|

Feature |

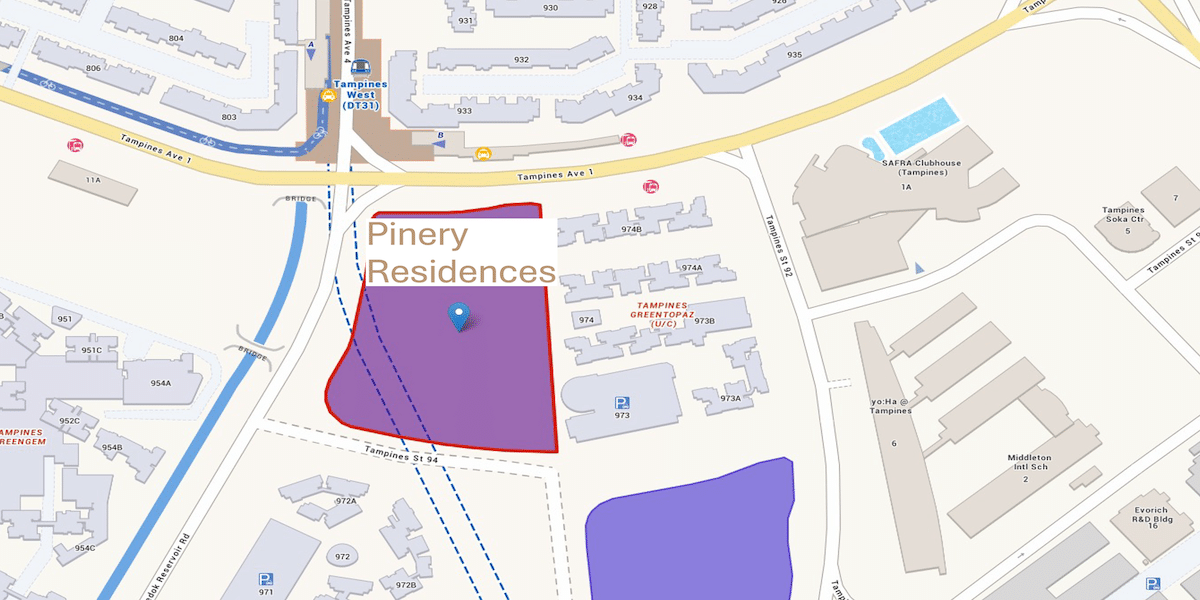

Pinery Residences |

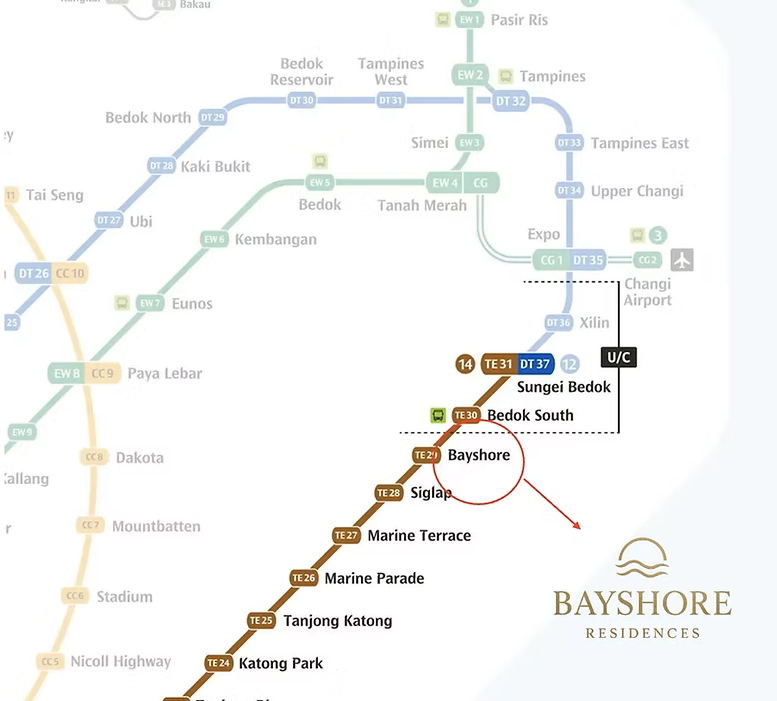

Bayshore Residences |

River Modern |

|---|---|---|---|

|

Location |

Tampines Street 94, (District 18) |

Bayshore / East Coast (District 16) |

River Valley / District 9 (Core Fringe) |

|

Launch Year / Expected Completion |

Launch 2025 / Completion 2029 |

Launch 2026 / Completion 2029 |

Launch 2026 / Completion 2030-31 |

|

Tenure |

99-year leasehold |

99-year leasehold |

99-year leasehold |

|

Developer |

Hoi Hup Realty & Sunway Developments. |

SingHaiyi Garnet Pte. Ltd. (SingHaiyi Group) |

Guocoland |

|

Units |

596 |

515 |

455 |

|

MRT |

Tampines West (DTL) |

Bayshore (TEL) |

Great World (TEL) |

Top 3 Singapore Projects That Could Outperform in 2026

If you’ve been investing long enough, you know that in Singapore, usually, the quiet, “unsexy” ones, and the ones that don’t make the headlines, end up outperforming the market.

In 2017, people dismissed Parc Esta, until it quietly became one of the best-performing OCR launches of its year.

In 2019, many laughed at Sky Everton’s price, until it doubled for early buyers.

In 2021, most investors overlooked Pasir Ris 8 until it became one of the most profitable OCR mixed-use launches ever.

In 2022, Terra Hill’s skeptics were loud, until transacted prices climbed higher than anyone predicted.

And 2026?

Three projects with strong signals and undeniable if you’re paying attention.

Projects that may outperform because the numbers and the timing make sense, and the fundamentals are aligned with how Singaporeans actually buy, live, rent, and upgrade today.

Now, let me show you those three projects.

1. PINERY RESIDENCES

The Suburban Mixed-Use Development With a Quiet Advantage

Let me start with a confession: Pinery Residences is the kind of project that doesn’t impress you at first glance.

It doesn’t have the waterfront glamour. No flashy branding. Not a high-profile CCR launch. And that is exactly why it’s dangerous, because this is the type of project that quietly outperforms while the market is distracted by the big shiny names.

Location Advantage: Tampines West MRT — A Game Changer Most Ignore

Just look at the pattern: Properties within 300m of MRT stations in suburban estates consistently achieve stronger resale demand and rental resilience.

– 5–10 mins to established schools

– Mature amenities

– No “ghost town” vibes

– Predictable resale demand

The data shows it clearly (updated as of Dec 2025)

- OCR condos near MRTs have 8–12% higher resale velocity

- Average rental occupancy reaches 97%

– Current OCR 2-bedder rent: $3,800–$4,200 (Dec 2025)

– Vacancy rates in mature OCR zones: <5.5%

– Demand from young families waiting for BTO keys or expats priced out of RCR

- Price floors hold even in weak markets due to upgrader demand

Now combine this with…

Mixed-Use = Higher Footfall, Higher Rent, Higher Long-Term Value

Pinery isn’t just a residential project — it’s a mixed-use project.

That means:

- Supermarket

- F&B + daily retail downstairs = premium on rent

- Retail convenience

- Every day footfall that strengthens long-term viability

Mixed-use projects in Singapore tend to:

✔ Maintain higher rental yields

✔ Outperform in family-oriented neighborhoods

✔ Enjoy low vacancy risk

✔ Units are easier to lease and easier to resell

Think of Pasir Ris 8, North Park Residences, and Hillion Residences; history speaks for itself.

Family Market = The Most Stable Buyer Segment in 2026

Singapore’s biggest driver for OCR demand in 2026? Upgraders.

- About 22,000 HDBs reach MOP in 2026

- Tampines has one of the strongest upgrader pools in the East

- Families want near-MRT, near-schools, near-amenities homes

This is exactly Pinery’s target buyer group.

And investors?

You are indirectly riding on family-driven demand, the most stable, predictable, and recession-resistant segment of Singapore real estate.

|

My Honest Take |

2. BAYSHORE RESIDENCES

First-Mover Advantage in a New Coastal District — A Rare Singapore Opportunity

Let me ask you a question.

When was the last time Singapore unveiled an entirely new waterfront residential precinct?

Exactly.

Bayshore is not just another launch; it is one of the last major coastal masterplans in Singapore with such strong potential.

This Is East Coast… But Reborn as a New Waterfront Lifestyle District

The Bayshore masterplan brings:

- Thomson-East Coast Line connectivity

- Park connectors

- Pedestrian-friendly lifestyle

- Sea-breeze living

- A future car-lite coastal town

Singaporeans love the East Coast for a simple reason: It feels like a different country, relaxed, breezy, peaceful, yet connected.

The moment you combine that lifestyle with new MRT connectivity, demand shifts instantly.

First Private Project in a New Precinct = Highest Growth Potential

History of first-movers:

- The early buyers of Punggol’s first ECs saw huge upside

- One-North’s early projects tripled for some buyers

- Jurong Gateway’s first batch became top performers

- Pasir Ris 8 — early buyers won big

Being FIRST in a masterplan gives you:

✔ Future price uplift from subsequent launches

✔ Additional value created by infrastructure

✔ Strong capital appreciation potential

Sea Views + Lifestyle = Rental Premium

Tenants pay for lifestyle, not just square footage.

Sea-facing developments in Singapore consistently fetch:

- 8–15% rental premium

- Low vacancy rates (<4%)

- Attraction for expats, singles, couples, professionals

Current Bayshore-area rents (Dec 2025):

– 2BR: $4,500–$5,200

– 3BR: $6,000+

Vacancy rates:

– Among the lowest in District 16

Bayshore is positioned to attract both families and young professionals due to its:

- TEL access (Aviation/tech professionals)

- Proximity to Changi Business Park

- Direct line to Orchard & Woodlands

- East Coast lifestyle

- Future commercial & retail node

Low Entry Relative to Prime East Coast Freehold

The surrounding East Coast freehold resale market is expensive. That creates a natural price support and makes Bayshore’s launch prices, even if not cheap, appear strategic.

|

My Honest Take |

3. RIVER MODERN

The “Almost CCR” Development With a Rare Core Fringe Advantage

Among the three, River Modern is the one that feels… misunderstood. Underestimated.

It’s not in the heart of the River Valley. It’s not priced like Orchard or marketed as CCR. Yet anyone who studies investor behaviour knows:

Core Fringe (RCR bordering CCR) is where value grows fastest during supply squeezes.

And guess what 2026 is?

A supply squeeze.

Why Core Fringe Leads in Upside Cycles

Two simple reasons:

- CCR becomes too expensive

- OCR becomes too crowded

River Modern sits in that sweet spot:

- Minutes from Great World

- Fast route to CBD

- Near the Singapore River lifestyle zone

- Surrounded by future redevelopment nodes

So buyers who want something “premium” without CCR pricing automatically shift into RCR.

RCR’s 5-Year Outperformance Over OCR

Based on URA and industry data (Dec 2025):

- RCR prices grew 36% over the last 5 years

- OCR grew 29%

- CCR grew 22%

Why? Because RCR is the “value zone”. Not too high. Not too low.

Perfect for owner-occupiers and long-term investors.

Smaller-Scale, More Exclusive = Faster Absorption & Higher Rent

River Modern, at 455 units, sits in the “sweet spot” size category:

- Not too big (so supply isn’t overwhelming)

- Not too small (so facilities are strong)

Smaller prime-fringe developments often enjoy:

✔ Higher owner-occupancy

✔ Faster resale velocity

✔ More premium lifestyle positioning

✔ Stable rental demand from professionals

Connectivity & Lifestyle Advantage

Tenants want:

- Near the MRT

- Near the CBD

- Near nightlife / dining

- Near fitness & lifestyle

River Modern checks all the boxes.

|

My Honest Take |

WHY THESE 3 MAY OUTPERFORM IN 2026

It’s not luck or hype. Its fundamentals:

- MRT or strong connectivity

- Family or lifestyle demand

- Mixed-use or lifestyle edge

- Strong buyer pools (upgraders, professionals, expats)

- Masterplan uplift (especially Bayshore)

- Limited 2026 supply

- Rising replacement cost

- Low launches in CCR & RCR

- Singapore’s stable property cycle

And the real reason I believe these three projects stand out?

Pinery = stability + yield

Bayshore = transformation + lifestyle demand

River Modern = capital growth + convenience premium

Three very different strengths and buyer profiles. But all three have something in common:

They are positioned to outperform in 2026 — quietly but powerfully.

A property you can hold without worry.

The kind of returns that don’t make headlines…but change portfolios.

Plan Your 2026 Move Before the Window Closes

If you’ve read this far, I know you’re serious. And you want a project that is stable, safe, and positioned for long-term growth.

These 3 projects — Pinery, Bayshore, River Modern — are the ones I would personally brief my closest clients on.

Let me help you understand which one matches your profile, which layout gives the best value, or units that have the strongest upside.

Message me now!