are pricing exactly at what buyers can afford, making 2026 launches very attractive even in a cautious economy.

Which Segments Will Be Affected Most?

To make things easier, let’s break the impact down into Singapore’s three key regions.

Core Central Region (CCR) — Scarcity Premium Accelerates

- GLS supply remains extremely limited

- Luxury buyers return once interest rates ease.

- TOP-ready CCR units will see strong demand from foreigners and family offices.

- High land prices keep entry costs elevated

- Foreigners are gradually returning

- Even with cooling measures, prices hold firm; expensive stays expensive when supply is tight

|

Who benefits? Investors who secure CCR units in 2025 at softer price levels. |

Rest of Central Region (RCR) — Strong and Stable

- Consistent demand from both investors and upgraders.

- Buyers priced out of CCR spill into RCR.

- Land cost has risen significantly, so fewer RCR options at “affordable” levels.

- Fewer launches than in previous years

Who benefits?Buyers who enter early, before newer projects push prices higher. |

Outside Central Region (OCR) — The Pressure Zone

- This is the biggest pressure point.

- OCR has the most upgrader demand… and the fewest upcoming launches.

- Supply share drops from 40% to 28% of new launches

- Young families compete aggressively for the limited supply.

- The battleground for upgraders seeking affordability

- Prices could rise faster due to sheer demand volume.

- HDB MOP wave pushes demand higher

- Smaller units = more quantum-friendly = higher sell-out risk

|

Who benefits? Upgraders, first-time buyers, and investors who secure OCR units now at 2025 pricing. |

The Hidden Winners of 2025–2026: Act Before the Gap Widens

If you buy before the supply gap becomes obvious, you win big.

- Lock in the best entry price before PSF spikes

- Enjoy more choices of unit stacks and facings

- Access developer incentives before they vanish

- Secure lower mortgage rates before demand pushes them up

- Benefit from strong rental demand amid tighter supply

|

Imagine entering at $2,300 psf now, 2026 launches could easily start at $2,500–$2,600 psf due to smaller units and tighter supply. |

What This Means for You: Your Next Steps Matter More Than Ever

If you plan to buy in the next 12–18 months:

2025 is your last chance for real choice.

In 2026, expect:

- Fewer launches

- Smaller units

- Higher PSF

- Fiercer competition

- Higher resale prices from upgrader demand

- Strong rental demand from returning expats and students

Waiting won’t get you a better deal; it will cost you options and peace of mind.

Most buyers act only when choices disappear. Most investors move only after prices rise.

And by then, it’s often too late.

If you’re serious about your next Singapore property, talk to me now.

I’ve helped families, foreign investors, and local buyers for almost 2 decades.

Don’t let 2026 catch you unprepared. The window is closing, and it won’t wait.

Message me now!