|

Market Segmentation: Not All Properties Are Created Equal |

|---|

|

The impact of retrenchments might vary depending on the type of property you own:

|

Singapore Property Market & The Retrenchment Ripple Effect

Just this morning, I received an email notification from Sharon, a property owner in Bukit Timah, who is facing challenges with her rental property.

The connection between retrenchments and the property market is undeniable.

When people lose jobs, their buying power shrinks.

This can lead to a domino effect: fewer buyers, potentially stagnant or even declining property prices, and a tougher rental market.

So, what does this mean for you as a landlord or property owner facing similar challenges to Sharon?

Does the recent buzz about retrenchments leave you feeling a chill down your spine?

But before you panic, take a deep breath. We'll navigate these uncertain waters together.

This article dives deep into the impact of retrenchments on the rental market, explores proactive strategies to adapt, and unveils valuable resources to help you navigate these uncertain times.

Understanding the

Impact of Retrenchments

Tenants, Vacancies, and You

Zooming in on Tech Talent

The tech industry, a significant renter pool, did experience some retrenchments. This affects most units with expats as tenants.

The spike in retrenchments was high in Mar & April 2024. Rippling effects of high supply of units as a result of early termination causing imbalance of tenant to unit ratio (oversupply), in what we term as tenant’s market now.

While the recent retrenchment whispers might cause concern, let's dive into the data and see how it truly affects the rental market. Here's a breakdown of the retrenchment-rental connection:

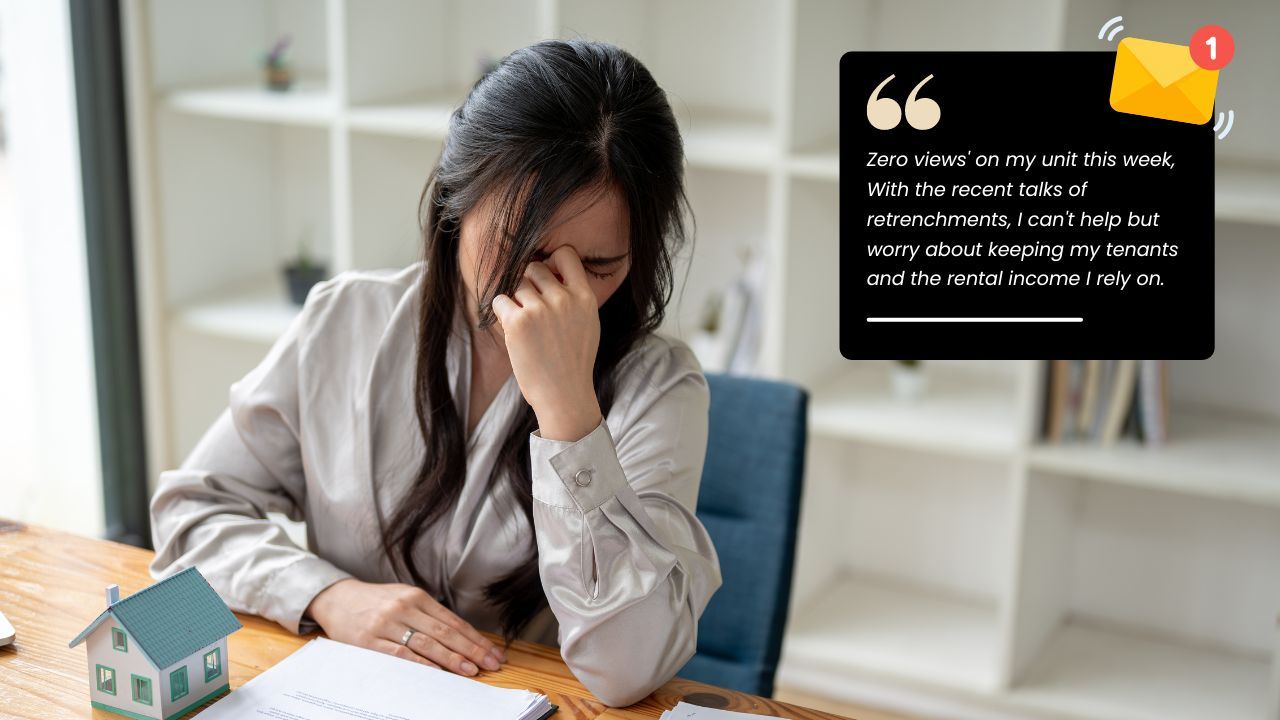

Retrenchment Trends: Separating Fact from Fear

While some sectors saw job cuts in early 2024, there's a positive twist. According to the Ministry of Manpower (MOM), retrenchments have actually decreased for two quarters in a row, including Q1 of 2024.

- Employment growth: Up 4,900, driven by residents (non-residents declined).

- Unemployment: Slightly up (2.1%), but within historical norms..

- Retrenchments: Down to 3,000 (from 3,460) and expected to decline further.

- Hiring intentions: Businesses are more likely to hire (50.7%) but wage growth might slow.

This indicates a potential stabilization in the job market. But oversupply effects will require at least 2-3 months before it gets absorbed to norms.

Demand and Supply: A Delicate Balance

Retrenchments can create a complex interplay between rental demand and supply. Here's how:

Decreased Demand

Job losses can lead to a decrease in rental demand. Tenants been retrenched will need to leave the country if they could not get a new job within 30 days. Hence lesser tenants in market.

- Downsizing

Those currently renting high-end apartments might consider moving to smaller, more affordable units.

Increase Supply

However, retrenchments can also lead to an increase in rental supply:

- Forced Sales

Homeowners who lose their jobs might struggle with mortgage payments and be forced to sell their properties. These additional units entering the market could create more competition for landlords.

|

Expats and the Diplomatic Clause |

|---|

|

Singapore's rental market has a unique dynamic due to expats who often utilize diplomatic clauses. These clauses allow them to terminate the lease early if they are relocated by their employer or experience job loss.

|

Strategies for

Adapting to the Market

It's Time To Be Proactive, Not Reactive

Now that we've unpacked the retrenchment-rental connection, let's get tactical!

The Singapore property market is known for its resilience, and with the right strategies, you can navigate any potential headwinds. Here are some key tactics to keep your rental income flowing

Understanding Early Termination Clauses

Tenancy agreements often include early termination clauses, outlining the process and potential consequences if a tenant breaks the lease before its expiry.

Open and honest communication with your existing tenants is crucial.

If a tenant approaches you due to difficulties related to retrenchments, explore all options before resorting to strict enforcement of the early termination clause.

- Negotiate a Buyout: Consider a buyout agreement, where the tenant pays a fee to break the lease early. This can help minimize your losses and allow them a smoother exit.

- Find a Replacement Tenant: Work with your tenant to find a suitable replacement to take over the lease, ensuring a smooth transition and avoiding a vacancy.

By incorporating this flexibility and exploring early termination options collaboratively, you can foster positive tenant relationships and potentially minimize financial losses during challenging times.

Remember, a proactive approach is key to maximizing your rental success!

Long-Term Strategies and Diversification

Building a Rental Empire

So far, we've explored navigating the immediate impact of retrenchments on the rental market. But what about the long game? Here are some strategies to ensure your property remains a reliable source of income for years to come:

First impressions matter, especially in a competitive rental market. Here's why keeping your property in top shape is crucial:

- Attract Quality Tenants: A well-maintained property with modern amenities is more likely to attract responsible tenants willing to pay competitive rent.

- Retain Tenants: Tenants who appreciate a well-kept living space are more likely to renew their leases and avoid frequent vacancies.

- Long-Term Value Preservation: Regular maintenance helps prevent costly repairs down the road and contributes to the overall value of your property.

Investing in minor upgrades like fresh paint, modern lighting fixtures, or energy-efficient appliances can significantly enhance your property's appeal and potentially command a higher rent. Remember, a well-maintained property is an investment in your long-term rental success.

|

Investment Diversification: Don't Put All Your Eggs in One Basket |

|---|

|

While property ownership offers numerous benefits, it's wise to diversify your investment portfolio. Here's why:

|

Remember, diversification is not about abandoning your property investment. It's about creating a robust financial safety net that allows you to weather market downturns and ensure your overall financial well-being.

Investing Abroad

Exploring Global Opportunities

Investing abroad can help diversify your rental portfolio in several ways:

1. Geographic Diversification

By investing in real estate properties in different countries, you reduce your risk exposure to fluctuations in your home market. This diversification strategy can help stabilize your rental income and overall portfolio performance.

2. Currency Diversification

Holding assets in foreign currencies can provide protection against currency risk and potentially increase your wealth through favorable exchange rate movements. This aspect of diversification can add a layer of stability to your rental income streams.

3. Access to Different Markets

Investing overseas opens up opportunities in markets that may offer unique advantages, such as higher rental yields, growth potential, or specific property types not available in your home country. This diversity can enhance the overall performance of your rental portfolio.

4. Lifestyle Benefits

Owning rental properties abroad can offer lifestyle benefits, such as having a vacation home that can also generate rental income when not in use. This dual-purpose investment can provide both personal enjoyment and financial returns.

5. Risk Mitigation

International real estate investments can provide risk mitigation by diversifying your portfolio across different countries and regions. This diversification helps reduce the impact of economic or political changes in any single area, safeguarding your rental income against localized risks.

Time is Ticking! Avoid Rental Roadblocks – Get Help Today!

While retrenchments are ongoing for expats and even locals. This might signal an opportunity to pick up a good buy. If you are a landlord struggling to find tenants let me help. If you require financial planning for your assets, it does not harm to meet for a review.

Don't wait for the time bomb to explode!

Let's connect!

I can guide you through your options, explore early termination possibilities (if needed), and help you find a suitable solution that aligns with your current situation.

Remember, a proactive approach is key! Don't wait for anxieties to turn into bigger problems.

Contact us now!