|

Project Name |

Launch Date |

Units Launched |

First-Day Take-Up Rate |

Average PSF |

Most Popular Unit Types |

|---|---|---|---|---|---|

|

Chuan Park |

Nov 10, 2024 |

916 |

77% |

$2,500 |

2- & 3-bedroom units |

|

Union Square Residences |

Nov 9, 2024 |

366 |

20% |

$3,200 |

1-, 2-, & 3-bedroom units |

|

Emerald at Katong |

Nov 16, 2024 |

846 |

99% |

$2,621 |

2- & 3-bedroom units |

|

Nava Grove |

Nov 16, 2024 |

552 |

65% |

$2,448 |

3- & 4-bedroom units |

|

Novo Place EC |

Nov 16, 2024 |

616 |

57% |

$1,654 |

3-bedroom units |

|

The Collective at One Sophia |

Nov 6, 2024 |

367 |

10% |

$2,500 |

1-bedroom units |

Singapore Recent Launches

With record-breaking launches and competitive pricing strategies, Singapore’s property market is changing rapidly.

Recent Launch Performance

Despite economic uncertainties, recent property launches in Singapore have been met with strong demand. Some of the newest projects are selling out quickly, while others are attracting serious investor interest.

BUT WHAT'S DRIVING THESE TRENDS, AND WHICH PROPERTIES ARE WORTH YOUR ATTENTION?

SHOULD YOU BUY NEW, OR SHOULD YOU CONSIDER THE RESALE MARKET?

As we head into 2025, let’s explore why certain projects are flying off the shelves, and others are struggling to gain traction. With prices fluctuating and global factors like interest rates and political shifts influencing the market, you’ll want to know the key numbers and trends before you make your next move

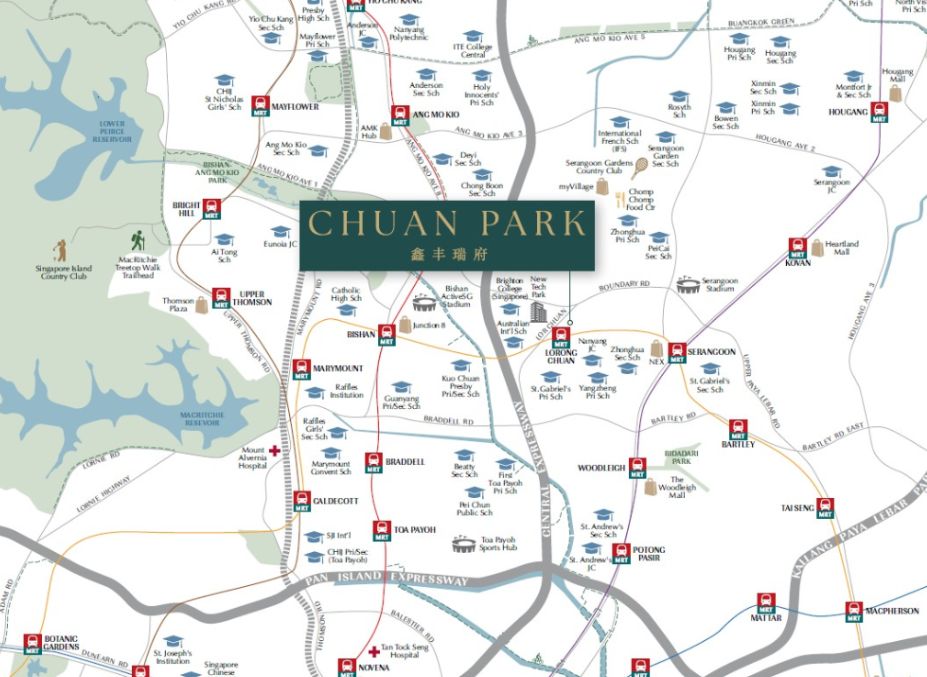

Chuan Park: A Strong Performer

Project Overview

- Total Units: 916 residential units

- Site Area: Approximately 37,215.6 square meters (400,588 square feet)

- Building Structure: The development features three blocks of 22-storey buildings and two blocks of 19-storey buildings, designed to offer a variety of living spaces.

- Tenure: 99-year leasehold

- Expected Completion: The project is anticipated to be completed by late 2028 to early 2029.

- Location: 240 Lorong Chuan, Singapore, situated in the vibrant District 19, conveniently located next to Lorong Chuan MRT Station.

- Developer: Kingsford Development and MCC Land, both reputable entities in Singapore’s real estate market known for their commitment to quality and innovative designs.

- Architectural Design: The project is designed by AGA Architects Pte Ltd, ensuring modern aesthetics and functional living spaces that cater to contemporary lifestyles.

This development is a significant redevelopment of the former Chuan Park Residences, which was sold in a collective sale for approximately $890 million in July 2022.

Chuan Park aims to provide a comprehensive living experience with various amenities including Swimming Pool, Tennis Court, Gym, Communal Landscape Deck, Barbecue Pits, Children’s Play Area and Two commercial units for community services.

The design emphasizes a garden-themed environment, integrating lush landscaping with modern living spaces.

The launch of Chuan Park comes after a notable gap in new developments in the area, with the last major project being The Scala in 2010. Given the limited supply of new residential units in District 19, there is expected to be strong demand for this project.

The development’s proximity to Ang Mo Kio, Bishan, and Serangoon gives it an edge in terms of location, offering easy access to schools, MRT stations, and parks.

Given its strong performance and value-for-money pricing, this is a solid pick for investors who are looking for a mid-tier, well-located property with good potential for capital appreciation.

|

Chuan Park offers an excellent opportunity for investors seeking a solid, family-friendly development in a well-connected area. |

Union Square Residences: A Premium Project with Limited Initial Interest

Project Overview

- Total Units: 366 residential units

- Site Area: Approximately 6,238 square meters (67,145 square feet)

- Building Structure: The development features a 40-storey residential tower with commercial spaces located on the first and second levels.

- Tenure: 99-year leasehold

- Expected Completion: The project is anticipated to be completed by late 2028 to early 2029.

- Location: 20 Havelock Road, Singapore 059765, situated in the vibrant District 1, near Clarke Quay MRT Station.

- Developer: City Developments Limited (CDL), a prominent player in Singapore’s real estate market known for its commitment to quality and innovation.

- Architectural Design: The project is designed by Aedas Pte Ltd, with ADDP Architects LLP serving as the resident architect, ensuring modern aesthetics and functional living spaces.

- The development boasts a comprehensive range of facilities, including Infinity swimming pools, state-of-the-art gym, BBQ pavilions, children’s play zones, landscaped gardens and meditation areas and private function rooms for social gatherings

- Each unit is equipped with modern smart home technology, allowing residents to control various aspects of their living environment, such as lighting and security systems, enhancing convenience and comfort. The project incorporates eco-friendly design elements, aligning with contemporary trends towards sustainable living.

Despite its premium location in District 1, Union Square Residences has only achieved a 20% take-up rate with prices averaging $3,200 PSF. While their pricing reflects the quality and luxury of the development, it may have deterred some buyers who are more price-sensitive like first-time homebuyers or those seeking better value, especially in a market where there are numerous new launches offering more affordable options.

November 2024 was a busy month for new launches in Singapore, with several projects debuting simultaneously. This saturation could have diluted buyer interest across the board, making it challenging to capture significant attention on launch day.

While the initial response may seem modest, the development's unique features and strategic location could attract more buyers over time, particularly as market conditions evolve and potential residents become more familiar with what Union Square Residences offers.

|

For those with deep pockets seeking a prime location in District 1, Union Square Residences still holds appeal, but it may need time to gain momentum. |

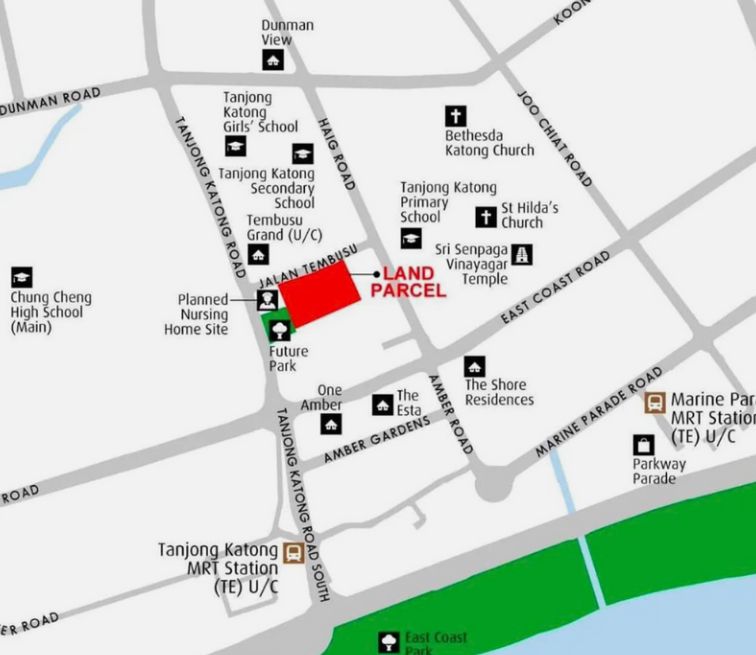

Emerald at Katong: A Clear Winner

Project Overview

- Total Units: 846 residential units

- Site Area: Approximately 20,572 square meters (221,436 square feet)

- Building Structure: The development comprises 6 blocks of 18, 19, and 21 storeys, featuring a landscape deck, basement car park, and communal facilities.

- Tenure: 99-year leasehold, effective from November 7, 2023

- Expected Completion: The project is anticipated to be completed by June, 2029.

- Location: Jalan Tembusu, Singapore 438673, situated in the vibrant District 15, near Tanjong Katong MRT Station.

- Developer: Sim Lian Group, a well-established developer in Singapore known for its commitment to quality and innovation in real estate.

- Architectural Design: Designed by M.A.N Architects LLP, ensuring modern aesthetics and functional living spaces.

- Car Parking: Includes 682 basement car park lots, with provisions for electric vehicle charging and accessible parking.

- This project has set a new benchmark in Singapore's real estate market, achieving an impressive 99% take-up rate on its first day.

- With prices averaging $2,621 PSF, this development has quickly become a favorite among buyers, particularly for its highly sought-after 2- and 3-bedroom units.

Located in the highly desirable District 15, this project is an attractive choice for families and young professionals who are drawn to the East Coast lifestyle, offering easy access to MRT stations, schools, and recreational areas like East Coast Park.

The East Coast's popularity combined with strong demand for family-sized homes at a competitive price point makes Emerald at Katong an ideal investment opportunity.

|

Emerald at Katong has capitalized on the East Coast's strong appeal, and its 99% first-day sales reflect the high demand in the area. Investors looking for rental potential in a family-friendly neighborhood should strongly consider this development |

The Collective at One Sophia: A Luxury Option with Slower Initial Sales

Project Overview

- Total Units: 367 residential units

- Site Area: Approximately 7,118 square meters (76,618 square feet)

- Building Structure: The development consists of two blocks of 19-storey residential towers, with commercial spaces located on the first and second levels.

- Tenure: 99-year leasehold

- Expected Completion: The project is anticipated to be completed by December, 2029.

- Location: 1 Sophia Road, Singapore, situated in the vibrant District 9, near multiple MRT stations including Dhoby Ghaut, Bencoolen, Rochor, and Bras Basah.

- Developer: A consortium led by SingHaiyi Group, along with CEL Development and KSH Holdings, known for their commitment to quality and innovation in real estate.

- Architectural Design: Designed by ADDP Architects and studioMilou, the project emphasizes modern aesthetics and functional living spaces while integrating lush landscaping and communal areas.

- The Collective at One Sophia has seen a slow start, with just a 10% take-up rate on Nov 6, 2024, with 35 out of 367 residential units sold, despite its premium pricing at $2,500 PSF.

- While there was significant buzz around the launch, potential buyers might still be in the process of gathering information and evaluating their options.

- 1-bedroom units are the most popular, catering to singles and professionals who want to live in the heart of Orchard Road.

The Orchard Road location gives this development strong rental potential for those looking for an upscale city lifestyle.

However, the initial sales rate might suggest that buyers are hesitant to take on the high price point, especially given the large number of other luxury options available in nearby districts.

|

If you are looking for a prime location in Orchard Road, The Collective at One Sophia could be a good option for investors. However, its slow start may indicate that the pricing might need some adjustment to generate faster sales. |

Nava Grove: A Steady Performer, But Not Exceptional

Project Overview

- Total Units: 552 residential units

- Site Area: Approximately 25,039 square meters (269,552 square feet)

- Building Structure: The development features three 24-storey residential towers housing the 552 units, with a range of configurations from 2-bedroom to 5-bedroom layouts.

- Tenure: 99-year leasehold

- Expected Completion: The project is anticipated to be completed by late 2028 to early 2029.

- Location: 38, 40, 42 Pine Grove, Singapore, situated in the desirable District 21, near the vibrant Holland Village and educational institutions.

- Developer: Jointly developed by MCL Land and Sinarmas Land, both reputable players in Singapore’s real estate market known for their commitment to quality and innovation.

- Architectural Design: Designed by P&T Consultants Pte Ltd, ensuring modern aesthetics and functional living spaces that harmonize with the surrounding environment.

- Nava Grove launched on Nov 16, 2024, and recorded a 65% first-day take-up rate with prices at $2,448 PSF. While this is a solid result, it doesn’t compare to the 99% take-up rate of Emerald at Katong.

- This project, with 3- and 4-bedroom units, is likely appealing to families looking for larger spaces in a well-established area near Clementi.

Given that Nava Grove has relatively affordable pricing compared to District 9 or District 10, it may struggle to stand out against higher-demand areas or premium projects like The Collective at One Sophia. However, it is still a solid option for those seeking larger units in a quieter, residential area.

|

While Nava Grove is attractive for families looking for affordable larger units, its competition in established areas means it may not see as much appreciation as its more centrally located counterparts. |

The Rising Gap

New Launch vs. Resale Properties

The current property market is experiencing a significant divergence between new launches and resale properties. New launches are averaging between $2,500 and $3,200 per square foot (PSF), creating a price gap that has widened considerably. In fact, new projects are now priced at least 40% higher, or approximately $300 PSF more than resale properties. This disparity prompts critical questions for investors:

SHOULD YOU CONTINUE PURSUING NEW LAUNCHES WITH THEIR PREMIUM PRICING, OR IS THE RESALE MARKET A MORE VIABLE OPTION?

The Case for Resale:

- Value for Money: Mature estates like District 10 and 15 offer resale units at attractive $300 PSF lower than new launches.

- Immediate Occupancy: Skip the wait and move in or rent out immediately.

- Proven Track Record: Established developments provide data on rental yields and market performance.

Top Resale Picks

- 19 Nassim (District 10): Ultra-luxury living near the Botanic Garden with an average price of $2,800 PSF, down from its historical high of $3,200 PSF and an excellent rental yield potential.

This development is strategically positioned near the Botanic Gardens and high-end amenities, making it an attractive choice for affluent tenants and buyers. Recent data shows that luxury properties in this area have recorded rental yields of up to 4-5%, appealing to investors seeking consistent returns.

- Cuscaden Reserve (District 9): Prestigious address offering units at an average of $3,000 PSF with high rental appeal.

Situated in the coveted Orchard Boulevard area, Cuscaden Reserve is perfect for those looking for a prestigious address at a competitive price point. With proximity to the Orchard MRT station and a wealth of shopping and dining options, this development is poised to attract high rental demand. Current listings indicate that units here are priced between $2,711 and $3,976 PSF, reflecting its premium status while still being more affordable than many new launches.

How External Factors Influence the Market and 2025 Outlook for Investors

Trump’s Trade Policy and Hong Kong’s Recovery

With Donald Trump set to assume office in January 2025, potential shifts in global trade dynamics could impact property investment trends significantly. His economic policies may encourage international investments in Singapore, further driving demand and potentially increasing property values.

Additionally, as Hong Kong's property market begins its recovery—projected to rise by 10% following a steep decline—many investors are looking at Singapore as a viable alternative. This cross-border interest is likely to intensify competition for prime properties, especially in established districts.

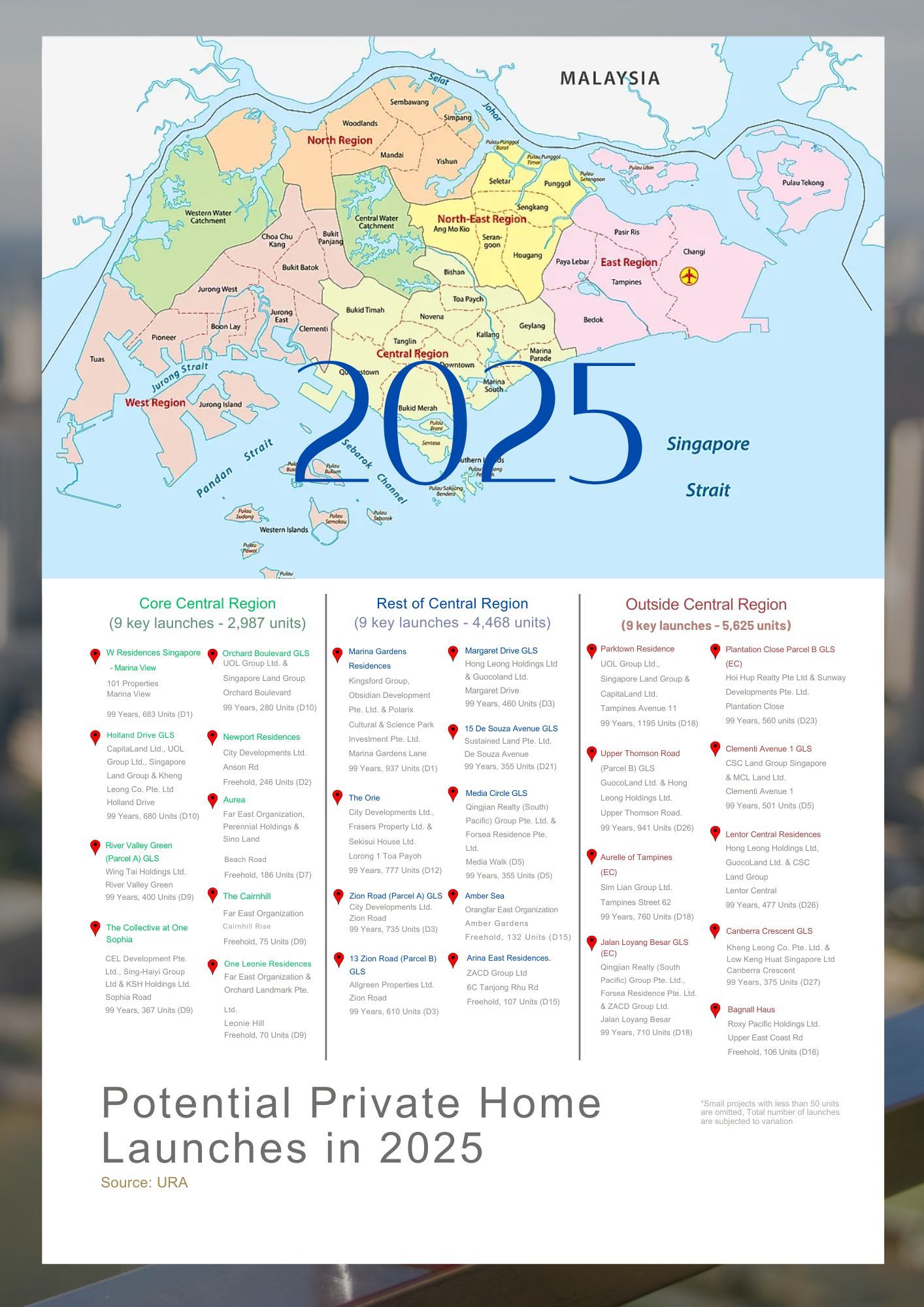

Projections for 2025: What to Expect?

- Increased Demand in Resale Market: As the price gap between new launches and resale properties widens, with resale units averaging $300 PSF lower, we anticipate a surge in demand for resale properties from price-sensitive buyers looking for immediate occupancy and better value.

- Shift to Australia: Cities like Perth and Brisbane are catching up to Melbourne in terms of property prices, making Melbourne an increasingly attractive option for investors seeking consistent appreciation without the volatility associated with other markets.

- Continued Growth in Prime Districts: Districts 9, 10, and 15 are expected to remain popular among investors seeking stability and luxury. Properties in these areas are projected to appreciate steadily due to their desirable locations and the ongoing demand from high-net-worth individuals.

Capitalize Now Before Prices Soar in 2025!

If you’re considering investing in real estate, now is the perfect time to take action! With interest rates stabilizing and significant political shifts on the horizon—especially with Donald Trump’s anticipated economic policies—there’s a strong PUSH into our market. This could drive demand and prices higher, making it essential for you to position yourself wisely before the market heats up.

Many investors from Hong Kong are also looking to redirect their funds as property prices rise in their home city. Singapore and Melbourne are becoming increasingly attractive alternatives, which means competition is likely to intensify. From my perspective, I see signs that property prices across key markets are set to rebound by mid-2025. This makes now an ideal time for savvy investors like you to jump in and capitalize on the current conditions before prices start to climb.

Don’t overlook emerging markets! If you're open to exploring beyond Singapore, Melbourne’s Southbank area is poised for growth, with prices still trailing behind Sydney and Perth. Don’t wait too long, you might miss out on some fantastic opportunities!

Connect with me today! I’d love to help you explore your options and find the perfect investment that aligns with your goals. Your future self will thank you!