|

Quarter |

Average Price (SGD psf) |

% Change QoQ |

|---|---|---|

|

Q2 2024 |

1,450 |

+1.7% |

|

Q3 2024 |

1,475 |

+1.7% |

|

Q4 2024 |

1,490 |

+1.0% |

|

Q1 2025 |

1,505 |

+0.8% |

Singapore Property Q1 2025: Wait or Buy Now?

Let me tell you about a client of mine. Let’s call her Chen.

Chen was eyeing a freehold unit in District 15 back in mid-2024. It was a rare corner stack — quiet, breezy, and with unblocked views. But she hesitated. She thought prices would drop.

Fast forward today, that unit has been sold and similar layouts are now $120,000 more. Not only that, but the new owner has already secured a tenant with a 4.5% rental yield.

I’m not here to shame hesitation. I’m here to help you stop losing time, losing value, and losing opportunities.

What’s Really Happening in the Market?

Let’s be honest — Q1 2025 didn’t bring the property crash some were hoping for.

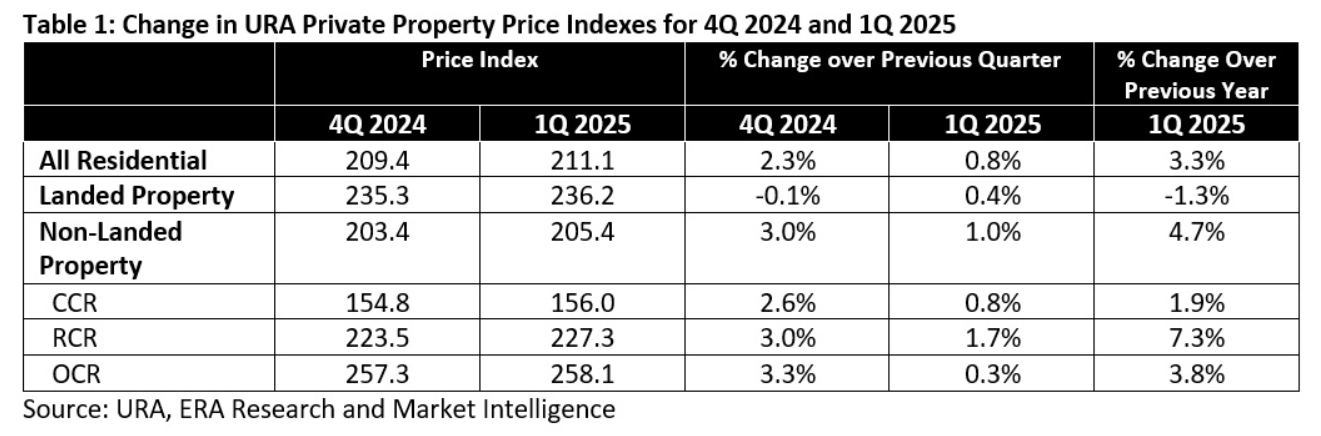

- Private home prices rose approximately 0.8% in Q1 2025, according to URA’s flash estimates released in April 2025.

- New launches like The Arcady at Boon Keng and Pinetree Hill were well received, with units moving steadily due to limited new supply.

- On the resale front, demand remained strong in city-fringe and OCR areas.

- Rental listings have declined 15% year-on-year, signaling tighter supply and ongoing leasing demand.

Average Private Residential Prices in Singapore (2024–Q1 2025)

Even as interest rates stabilize, prices continue climbing each quarter — reflecting confidence (a consistent and healthy market trajectory), not speculation.

Price Trends by Region (2024–Q1 2025)

|

Quarter |

Average Price (SGD psf) Q1 2025 |

% Change QoQ (Q4 2024 to Q1 2025) |

Market Characteristics & Examples |

|---|---|---|---|

|

Core Central Region (CCR) |

2300-2450 |

+0.5% to +1.0% |

Prime districts like Orchard, River Valley, Bukit Timah. Strong demand for luxury and new launches like The Arcady, Pinetree Hill, Lentor Mansion. Prices stable with selective appreciation. |

|

Rest of Central Region (RCR) |

1,600 – 1,750 |

+1.0% to +1.5% |

City-fringe areas such as Toa Payoh, Novena, Balestier. Projects like The Orie and Sky Everton see steady interest from owner-occupiers and investors. Moderate price growth. |

|

Outside Central Region (OCR) |

1,300 – 1,450 |

+1.5% to +2.0% |

Suburban towns like Bukit Panjang, Jurong, Woodlands. New launches such as Parktown Residences, Elta at Mayflower attract families and first-time buyers. Stronger price growth due to affordability and improving amenities. |

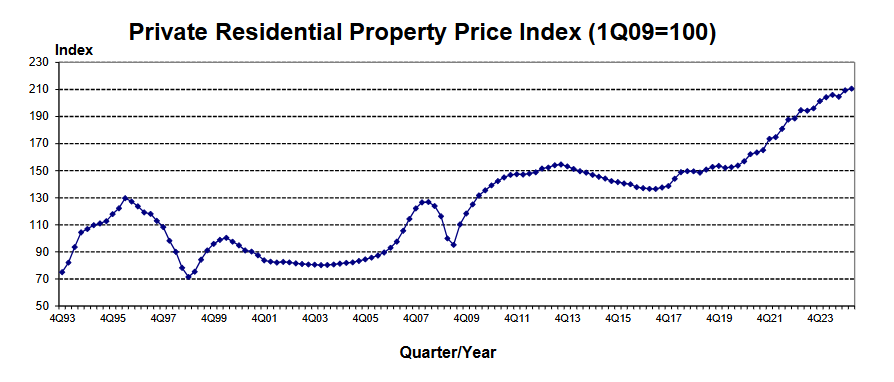

Will Prices Come Down?

It’s a fair question. But do you really think you’ll catch the bottom?

Even during the steep rate hikes of 2023, Singapore’s property market held firm. In fact, the supply of new homes is forecast to shrink from 8,433 units in 2024 to 5,920 in 2025, further limiting options for buyers.

And there’s another reason not to wait:

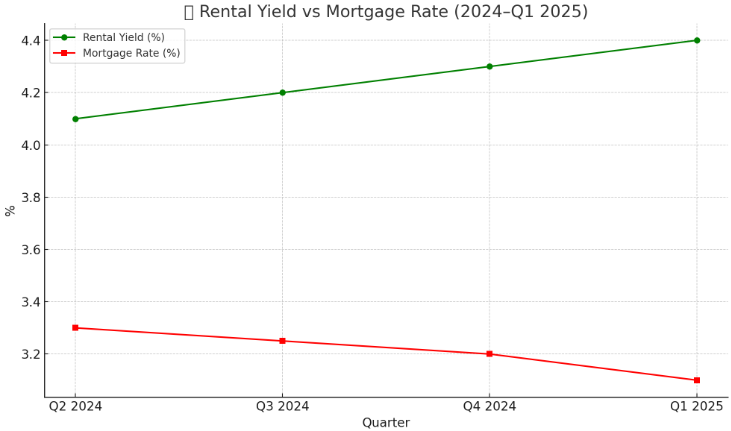

Rental Yield vs Mortgage Rate

(2024 - Q1 2025)

|

Quarter |

Average Rental Yield (%) |

Average Mortgage Rate (%) |

|---|---|---|

|

Q2 2024 |

4.3% |

3.6% |

|

Q3 2024 |

4.4% |

3.4% |

|

Q4 2024 |

4.4% |

3.2% |

|

Q1 2025 |

4.4% |

3.1% |

Source: URA, MAS, bank mortgage average rates

- Rental yields have consistently outpaced mortgage rates, providing positive net returns for savvy investors.

- As of Q1 2025, yields are at 4.4%, while average mortgage rates have eased to around 3.1%—a favorable gap for buyers seeking cash-flow-positive properties.

So, What’s Stopping You?

What if prices dip after I buy?

— Yet history shows prices correct modestly, but trend upward long term.

ABSD confusion?

— If you already own a property, you may still have options — decoupling, trust structures, or buying under your children’s name.

Interest rate fears?

— As of May 2025, floating rates are around 3.1%, with fixed rates from 3.35% — banks are signaling no sharp hikes ahead.

Policy concerns?

— Since the April 2023 ABSD hike, there have been no new increases, and government statements suggest stability to support long-term homeownership.

The bigger risk? Doing nothing.

Top 4 Projects Overview

(based on Q1 2025 data and market traction)

|

Project Name |

Location |

Avg Price (psf) |

Rental Yield (%) |

Completion |

Highlights |

Buyer Type |

|---|---|---|---|---|---|---|

|

The Arcady |

Boon Keng (RCR) |

$2,420 |

4.3% |

2027 |

City-fringe, near MRT, walkable to shops and amenities, strong tenant demand |

Investors & Own Stay |

|

Pinetree Hill |

Ulu Pandan (CCR) |

$2,390 |

4.2% |

2027 |

Nature-facing, near education belt |

Families & Nature Lovers |

|

Lentor Mansion |

Lentor Hills (OCR) |

$2,150 |

4.5% |

2028 |

Near MRT, high rental uptake |

Young Couples & Investors |

|

The Chuan Park |

Lorong Chuan (RCR) |

$2,400–$2,600 |

4.1% to 4.4% |

2027 |

Large land plot, next to MRT, near top schools, in mature estate |

Upgraders & Investors |

These projects are seeing demand because they offer the right combination of growth, yield, lifestyle, location and future resale value — the winning formula in today’s market.

My Honest Advice?

You don’t need to buy today. But you do need to start planning today.

The “perfect” time isn’t coming. What’s available now — especially if it’s a high-quality, well-located property — may not be available again.

It’s not about rushing. It’s about securing options.

And that’s what I’m here for. Let's talk!