|

Sold Units: |

Singapore New Launches to Watch (June–Aug 2025): Which Condo Is Worth Buying?

Singapore’s property market is set for several significant launches in the next three months but before diving into specific projects, let's look at the current market trends first.

April 2025 Sales

New home sales dipped by 9% month-on-month to 663 units (excluding EC's) but did you know it actually double the sales from a year ago?

In fact, a whooping 120.3% year-on-year increase. This indicates a robust market despite short-term fluctuations.

This rebound is fueled by a combination of factors:

- Lower mortgage rates: With current rates around 2.5-2.6%, down from approximately 4% a year ago (with expectations of further modest declines), buyers are enjoying substantial savings. Source: The STRAITSTIMES

- Increased housing supply: The Government Land Sales (GLS) programme is set to supply 8,505 private residential units in the first half of 2025, up from 8,140 in the second half of 2024.

Price Trends

New launch prices are setting new benchmarks:

- Outside Central Region (OCR): $2,200–$2,700 PSF

- Rest of Central Region (RCR): $2,600–$2,800 PSF

- Core Central Region (CCR): Starting from $3,000 PSF

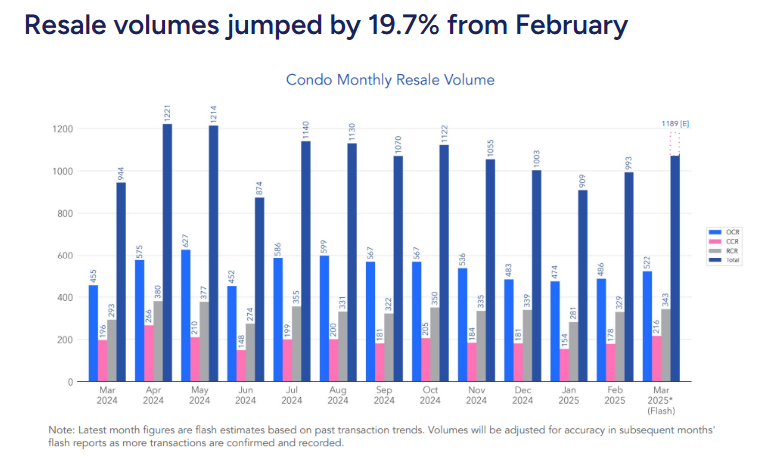

Resale Market

Resale condo prices dipped slightly by 0.5% month-on-month in March 2025, but take note that sales volumes jumped 19.7% from February 2025.

Source: 99.co

Just to give you a sense of how active the market is right now, resale volumes in March were actually 26% higher than the same time last year, and even 12.2% above the five-year March average.

|

Let's break it down a bit: - Nearly half (48.3%) of all resale transactions happened in the Outside Central Region (OCR), - 31.7% were in the Rest of Central Region (RCR), and - 20% took place in the Core Central Region (CCR). |

It’s also interesting to note that sub-sale transactions (those are units sold before the project is completed) made up 7.9% of all secondary sales. That’s a little lower than what we saw in February, which suggests that fewer unfinished units are being flipped right now.

Overall, this points to a healthy, active resale market, with most of the activity happening in the OCR and RCR, and a slight cooling in sub-sales.

Private Condo Launches (June–August 2025): My Picks & Personal Thoughts

Lyndenwoods – Science Park Drive

Where Innovation Meets Luxury Living

Project Details:

|

Type |

Description |

|---|---|

|

Project Name |

Lyndenwoods at Kent Ridge MRT |

|

Developer |

Capitaland |

|

Architect |

ADDP |

|

Location |

69 & 71 Science Park Drive Singapore 119317, 118253 (District 05) |

|

Tenure |

99 Years from 28 April 2025 |

|

Estimated Completion |

30th June 2029 |

|

Site Area |

Approx 11,557 sqm |

|

Total Units |

343 units of 2BR to 4BR, in 2 blocks of 24 Storeys. |

|

Car Park Lots |

240 lots; 36 EV Lots in 2 storeys of Basement Carpark |

Why Lyndenwoods Stands Out?

If you’re looking for a future-proof investment tied to Singapore’s innovation and tech economy, Lyndenwoods is a rare first-mover opportunity you won’t want to miss. It’s the very first residential project in the prestigious Singapore Science Park, putting you right at the heart of a thriving R&D and business hub.

Location & Connectivity:

- Just a 4-minute walk to Kent Ridge MRT via a direct underground pedestrian link—unmatched convenience for daily commuting.

- Surrounded by top employment nodes: One-North, Science Park, and Kent Ridge.

Excellent access to lifestyle and retail options like The Star Vista, Rochester Mall, and Holland Village. - Close to renowned schools and institutions: National University of Singapore (NUS), Anglo-Chinese Junior College (ACJC), and more.

What to Expect:

- Lyndenwoods isn’t about instant capital gains or lifestyle flair—it’s a strategic, long-term play. The area is still developing its character, so you’re buying for logic, not charm.

- As the first residential project in Science Park, it offers unique “work-live-play” integration, which is rare in Singapore.

- Site facilities and exteriors are designed for modern professionals and families, with a range of 2- to 4-bedroom layouts.

Pricing & Discounts:

- Early registrants may enjoy first-mover pricing and launch discounts. (Contact me for the latest price list and floor plans.)

|

My Take: |

W Residences @ Marina View

Captivating Views, Unparalleled Living, Timeless Investment.

Project Details:

|

Type |

Description |

|---|---|

|

Project Name |

W Residences at Marina View |

|

Developer |

Boulevard View – a subsidiary of IOI Properties Group |

|

Location |

22 Marina View (District 01) |

|

Tenure |

99 year lease from 27 Dec 2021 |

|

Estimated Completion |

Q1 2029 |

|

Site Area |

Approx. 84,147.9 sqft / 7,817.6 sqm |

|

Total Units |

683 residential units and 360 hotel rooms (under the Marriott brand of “W Singapore”) in one tower of 51 storeys |

|

Car Park Lots |

342 Lots (including 24 EV ready lots) + 4 accessible lots |

Why W Residences is a Trophy Address?

Let’s be clear: W Residences is pure luxury and exclusivity. This is not a project focused on rental yield or quick flips — it’s about prestige, breathtaking waterfront views, and owning a piece of Singapore’s most coveted address in Marina Bay.

If you’re someone who values lifestyle, brand, and long-term legacy, this development will definitely turn heads.

Prime Location & Connectivity:

- Nestled in the heart of Marina Bay, just a 3-minute walk to Shenton Way MRT, with access to 4 MRT lines (North-South, Circle, Downtown, and future Thomson-East Coast Line).

- Seamless connectivity to major expressways: East Coast, Central, Ayer Rajah, and Marina Coastal.

- Steps away from Marina Bay Sands, the financial district, Orchard Road, and iconic attractions

Unmatched Lifestyle & Amenities:

- 24/7 hotel-style premium services by W Hotels, managed by Marriott International.

- Resort-like facilities including swimming pools, sky gardens, fully equipped gyms, clubhouses, BBQ pits, steam rooms, and smart-home features.

- Integrated mixed-use development with retail and hotel components, offering convenience and vibrancy right at your doorstep.

Nearby Highlights & Lifestyle

- Shopping & Dining: Guoco Tower, International Plaza, Marina Bay Link Mall, The Shoppes at Marina Bay Sands, and Clarke Quay nightlife are all within walking distance.

- Education: Close to Cantonment Primary School and Outram Secondary School, ideal for families.

- Green Spaces: Enjoy nearby Marina Barrage and Gardens by the Bay for relaxation and outdoor activities.

- Transport: Proximity to multiple MRT stations including Shenton Way, Tanjong Pagar, Downtown, and Marina Bay MRT Interchange ensures unparalleled connectivity.

|

My Take: |

The Robertson Opus – River Valley Green

Invest in Prestige, Live in Style.

Project Details:

|

Type |

Descriptions |

|---|---|

|

Project Name |

The Robertson Opus |

|

Developer |

Frasers Property & Sekisui House |

|

Location |

Unity Street, River Valley, District 09 |

|

Tenure |

999-year leasehold |

|

Estimated Completion |

2028 |

|

Site Area |

Approximately 12,000 sqm |

|

Total Units |

Approximately 348 luxury residential units |

Why The Robertson Opus Is a Rare and Coveted Address?

999-year tenure. River Valley. Do I need to say more?

This is one of those rare gems. If pricing stays below $3,200 psf, I expect this to move very quickly. The area’s tenant profile is strong — families, expats, and locals all love it for its proximity to Orchard, the CBD, and lifestyle spots.

The only catch? It might be tight on layout and high on psf, but that’s the trade-off for location and tenure.

Prime Location & Connectivity:

- Nestled in the heart of Robertson Quay, just minutes from Orchard Road and the CBD.

- Excellent MRT access: Fort Canning MRT (Downtown Line) is a 5-minute walk, and Clarke Quay MRT (North-East Line) is under 10 minutes away, providing seamless connectivity to Marina Bay, Bugis, HarbourFront, and beyond.

- Easy driving access via Central Expressway (CTE) and Ayer Rajah Expressway (AYE), with key districts reachable within 10 minutes.

Lifestyle & Surroundings:

- Enjoy riverside serenity along the Singapore River Promenade and Robertson Quay’s alfresco dining and nightlife.

- Nearby green escapes include Fort Canning Park and the UNESCO - listed Singapore Botanic Gardens, perfect for outdoor recreation and relaxation.

- Close proximity to top schools such as River Valley Primary School, Alexandra Primary, Anglo-Chinese School (Junior), and St. Margaret’s School, ideal for families.

|

My Take: |

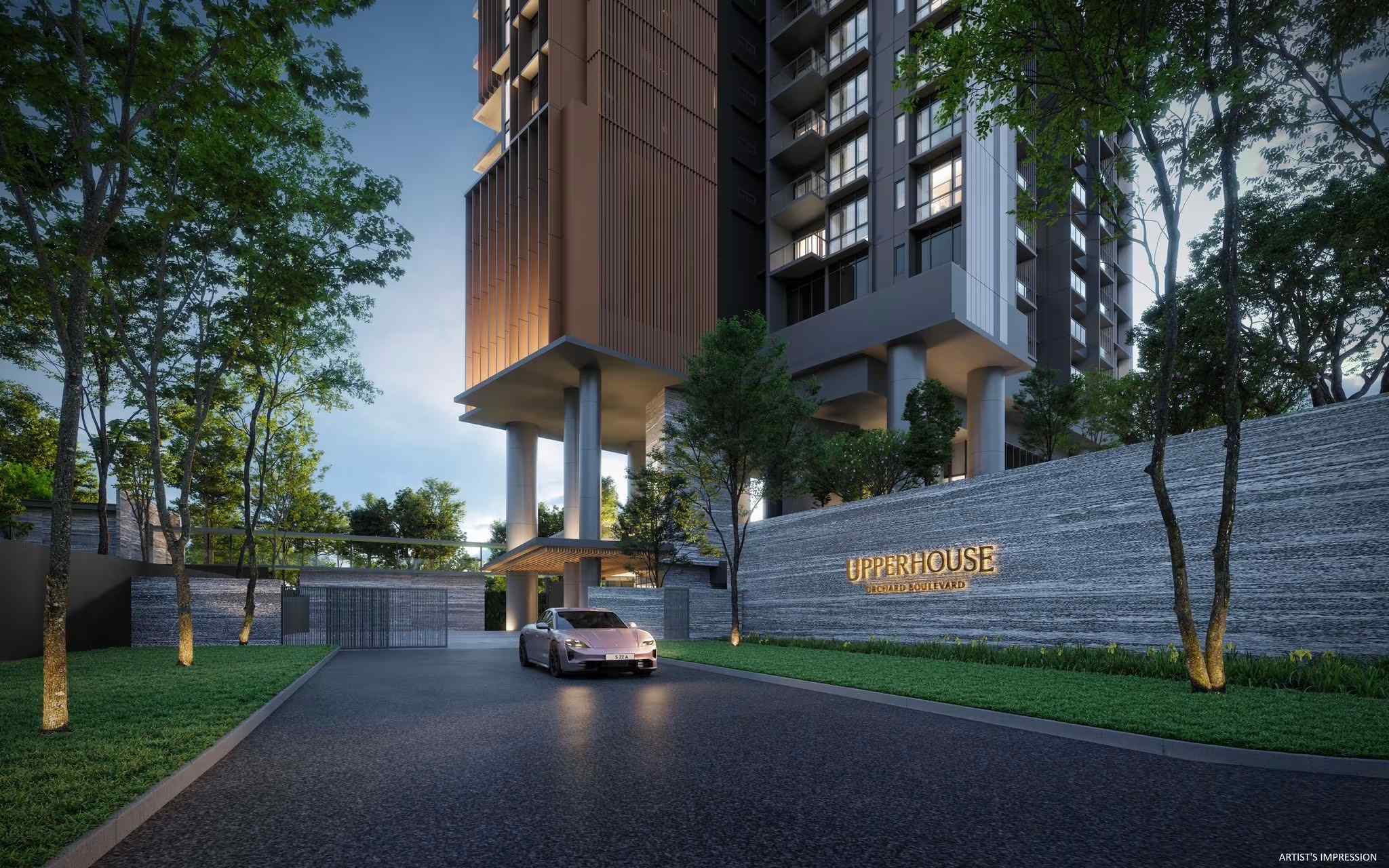

UpperHouse – Tomlinson Road

Invest in Luxury, Own a Piece of Orchard’s Finest.

Project Details:

|

Type |

Descriptions |

|---|---|

|

Project Name |

UpperHouse (傲杰嘉苑) at Orchard Boulevard MRT |

|

Developer |

UOL & Singland |

|

Architect |

ADDP (Award-Winning) |

|

Location |

22 Orchard Boulevard Singapore 249628 (District 10) |

|

Tenure |

99 Years |

|

Estimated Completion |

Q1 2029 |

|

Site Area |

Approx 7,031.5 sqm |

|

Total Units |

301 residential units in 38 Storeys with Commercial on 1st Storey. Signature Collection: 270 units – 1+S – 2BR Premium – 2BR Premium +Study – 3BR Premium

– 4 Bedroom Suites with private lifts & private carpark lot |

|

Car Park Lots |

Estimated 80% Allocation |

Why UpperHouse Is an Ultra-Exclusive Legacy Home?

Orchard Boulevard. Quiet. Ultra-exclusive. But I’ll be frank — Tomlinson launches tend to be priced for the ultra-high net worth, and Upperhouse is likely no exception.

It’s not a “run-of-the-mill” investment. You buy here if you want a residence that your children will inherit — a legacy home.

Prime Location & Connectivity:

- Directly linked to Orchard Boulevard MRT Station (Thomson-East Coast Line), offering seamless connectivity to Marina Bay, Shenton Way, and the Greater Southern Waterfront.

- Minutes away from Orchard Road’s luxury shopping malls including ION Orchard, Takashimaya, Wisma Atria, and Paragon.

- Close to top educational institutions such as Anglo-Chinese School (ACS), Singapore Chinese Girls’ School, and River Valley Primary School.

- Easy access to Central Expressway (CTE) and Ayer Rajah Expressway (AYE) for convenient driving.

Nearby Highlights & Lifestyle:

- Shopping & Dining: Steps from Orchard’s premier retail malls and Michelin-starred restaurants, plus vibrant nightlife and fine dining at Dempsey Hill nearby.

- Green Spaces: Close to the UNESCO World Heritage-listed Singapore Botanic Gardens and Four Seasons Hotel Green Thumb Garden for peaceful retreats.

|

My Take: |

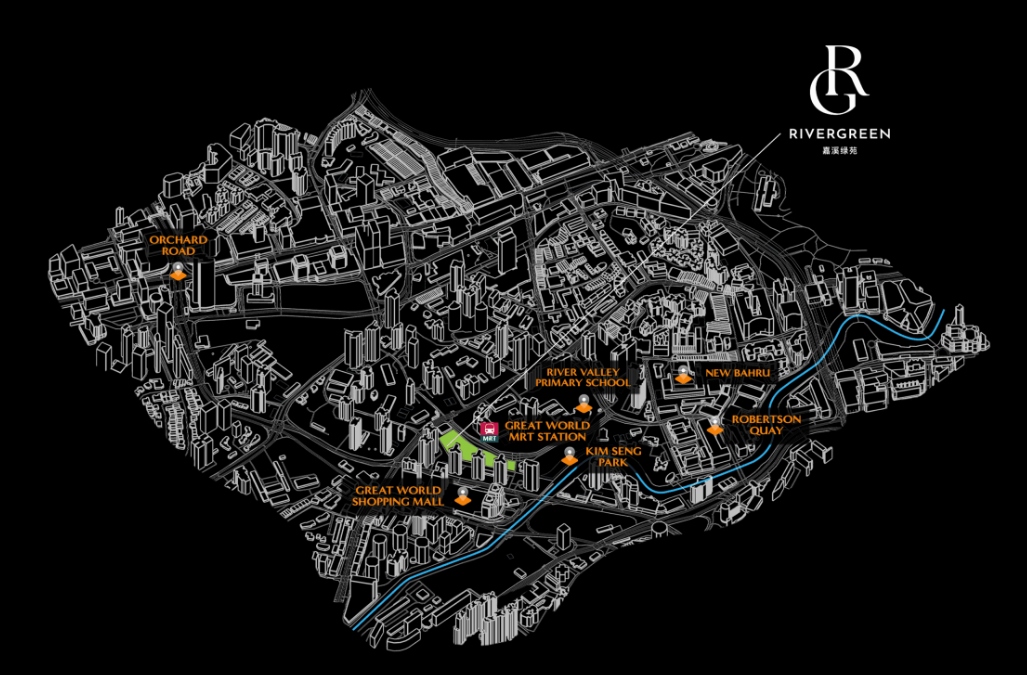

River Green (Parcel A) – River Valley Green

Urban Sophistication, Lasting Value

Project Details:

|

Type |

Type |

|---|---|

|

Project Name |

River Green |

|

Developer |

Wingtai Holdings |

|

Location |

351 River Valley Road (District 09) |

|

Tenure |

99 Years |

|

Estimated Completion |

2029 |

|

Site Area |

9,291.1 Sqm / 100,104 Sqft |

|

Total Units |

Estimated 380 units |

|

Car Park Lots |

Estimated 80% Allocation |

Why River Green Is a Smart Choice in River Valley?

River Green (Parcel A) is an exciting new launch in the heart of River Valley, offering a rare blend of prime location, modern luxury, and excellent connectivity. While it sits close to The Robertson Opus, the key difference is that River Green is a 99-year leasehold—which could mean a lower entry price and potentially better short-term gains, especially if the price gap to Robertson Opus is $400 psf or more.

- Directly integrated with Great World MRT Station (Thomson-East Coast Line), giving you seamless access to Orchard, Outram Park, Marina Bay, and more.

- Steps from Great World City mall for shopping, dining, and entertainment; Orchard Road’s shopping belt is just 1km away. Zion Riverside Food Centre, and Robertson Quay’s trendy eateries are all within easy reach.

- Easy access to major expressways (CTE, AYE) and well-served by bus routes.

- Within 1km of River Valley Primary and Alexandra Primary, and close to Anglo-Chinese School (Junior), Gan Eng Seng Primary, and top international schools.

- Enjoy nearby Kim Seng Park, Fort Canning Park, and the Singapore River promenade for recreation and relaxation.

|

My Take: |

What About Executive Condos (ECs)?

Otto Place EC – Tengah Plantation Close

Live Smart, Live Green, Live at the 1st Forest Town in Singapore

Project Details:

|

Type |

Descriptions |

|---|---|

|

Project Name |

Otto Place EC |

|

Developer |

Hoi Hup Realty and Sunday Developments |

|

Location |

Plantation Close (District 24) |

|

Tenure |

99 Years |

|

Estimated Completion |

2030 |

|

Site Area |

Approx 215,691 sqft |

|

Total Units |

Estimated 560 units |

|

Car Park Lots |

Estimated 80% Allocation |

Why Otto Place EC Is the Top Pick for HDB Upgraders and Future-Focused Buyers?

Otto Place EC is the latest executive condominium (EC) in Tengah, Singapore’s pioneering “Forest Town.” This project is a prime choice for families and HDB upgraders looking for value, future growth, and a green, smart-living environment.

But let’s be honest: Tengah is still very raw. No MRT is operational yet, and construction is everywhere. However ECs like Otto Place are always in high demand—they’re undervalued at launch and become full private property after 10 years, offering strong capital appreciation potential.

Prime Tengah Location & Connectivity:

- MRT: Walking distance to two upcoming Jurong Region Line stations—Tengah Park and Bukit Batok West—ensuring future seamless access to Jurong East, Choa Chu Kang, and beyond.

- Expressways: Easy access to PIE and KJE for fast connections across Singapore.

- Jurong Lake District & Innovation District: Close to Singapore’s largest mixed-use business hub and key employment nodes, supporting future rental and resale demand.

Smart, Green, and Family-Friendly Living:

- Tengah is designed as a car-lite, eco-friendly town with lush parks, a central green corridor, and smart technologies integrated throughout the estate.

- Otto Place EC is surrounded by greenery and will feature landscaped gardens, a green roof, and nature-inspired communal spaces.

- Comprehensive amenities: resort-style swimming pool, gym, tennis court, sky pavilions, BBQ areas, children’s playgrounds, wellness spa corners, and more.

Education & Schools:

- Within 1km of Princess Elizabeth Primary, Pioneer Primary, and Jurong Primary.

- Future Anglo-Chinese School (Primary) will be in Tengah by 2030, plus new primary schools opening in 2026 and 2028, making this a long-term family-friendly location.

|

My Take: |

GLS Sites to Keep an Eye On

1. Chuan Grove – Lorong Chuan

Project Details:

|

Type |

Descriptions |

|---|---|

|

Project Name |

Chuan Grove |

|

Location |

Lorong Chuan (D19) |

|

Units |

555 |

|

Tenure |

Likely 99 years |

|

Est. Completion |

2029 (est.) |

|

MRT/Connectivity |

Lorong Chuan MRT (CCL, ~400m) |

|

Schools Nearby |

St. Gabriel’s Pri, Yangzheng Pri, CHIJ OLQP |

|

Key Amenities/Features |

Family-focused, low density, large site, near schools, potential for future plot consolidation |

|

Notable Points |

Rare sizeable project in D19, strong own-stay/family appeal, likely to be a surprise hit |

Why Choose Chuan Grove (Lorong Chuan)?

It’s one of the few new launches in D19 that isn’t overly dense, offers real “breathing room,” and is within walking distance to the MRT and several top schools. The potential for future land consolidation could mean even more value down the road.

It's good for families, own-stay buyers, those prioritizing space, schools, and a quieter environment.

|

My Take: |

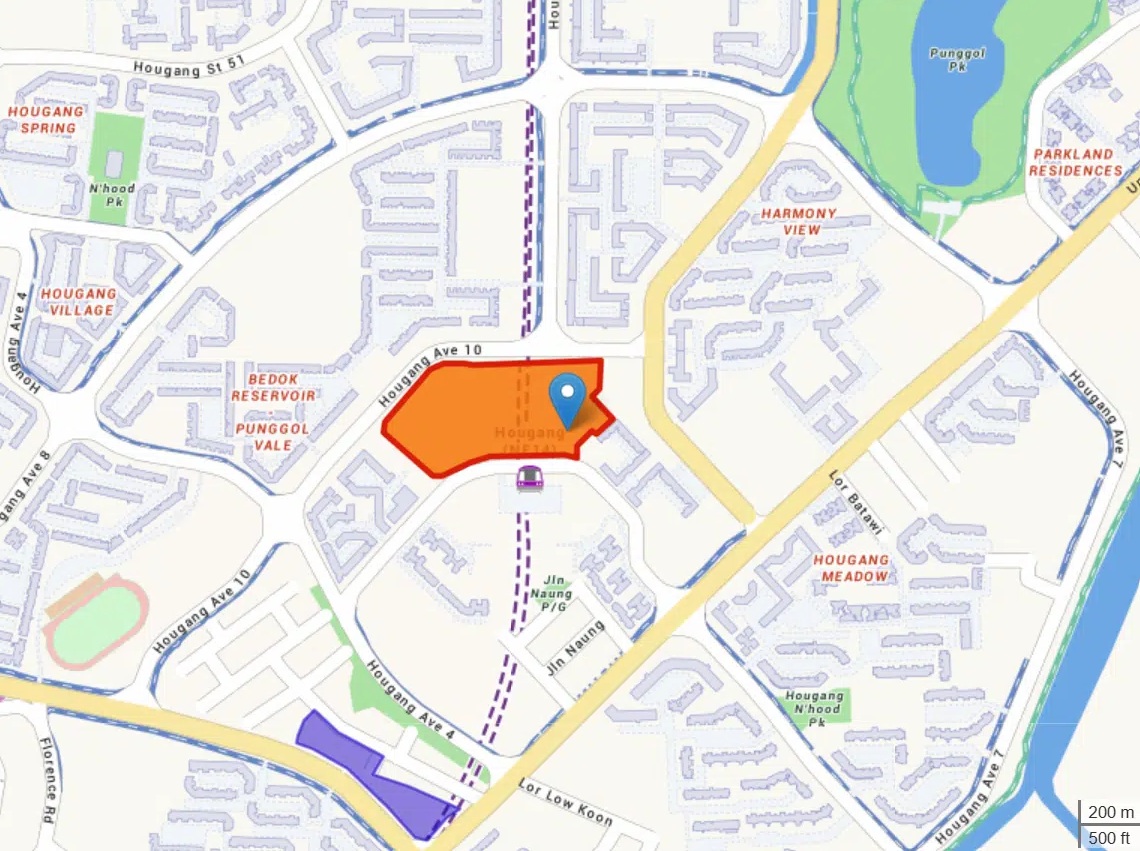

2. Hougang Central Mixed-Use

Project Details:

|

Type |

Descriptions |

|---|---|

|

Project Name |

Hougang Central Mixed-Use |

|

Location |

Hougang Central (D19) |

|

Units |

835 |

|

Tenure |

Likely 99 years |

|

Est. Completion |

2029–2030 (est.) |

|

MRT/Connectivity |

Direct to Hougang MRT (NEL/CRL) |

|

Schools Nearby |

Holy Innocents’ Pri, CHIJ Our Lady of Nativity |

|

Key Amenities/Features |

Integrated with retail/mall, direct MRT, large scale, strong footfall, retail synergy |

|

Notable Points |

Integrated projects command premium, ideal for first-timers, retirees, investors, strong exit liquidity and rental demand |

Why Choose Hougang Central Mixed-Use?

Integrated developments always sell like hotcakes — just look at Pasir Ris 8. With direct MRT access (NEL and upcoming CRL), a full retail mall below, and a huge scale, this project offers both lifestyle and investment appeal.

Historically, such projects appreciate well and are easy to rent or resell.

|

My Take: |

3. Bayshore Development

Bayshore Development – East Coast's Exciting New Estate

Why Bayshore Is the East Coast’s Next Big Thing?

This hasn’t launched yet, but mark my words — Bayshore is going to be Singapore’s most transformative new waterfront district — one that promises both lifestyle and long-term capital growth.

It fetched a record-breaking land bid of S$1,388 psf ppr – the highest ever in OCR.

Prime Waterfront Location & Connectivity:

- Situated along the East Coast, with many parcels offering panoramic sea views and direct access to East Coast Park.

- Two brand new MRT stations—Bayshore and Bedok South (Thomson-East Coast Line)—will anchor the precinct, providing seamless connectivity to the city, Changi Airport, and the entire island.

- Easy access to major expressways (ECP, PIE, TPE), making commutes to the CBD or Changi Airport a breeze.

Estate Masterplan & Lifestyle:

- Planned as a low-density, car-lite, and highly walkable precinct with lush landscaping, cycling paths, and direct park connectors to East Coast Park.

- Over 10,000 new homes (including HDB and private condos) are planned, with a full suite of amenities: schools, childcare, healthcare, retail, and F&B.

- Designed for waterfront living, with future-ready features, smart infrastructure, and sustainable urban design.

Nearby Highlights & Lifestyle:

- Shopping & Dining: Short drive to Parkway Parade, Bedok Mall, Siglap Centre, and Katong’s vibrant F&B scene.

- Recreation: Direct access to East Coast Park, cycling and jogging trails, and future waterfront promenades.

- Education: Near top local schools (Temasek Primary, Victoria School, Temasek Junior College) and international schools (Global Indian International School, Sekolah Indonesia).

|

My Take: |

New Launch vs. Resale: What Should You Buy?

New Launches: Offer modern layouts, fresh leases, better facilities/ amenities, higher rentability, progressive payment schemes, and potential for capital appreciation.

Resale Properties: Provide immediate occupancy, larger space and established communities.

Your choice should align with your investment goals, whether it's long-term appreciation, rental yield, or immediate occupancy.

Now, let’s address what’s on everyone’s mind:

"Can I still get $2,000 psf properties?"

Yes, for older developments. But many are leasehold, and not near MRT.

"Is $5,000 psf crazy?"

For ultra-luxury, no. Park Nova, Klimt, and Les Maisons are already there. But unless you’re buying to own a piece of the sky, this isn’t the norm.

The truth is, pre-Covid new launches averaged $2,600 psf. Now, $2,800 - $3,200 psf is common. That’s the new baseline. But there are still gems below that – if you know where to look.

|

What’s the Smartest Move Right Now? If you’re sitting on the sidelines, you’re going to miss the first-mover gains. The market is about to pick up, and prices are likely to rise once that happens. |