|

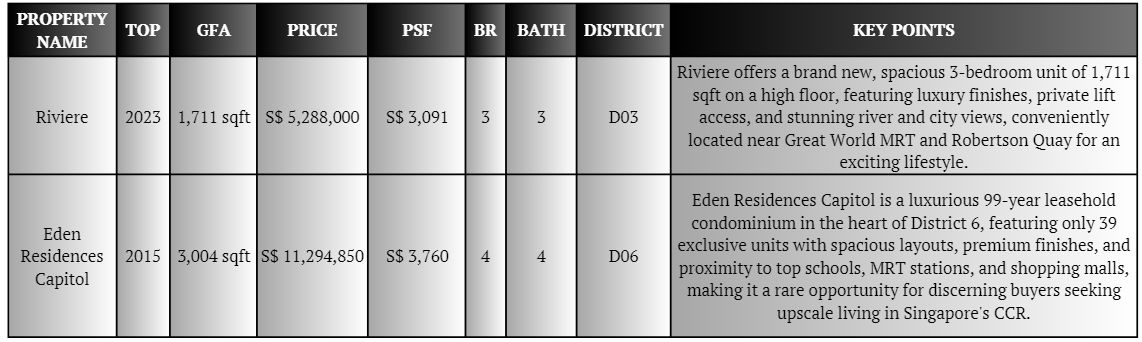

Region |

Average Price (psf) |

MoM Price Change (June 2024) |

YoY Price Change |

Resale Volume Share |

Median Capital Gain |

|---|---|---|---|---|---|

|

CCR |

$2,600 - $3,800 |

-0.6% |

-0.2% |

17.8% |

$9,000,000 |

|

RCR |

$1,800 - $2,600 |

+1.3% |

+6.4% |

31.7% |

$685,000 |

|

OCR |

$1,200 - $1,900 |

0.0% |

+5.7% |

50.5% |

$4,080,000 |

Singapore’s CCR Price Drop: What You Need To Know

Remember the pre-pandemic days?

Foreign buyers dominated the Core Central Region (CCR), pushing property prices to incredible heights.

But now, things are shifting.

A cooling measure introduced in 2023, along with rising interest rates, has changed the game.

The CCR has always been a hotspot for the wealthy, both local and foreign. However, as of mid-2024, CCR prices have dipped by approximately 1.9% year-on-year, with a notable decline in transaction volumes—down 34.6% to just 168 units sold in May 2024.

This change raises important questions and opens up exciting opportunities for smart investors.

Why is this happening, and what does it mean for you?

What’s the best entry price point, and which properties offer the best value?

If you're ready, let's dive deep into the CCR market.

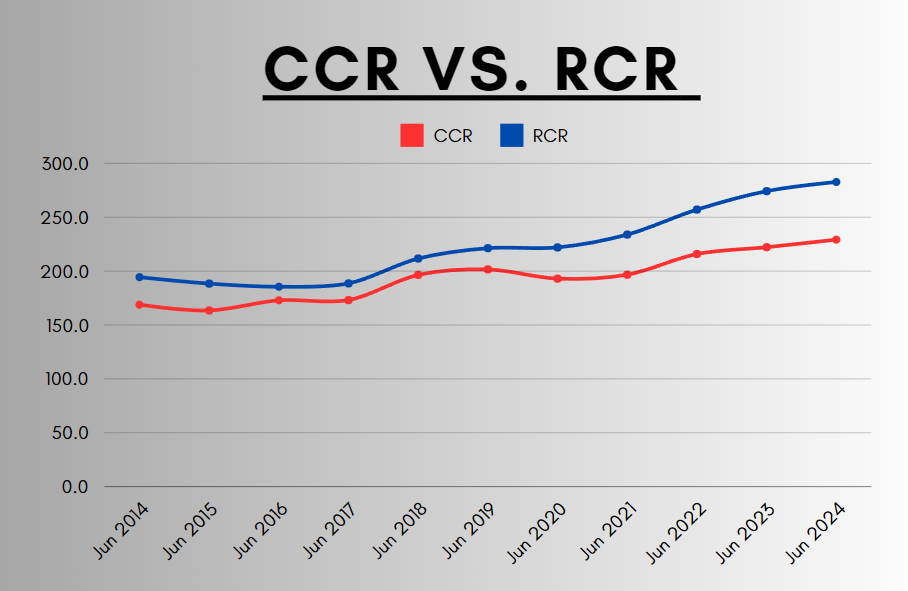

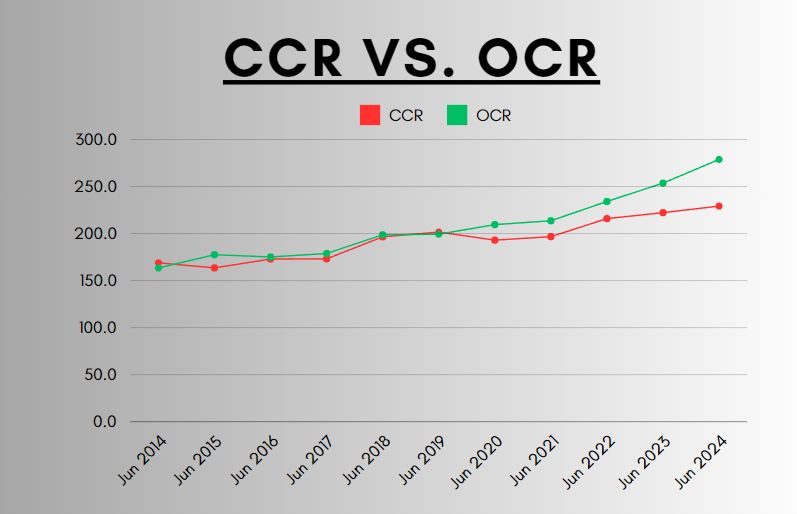

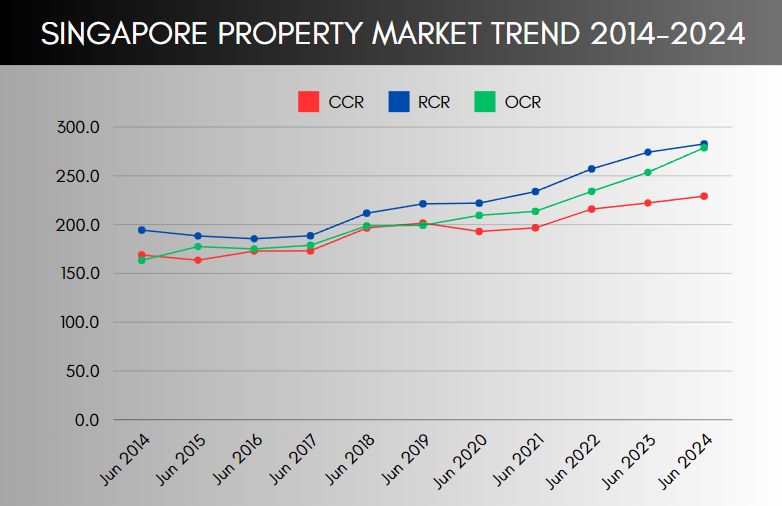

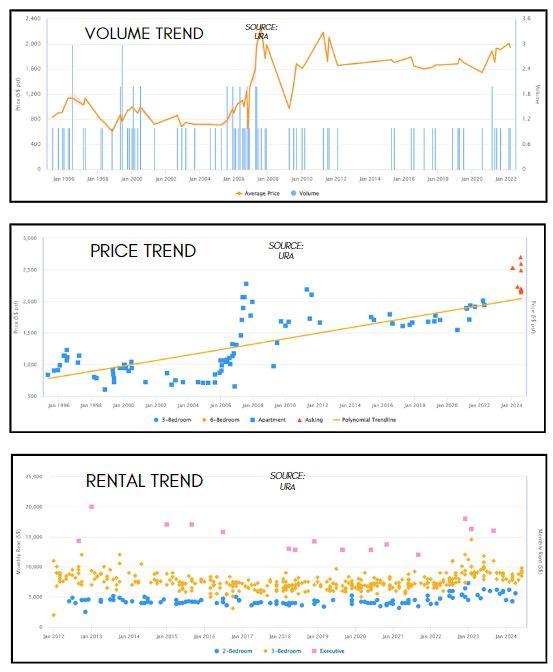

Comparing CCR Property Market Trends with OCR and RCR

Price Trends Overview

Condo Resale Market Trends in June 2024 Show RCR Prices Up 1.3%, While Volumes in All Regions Drop 29.9%.

Core Central Region (CCR)

- In June 2024, CCR prices saw a slight decline of 0.6%, continuing a trend of stagnation in this prime area. The overall median capital gain for resale condos in CCR was $443,000, with the highest transacted price reaching $9,000,000 for a unit at The Tate Residences. This indicates a high-end market that remains attractive.

- Despite the recent price drop, the CCR remains a coveted area for investors seeking long-term capital appreciation. Properties in this region are often viewed as stable investments, particularly those that are freehold, which offer a more extended runway for potential gains.

RCR (Rest of Central Region)

- The RCR experienced a modest price increase of 1.3% in June 2024, reflecting a more resilient market compared to the CCR. Year-on-year, RCR prices have risen by 6.4%, showcasing a robust demand for properties in this area, particularly among young professionals and families.

- The RCR is increasingly seen as an attractive alternative to the CCR, offering a balance of urban living with relatively lower entry prices. The average price per square foot (PSF) for new launches in the RCR has been competitive, often ranging from $2,460 to $2,800 PSF, making it appealing for both investors and owner-occupiers.

OCR (Outside Central Region)

- The OCR has remained stable, with prices showing no significant change in June 2024. However, year-on-year, OCR prices have increased by 5.7%, indicating a steady demand for more affordable housing options.

- The OCR is particularly attractive for first-time buyers and families, with a significant portion of transactions (50.5% in June 2024) occurring in this region. The average PSF for new developments in the OCR is notably lower, around $2,080 to $2,451 PSF, appealing to budget-conscious investors.

Price Gap Analysis

(SINGAPORE PRICE INDEX )

The average PSF in the CCR remains substantially higher than in the RCR, with CCR properties often exceeding $2,900 PSF, while RCR averages around $2,700 PSF.

This widening gap above suggests that while CCR properties may be perceived as premium investments, the RCR is rapidly gaining traction as a viable alternative.

The gap is even more pronounced when comparing CCR with OCR, where OCR properties can be found at prices as low as $2,080 PSF.

This disparity highlights the potential for investors to capitalize on the affordability and growth prospects in the OCR without sacrificing quality of living.

While the RCR and OCR have seen robust growth, the CCR’s relative stagnation makes it an undervalued gem. This trend underscores the potential upside for those investing in the CCR now.

As the market stabilizes, properties in the CCR are poised for a rebound. By investing now, you position yourself to benefit from future price increases.

3 Reasons Behind the Current Price Drop

1. Economic Conditions

The global economic situation has been difficult, with rising inflation, interest rates, and geopolitical tensions. These factors have created an environment of uncertainty, leading to a more cautious approach among buyers.

Many investors are taking a step back, carefully evaluating their options before committing to a purchase. This hesitancy has put downward pressure on prices in the CCR, where properties are typically purchased for investment purposes.

2. Government Policies

The Singapore government's introduction of higher Additional Buyer's Stamp Duty (ABSD) rates for foreign buyers has been a game-changer. The ABSD for foreigners has doubled from 30% to 60%, making it significantly more expensive for non-residents to invest in Singapore's property market.

This policy shift has effectively priced out many foreign buyers, who have traditionally been a significant driver of demand in the CCR.

As a result, we've seen a noticeable decline in transactions involving foreign investors, contributing to the price drop in this prime region.

3. Changing Buyer Behavior

One of the most interesting trends we've observed is the shift towards local buyers, particularly HDB upgraders. With prices in the RCR and OCR remaining relatively more affordable compared to the CCR, many Singaporeans are taking this chance to upgrade to private homes. These buyers are often looking for their own stay, rather than investment purposes, and are less affected by the ABSD hikes.

This changing buyer profile has helped sustain demand in the RCR and OCR, while the CCR experiences a more pronounced price correction.

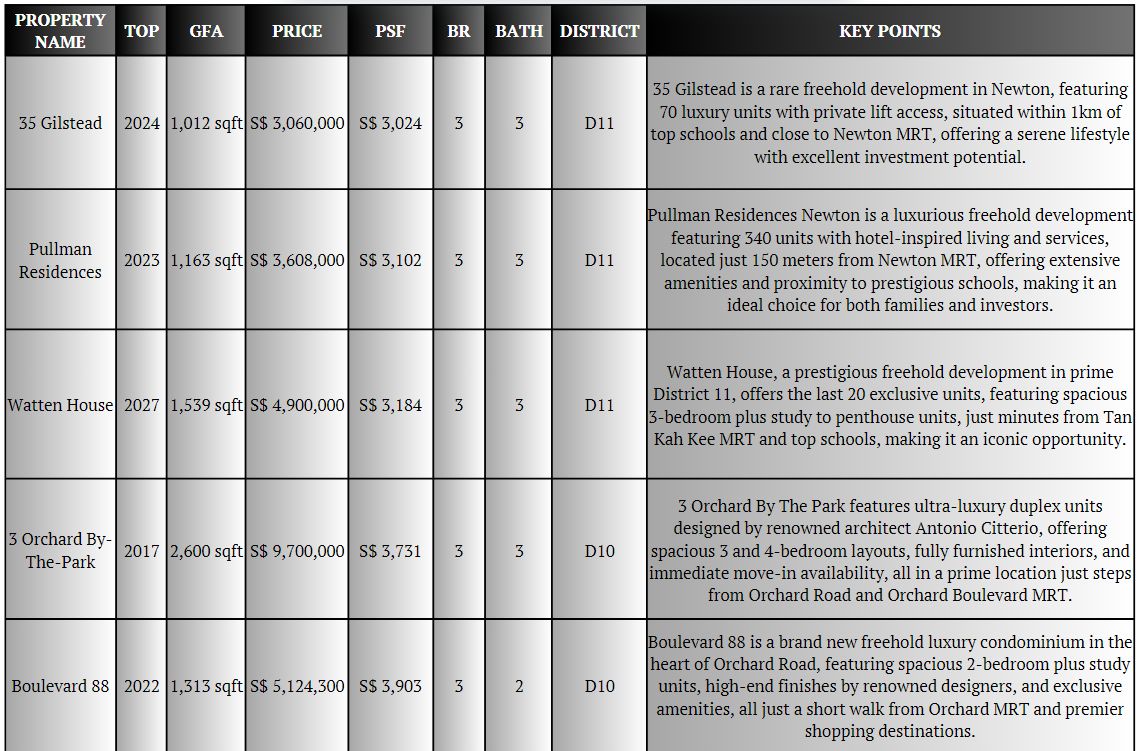

Investment Opportunities

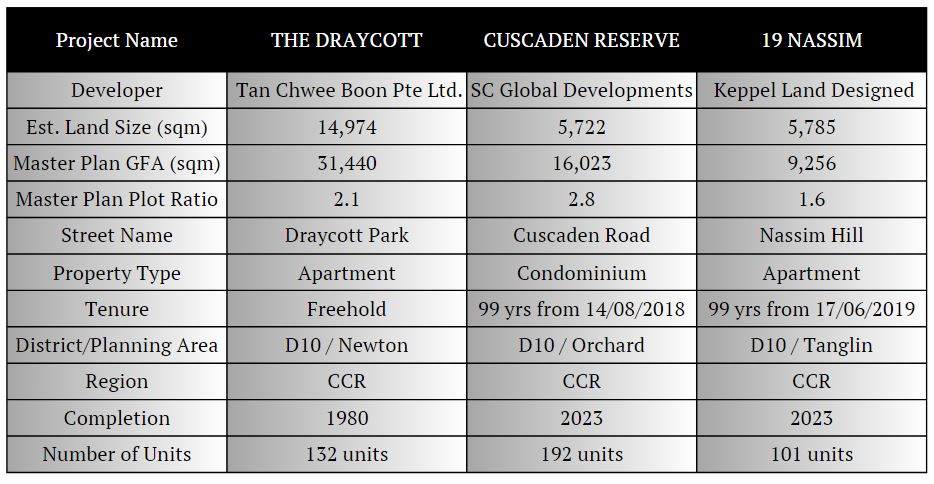

( The Draycott vs. Cuscaden Reserve vs. 19 Nassim )

Choosing the right property to invest in can be a daunting task, especially when all options are located in Singapore’s prestigious Core Central Region (CCR).

To help you make an informed decision, we have compared three of the most sought-after properties: The Draycott, Cuscaden Reserve, and 19 Nassim. Each of these developments offers unique features and investment potential.

Here’s a detailed comparison to guide your investment choice.

Project Information:

Below analysis focuses on three-bedroom units, providing you with a clear and fair perspective on their investment potential.

Property Details and Investment Potential

|

Property |

The Draycott |

Cuscaden Reserve |

19 Nassim |

|---|---|---|---|

|

Size (sqft) |

2,637 |

1,163 |

1,410 |

|

Price (SGD) |

5,888,000 |

3,499,000 |

5,100,000 |

|

Price per sqft (SGD) |

2,233 |

3,009 |

3,617 |

|

Bedrooms |

3 |

3 |

3 |

|

Bathrooms |

4 |

2 |

3 |

|

Key Features |

High floor unit, spacious living, bright and breezy interiors, unobstructed greenery and city views, proximity to top schools, shopping, medical facilities. |

Luxurious living, significant 20% discounts, private lifts, modern designs, 180 meters from Orchard Boulevard MRT. |

New luxury condominium, high-end finishes, prime location near Orchard Road and Botanic Gardens. |

Location and Accessibility

|

Property |

Nearby Educational Institutions |

MRT Stations |

Walking Time |

Distance |

|---|---|---|---|---|

|

The Draycott |

RGS, ACS |

NS22/TE14 Orchard MRT (13 mins), NS21/DT11 Newton MRT (17 mins) |

13 mins, 17 mins |

1.1 km, 1.4 km |

|

Cuscaden Reserve |

ACS, River Valley Primary School |

TE13 Orchard Boulevard MRT (3 mins), TE12 Napier MRT (9 mins) |

3 mins, 9 mins |

290 m, 750 m |

|

19 Nassim |

SG Chinese Girls School, Raffles Girls School, RGS |

TE12 Napier MRT (6 mins), TE13 Orchard Boulevard MRT (9 mins) |

6 mins, 9 mins |

500 m, 710 m |

Key Property Metrics

|

Project Name |

The Draycott |

Cuscaden Reserve |

19 Nassim |

|---|---|---|---|

|

Indicative Price Range / Average* |

S$ 2,724 - S$ 2,756 psf / S$ 2,740 psf |

S$ 2,824 - S$ 3,777 psf / S$ 3,054 psf |

S$ 3,001 - S$ 3,819 psf / S$ 3,366 psf |

|

Indicative Rental Range / Average** |

S$ 2.8 - S$ 4.8 psf pm / S$ 3.4 psf pm |

S$ 8.2 - S$ 9.4 psf pm / S$ 8.7 psf pm |

S$ 8.6 - S$ 9.9 psf pm / S$ 9.2 psf pm |

|

Implied Rental Yield** |

2.10% |

3.40% |

3.30% |

|

Historical High |

S$ 2,275 psf in Aug 2007 for a 2,637-sqft unit |

S$ 3,830 psf in Jun 2022 for a 1,163-sqft unit |

S$ 3,906 psf in Feb 2023 for a 1,410-sqft unit |

|

Indicative Average Price from Historical High |

-14.60% |

-20.30% |

-13.80% |

|

Historical Low |

S$ 607 psf in Nov 1998 for a 2,637-sqft unit |

S$ 2,824 psf in Mar 2024 for a 700-sqft unit |

S$ 3,001 psf in Mar 2024 for a 678-sqft unit |

|

Buyer Profile by Residential Status |

Singaporean 61.1%, PR 15.6%, Foreigner 16.7%, Company 4.4% |

Singaporean 75.2%, PR 19.3%, Foreigner 5.5%, |

Singaporean 68.8%, PR 16.7%, Foreigner 14.6%, |

Still Can't Decide Which Property to Invest In? Let's Dive Deeper!

In-Depth Analysis

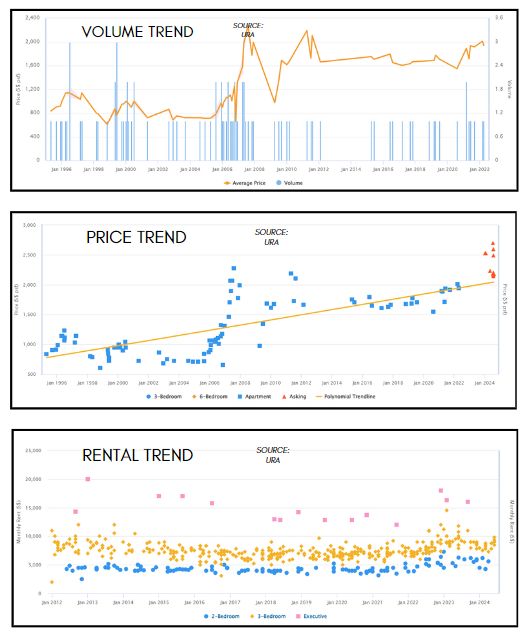

The Draycott: Timeless Elegance and Prime Location

The Draycott offers a unique blend of timeless elegance and strategic location. Built in 1980, this freehold property has maintained its appeal with spacious 2,637 sqft units, high ceilings, and an aura of sophistication.

The high-floor units provide unobstructed views of greenery and the cityscape, enhancing the living experience.

Personal Insight: Investing in The Draycott is like owning a piece of Singapore’s real estate legacy. Its enduring appeal and prime location make it a standout choice for investors seeking long-term value and stability.

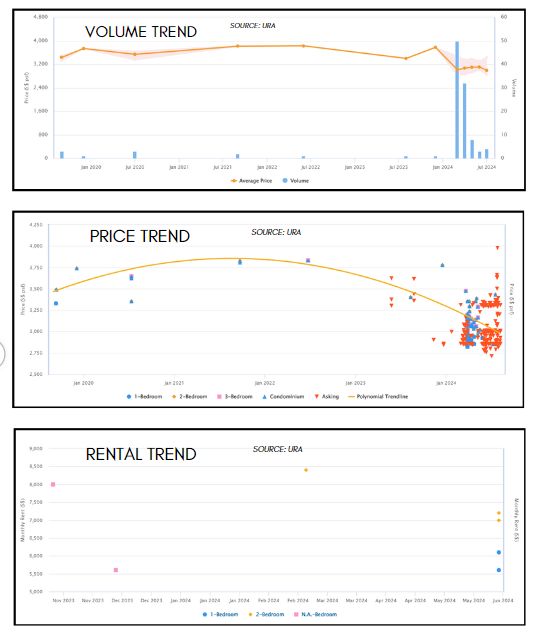

Cuscaden Reserve: Modern Luxury in a Serene Setting

Cuscaden Reserve, completed in 2022, represents the epitome of modern luxury. Located just 180 meters from Orchard Boulevard MRT, this 99-year leasehold property offers residents the perfect blend of convenience and tranquility.

The development features private lifts, modern designs, and 192 exclusive units, making it a haven for luxury living.

Personal Insight: Cuscaden Reserve is ideal for those seeking a modern, luxurious lifestyle in a serene setting. Its proximity to Orchard Road and exclusive features make it a compelling investment.

19 Nassim: Boutique Living with an Artistic Flair

19 Nassim, developed by Keppel Land and completed in 2023, offers a boutique living experience with an artistic flair.

This 99-year leasehold property features 101 exclusive units with high-end finishes, catering to those who appreciate luxury and aesthetics. Located near Orchard Road and the Botanic Gardens, 19 Nassim offers unparalleled convenience and exclusivity.

Personal Insight: 19 Nassim is perfect for investors who value exclusivity and artistic design. Its boutique nature and prime location make it a unique and highly desirable investment option. The property’s design, blending modern luxury with artistic flair, not only enhances its appeal but also ensures that it stands out in the competitive luxury market.

Comparative Investment Analysis

When comparing The Draycott, Cuscaden Reserve, and 19 Nassim, consider the following key factors to determine which property aligns best with your investment goals:

The Draycott

- Current Pricing: With a current price of S$2,233 psf, The Draycott offers the most affordable option among the three properties, reflecting a 1.8% decrease from its indicative high of S$2,275 psf. This freehold property in District 10 provides spacious living at a significantly lower price compared to its peak, making it a potentially lucrative investment for those valuing long-term capital appreciation and stability.

- Rental Returns: With an indicative rental yield of 2.10% and average rental rates between S$ 2.8 and S$ 4.8 psf per month, The Draycott’s rental returns are modest. However, its historic price drop could mean high future gains as the market rebounds.

- Buyer Profile: A majority of buyers are Singaporeans (61.1%), with a smaller percentage of foreigners, indicating a stable, local investor base.

Cuscaden Reserve

- Current Pricing: Priced at an average of S$ 3,054 psf, Cuscaden Reserve has seen a 20.30% decline from its peak of S$ 3,830 psf. This newly completed property offers significant modern amenities and luxury features at a competitive price, reflecting a substantial discount from recent highs.

- Rental Returns: Offering a higher rental yield of 3.40% and rental rates between S$ 8.2 and S$ 9.4 psf per month, Cuscaden Reserve provides stronger returns compared to The Draycott. Its proximity to Orchard Boulevard MRT and luxury features enhance its rental attractiveness.

- Buyer Profile: With 75.2% of buyers being Singaporeans and a notable portion of PRs, Cuscaden Reserve is popular among both local and permanent resident investors.

19 Nassim

- Current Pricing: At S$ 3,366 psf on average, 19 Nassim is the most expensive option, reflecting a 13.80% decrease from its high of S$ 3,906 psf. Despite its premium price, this property’s exclusivity and high-end finishes justify its value, especially in the prestigious Nassim area.

- Rental Returns: Offering a rental yield of 3.30% with rental rates between S$ 8.6 and S$ 9.9 psf per month, 19 Nassim's returns are competitive. Its boutique nature and prime location make it an appealing choice for investors seeking luxury and prestige.

- Buyer Profile: With 68.8% Singaporean buyers and a significant foreign presence, 19 Nassim appeals to a diverse investor base.

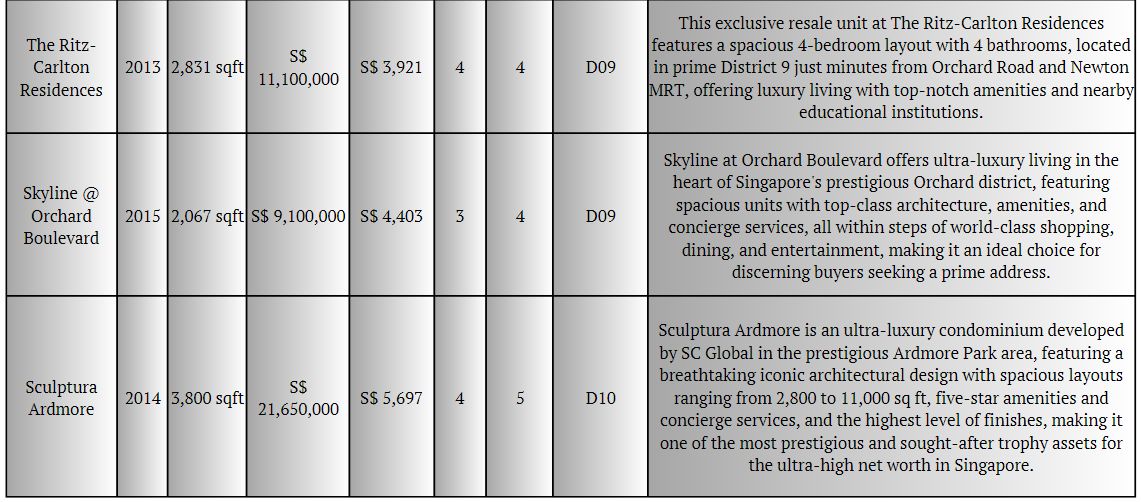

Other Properties Available in CCR

Other Prime Properties Available

SEIZE THE MOMENT! Invest in CCR Now and Enjoy Unmatched Returns!

So, What is the Best Entry Price Point?

Given the current market dynamics, the best entry price point in the CCR is likely around S$2,500 to S$2,800 psf for established properties. And among these exceptional options, The Draycott truly shines as an undervalued gem.

Its enviable location and freehold status not only enhance its appeal but also position it for substantial capital appreciation, particularly as infrastructure developments continue to enhance its appeal. Upcoming projects, such as new MRT lines and commercial hubs, are set to drive property values upward in the coming years.

This is an incredible opportunity for savvy investors who recognize the potential for growth in this prestigious area. Imagine the pride of owning a property in one of Singapore's most sought-after neighborhoods. Envision the security and comfort it will provide for your family, along with the long-term financial gains that come from making a smart investment.

Don't let this rare moment pass you by! Act now before the market rebounds and prices rise.

Contact us now!