Unveiling the New Normal: How $2,000+ PSF Is Reshaping Singapore Property Landscape

Navigating the Evolving Real Estate Landscape 2024

The Singapore property market is undergoing a transformative phase, with prices scaling unprecedented heights and new launches redefining the benchmarks for property investments.

As you consider your next move in this dynamic environment, it's crucial to gain understanding of the market trends, pricing dynamics, and investment potential.

Let's embark on a journey to unravel the intricacies of the evolving real estate landscape and explore the opportunities that await savvy investors like you.

The Current Market Trend

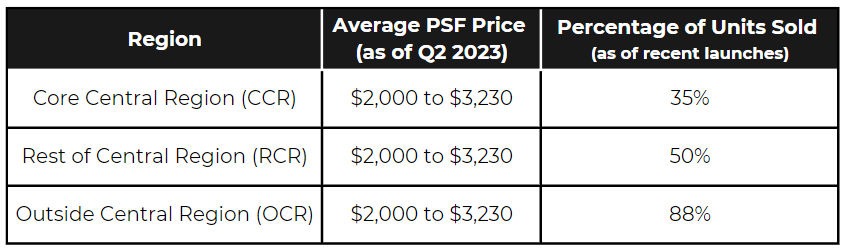

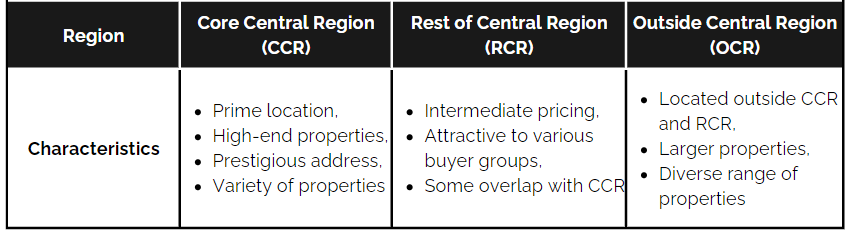

The Singapore residential property market has experienced significant changes, with prices reaching unprecedented levels. In the Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR), the average prices of new private homes have surged, impacting the market trends in these areas.

Recent Selling Prices and Percentage of Units Sold

Recent data indicates that the average price of new private homes in the prime condo market is around $2,000 to $3,230 per square foot (psf).

Notably, J'den achieved an 88% sales rate on launch day at an average price of $2,451 psf.

The average psf prices of new launch condos have increased by 62% between 2017 and Q2 2023, with the largest gap between average psf prices of new launch condos and resale observed in the OCR

At the balloting tent of J'den on its launch day on Nov 11 (Photo: CapitaLand Development)

Below is a table depicting the recent selling prices and the percentage of units sold in new launches across different regions of Singapore.

The average PSF prices of new launch condos have surged by 62% between 2017 and Q2 2023, with the largest gap between average PSF prices of new launch condos and resale observed in the OCR.

The recent selling prices and the percentage of units sold in new launches in these areas reflect the strong demand and increasing prices in the Singapore residential property market.

Decoding Price Per Square Foot

Factors Influencing Pricing Trends

Several factors influence the pricing trends in the Singapore residential property market:

- Government Regulations

Government policies and regulations play a crucial role in shaping the property market. Measures such as the Seller's Stamp Duty (SSD) rules and the Total Debt Servicing Ratio (TDSR) have impacted demand and supply dynamics, influencing price movements. - Foreign Buyer Involvement

The involvement of foreign buyers can significantly impact pricing trends.

With the recent ABSD increase, foreign investment is effectively curved to push any forms of speculation. - Economic Indicators

Economic indicators, including interest rates, inflation, and overall economic performance, have a direct bearing on property prices. Rising interest rates and talks about a global recession can create downside risks to home prices, while cost-push inflation of new launch prices may support price levels.

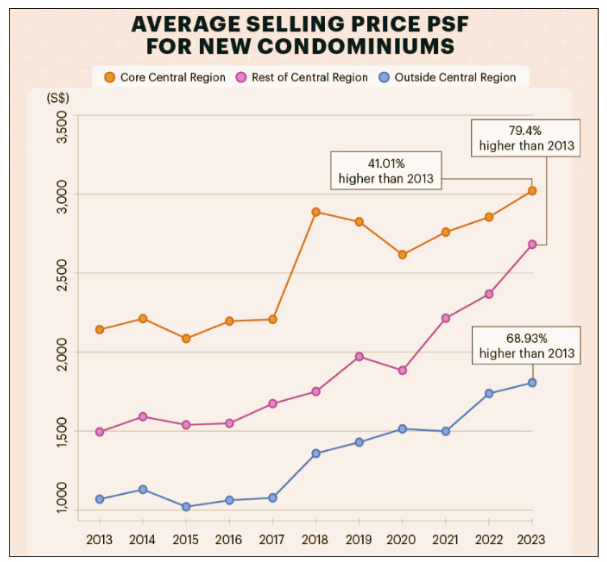

Historical Data and Future Projections

Historical data and future projections indicate a sustained upward trajectory, with $2,000+ PSF poised to become the new standard for new launches in 2024 and beyond.

However, downside risks to housing prices may emerge due to rising interest rates and supply-side factors, potentially leading to a softening of housing prices from 2024 onwards.

UNVEILING INVESTMENT POTENTIAL

Amidst the escalating prices, properties in different regions present compelling investment opportunities, characterized by promising rental yields, capital appreciation prospects, and potential resale value. Here are some examples that serve as testaments to the wealth-building potential inherent in the current market.

- Luxury Condominiums:

High-end condos offer a blend of luxury, convenience, and top-notch amenities. With the city’s growing affluence, the demand for such properties is on the rise, making them an attractive investment option.

- Landed Properties

Despite the scarcity of land in Singapore, landed properties like bungalows and terraced houses remain a coveted investment. These properties offer the luxury of space and are often located in prime districts, making them attractive for capital appreciation.

| Characteristics of Properties in CCR, RCR, and OCR |

Navigating Safe Entry Points

The concept of safe entry points underscores the need for strategic decision-making. Understanding the rationale behind these entry points and weighing the associated risks and rewards is pivotal for informed investment choices.

The Safe Entry Points Per Region in Singapore

Rationale Behind Safe Entry Points

The safe entry points for different regions are influenced by various factors, including historical price movements, market dynamics, and affordability considerations. Here's a breakdown of the rationale behind these safe entry points:

- Core Central Region (CCR)

The average PSF prices for CCR units have surged by 41% from S$2,142.29 in 2013 to S$3,020.99 in 2023. The $2,800 PSF entry point reflects the premium nature of properties in this prime location, balancing the potential for capital appreciation with the higher upfront investment.

- Rest of Central Region (RCR)

Prices for RCR units have skyrocketed by almost 80% from S$1,494.70 to S$2,681.62 PSF over the same period. The $2,400 PSF entry point acknowledges the increasing desirability of this region while considering affordability and potential returns.

- Outside Central Region (OCR)

OCR prices have soared almost 69% from S$1,068.90 to S$1,805.79 PSF over the same period. The $2,100 PSF entry point reflects the balance between affordability and the potential for future appreciation in this mass-market segment.

Potential Risks and Rewards

Navigating these safe entry points involves a careful evaluation of the associated risks and rewards:

Balancing Caution and Opportunity: Making Informed Property Investment Decisions

The current market situation evokes a mix of optimism and caution. While the surge in PSF prices reflects the dynamism and growth potential of the Singapore property market, it also raises concerns about housing affordability and the impact of external economic factors.

As a prospective buyer or investor, it's essential to navigate this landscape with a balanced approach, considering the long-term implications of pricing trends and the broader economic environment.

To gain a deeper understanding of how these trends may impact your specific property investment goals, I invite you to reach out for a personalized consultation. By leveraging expert insights and guidance, you can position yourself to capitalize on the potential gains and secure your foothold in the burgeoning property market.

Don't miss out on the chance to make a strategic investment that could shape your financial future.

Contact us now!