|

Property Type |

Residential |

Commercial |

Industrial |

|---|---|---|---|

|

Advantages |

|

|

|

|

Disadvantages |

|

|

|

Understanding the Tax Differences Between Commercial, Industrial, and Residential Properties in Singapore

If you are considering investing in properties in Singapore, this article is for you.

Investing in properties is a significant decision that requires careful consideration of various factors, including tax implications and other taxes, such as goods and services tax (GST) and stamp duties.

In Singapore, there are three main types of properties:

- residential,

- commercial, and

- industrial properties

Each property type has its unique characteristics and tax implications that investors need to understand to make informed decisions.

In this article, we will discuss the tax differences between commercial, industrial, and residential properties in Singapore. We will provide you with the insights you need to make informed decisions when investing in these properties.

We will cover topics such as property tax rates, goods and services tax (GST), and stamp duties.

By the end of this article, you will have a better understanding of the tax implications of investing in commercial, industrial, and residential properties in Singapore.

Key Differences Between Property Types

- Residential Properties

These properties are typically used for living purposes and can be divided into public or private housing. Most beginner property investors tend to purchase private property as a second property for investment purposes.

- Commercial Properties

These include offices, retail spaces, and other business premises. They generally offer higher rental yields (~5%) compared to residential properties (~2-3%).

- Industrial Properties

These properties are mainly used for manufacturing, warehousing, storage, and workshops. They can be divided into light industrial properties (B1 industrial properties) and heavy industrial properties (B2 industrial properties).

Property Tax Rates

Regarding tax rates, there are significant differences between commercial/industrial and residential properties in Singapore. Commercial properties tend to have higher tax rates due to their income-generating potential and higher assessed values.

|

Property Tax Formula: |

|---|

|

Annual property tax is calculated by multiplying the Annual Value (AV) of the property with the Property Tax Rates that apply to you. For example, if the AV of your property is $30,000 and your tax rate is 10%, |

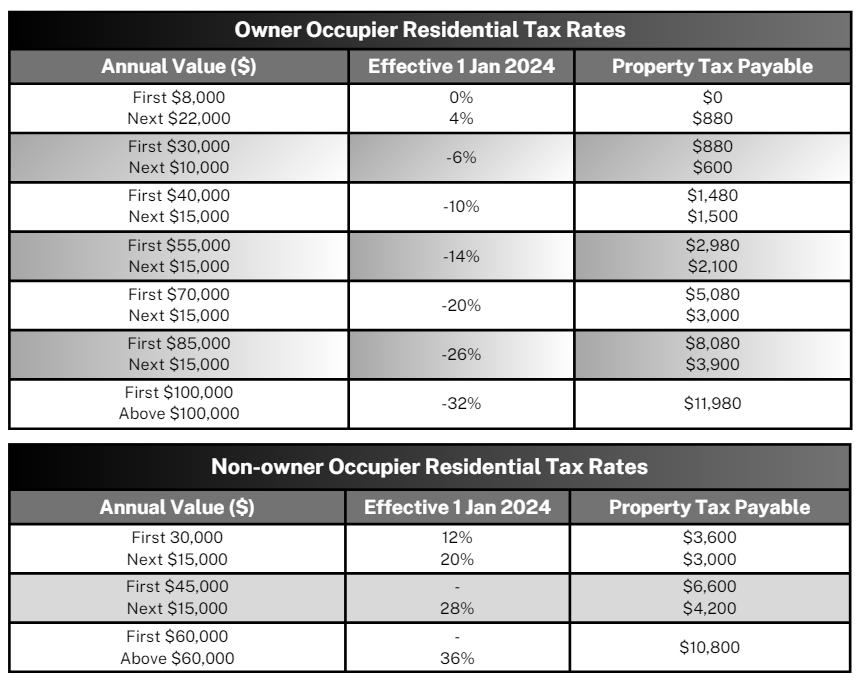

- Residential Property Tax Rates

Residential properties in Singapore have progressive tax rates depending on the annual value of the property. Additionally, the buyer stamp duty percentage has been revised for properties above S$1M.

- Commercial and Residential Property Tax Rates

For non-residential properties, such as commercial and industrial buildings and land, the tax rate is 10% of the annual value. There is only one type of property tax rate for industrial and commercial properties,. There is no differentiation between owner-occupied and non-owner-occupied tax rates for commercial properties.

Stamp Duties

Stamp duties are an essential aspect of property transactions in Singapore. Stamp duties are levied on written documents, as well as electronic instruments executed on or after leases. There are two types of stamp duties imposed on the buyer:

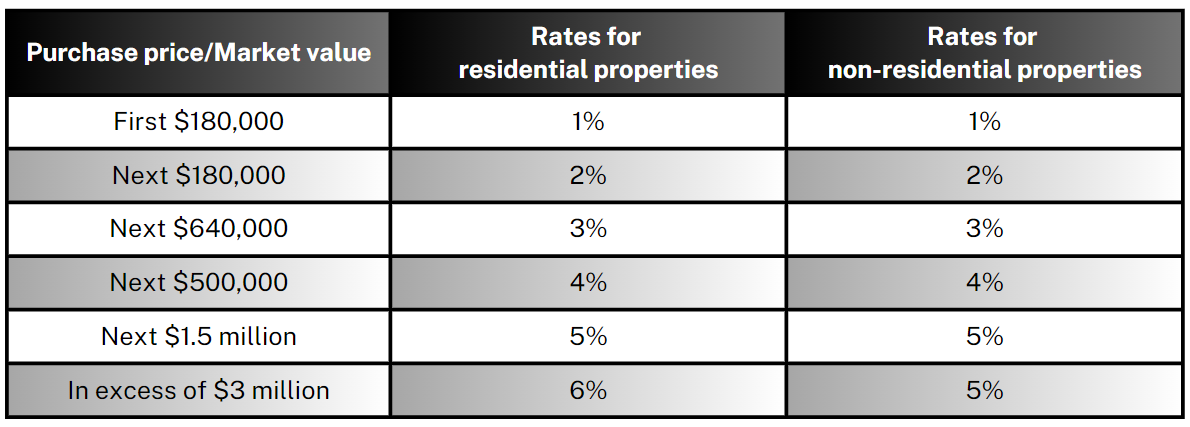

1. Buyer's Stamp Duty (BSD)

BSD is a tax on documents related to the purchases and leases of properties.

|

BSD rates for residential properties are progressive, ranging from 1% to 4% depending on the purchase price. |

|

BSD rates for non-residential properties are also progressive, ranging from 1% to 4% depending on the purchase price. |

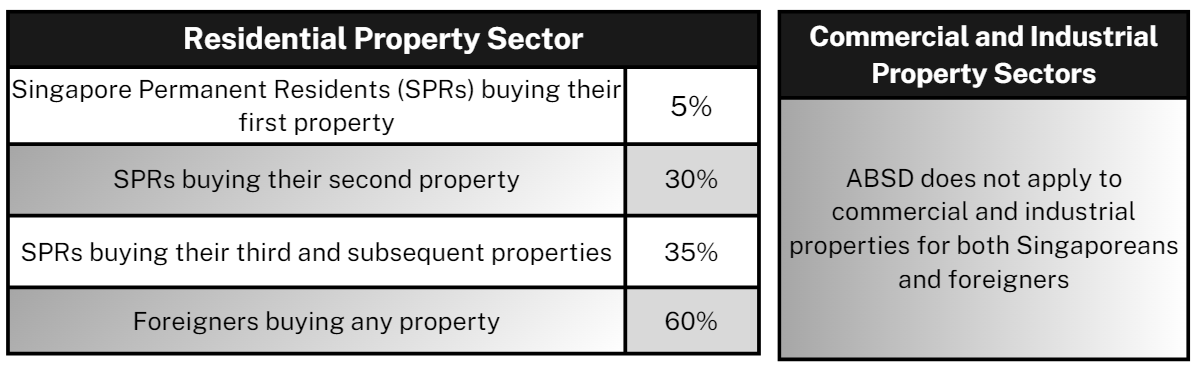

2. Additional Buyer's Stamp Duty (ABSD)

ABSD is a government tax typically charged on the purchase of a second and subsequent residential property.

The impact of ABSD on property investors can be significant, as it increases the overall cost of property ownership and reduces the potential returns on investment.

However, there are ways to avoid paying ABSD, such as purchasing properties under trust with family members or investing in commercial or industrial properties, which are not subject to ABSD.

Goods and Services Tax (GST)

Goods and Services Tax (GST) is a consumption tax levied on the supply of goods and services in Singapore.

The sale and lease of properties in Singapore are subject to GST, except for residential properties. GST is also chargeable on the supply of movable furniture and fittings in both residential and non-residential properties.

|

For commercial properties, GST is applicable if the seller or landlord is a GST-registered company. In this case, the buyer will need to pay an additional 9% (2024) on the property. |

Recent Changes in GST Rates:

- The GST rate will increase from 8% to 9% on 1 January 2024.

- The only exemptions from GST are prescribed financial services, the sale or rental of residential properties, the sale of digital payment tokens, and the import and local supply of investment precious metals.

The impact of GST on property investors can be significant, as it increases the overall cost of property ownership and reduces the potential returns on investment. Investors need to stay updated on these changes and consider them when making investment decisions.

Ownership

When it comes to property ownership, there are advantages and disadvantages to owning properties under personal or individual names versus company names.

The legal and financial implications of each ownership type can vary depending on the specific circumstances of the property and the investor. It's important to consult the latest sources and seek professional advice to make well-informed decisions about property ownership.

Singapore current Commercial, Industrial, and Residential

Property Trends

As we start the year 2024, the Singapore property market is experiencing a unique blend of challenges and opportunities.

- Residential Property Trends

|

The Singapore residential market is showing signs of stabilization in Q4 2023, with cooling demand in both public and private property markets. |

|

The rental market, particularly the private residential segment, is expected to cool as well. |

Despite the cooling measures and high prices, Singapore's residential market remains resilient. The government has taken several measures to curb rising property prices, such as doubling the stamp duty for foreigners to 60% in April 2023. However, these measures have not significantly impacted the market, and private home prices are still expected to increase.

- Industrial Property Trends

Rising Rents and Prices

|

The industrial property sector in Singapore has remained resilient, with rents and prices experiencing a sustained upward trajectory. |

According to the JTC All Industrial price and rental indices, the sector achieved its eleventh consecutive quarter of growth in Q2 2023. This trend is projected to persist, with rents for industrial and warehouse spaces expected to continue their ascent.

The outlook for the global economic growth may be subdued, but Singapore's industrial properties stand as a testament to unwavering growth amidst challenging times.

- Resilient Demand and Future Prospects

|

Despite the macroeconomic uncertainties, demand for industrial assets remains robust, particularly in the logistics, biomedical, and semiconductor segments. |

Singapore's strategic location and its status as a regional hub further bolster the sector's prospects, making it an attractive investment avenue for discerning investors. With higher supply expected to moderate rental and price growth, the industrial market's future remains characterized by a delicate balance of supply and demand.

- Commercial and Industrial Property Trends

|

The commercial real estate landscape in Singapore has continued to exude resilience and promise, with the industrial sector emerging as a bright spot amidst the broader market dynamics. |

The sustained growth in the industrial domain has not only defied global headwinds but has also underscored the sector's ability to weather challenges and emerge stronger.

4 Essential Factors to Consider When Investing

in Singapore Properties

- Diversification

Investing in a mix of residential, commercial, and industrial properties can help you diversify your investment portfolio and reduce risk. Diversification is a fundamental principle of investing and can help spread risk across different asset types and market sectors.

- Rental Yields

Commercial and industrial properties generally offer higher rental yields compared to residential properties, making them more attractive for investors. However, it's essential to carefully assess the potential risks and rewards of each property type before making investment decisions.

- Market Trends

The performance of the commercial and industrial property sectors is linked to the type of industry the tenants and the overall market trends. It's crucial to keep an eye on these trends to make informed decisions. Staying informed about market trends and economic indicators can help investors anticipate potential changes in property values and rental rates.

- Local Regulations

Be aware of local regulations, such as the Goods & Services Tax (GST) and the Additional Buyer Stamp Duties (ABSD) charges, which may affect your investment decisions. Understanding the local regulatory environment is crucial for property investors to ensure compliance and mitigate potential risks.

Don't Miss Out: Seize the Singapore Property Market Opportunity Now!

Investing in properties in Singapore can be a lucrative opportunity, but it also comes with challenges and risks. By understanding the tax differences between commercial, industrial, and residential properties, you can make more informed decisions when investing in Singapore's property market.

Diversification is key to reducing risk, and investing in a mix of residential, commercial, and industrial properties can help you achieve this. Commercial and industrial properties generally offer higher rental yields compared to residential properties, making them more attractive for investors but it's important to keep an eye on market trends and economic indicators to anticipate potential changes in property values and rental rates.

Additionally, understanding local regulations, such as the Goods & Services Tax (GST) and the Additional Buyer Stamp Duties (ABSD) charges, is also crucial for property investors to ensure compliance and mitigate potential risks.

I can provide you with expert guidance and support throughout the investment process. I can help you navigate the complexities of the Singapore property market and identify the best investment opportunities based on your unique needs and goals.

Contact me today to learn more about how I can help you achieve your financial objectives through property investment in Singapore.