|

Is this worth buying? Bukit Timah has long been associated with prestige and growth. With the upcoming Integrated Transport Hub at Beauty World, 8@BT is set to benefit from enhanced connectivity and infrastructure. As a mid-point between the CBD and educational institutions, this project promises long-term appreciation, especially given its proximity to trains. For investors, this represents a low-risk entry into one of Singapore’s most resilient markets. |

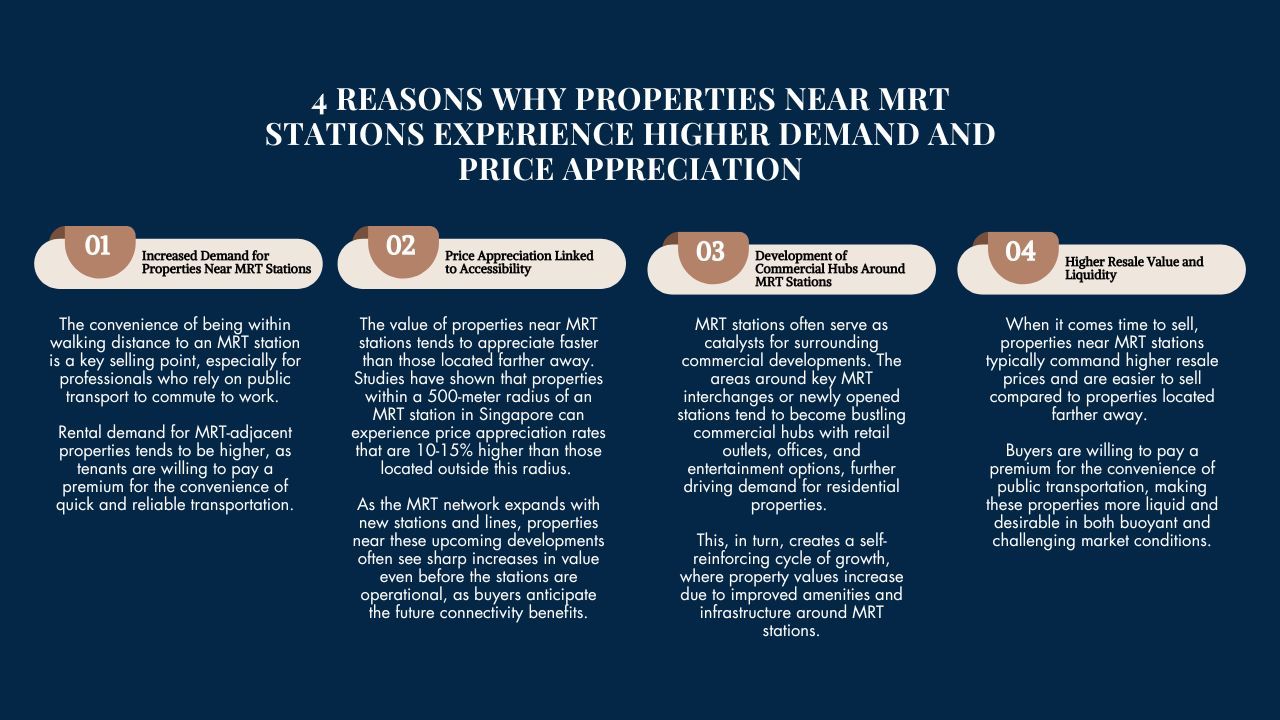

Why Investors Flock to MRT-Connected Properties?

Convenience is one thing, but imagine the potential financial rewards.

Let me share with you a few things about successful property investments—things many agents won’t tell you upfront.

Imagine you're a tenant searching for a place to rent. What draws you in? Proximity to conveniences like MRT stations.

Now, imagine owning that property. If it’s not attracting tenants, there's no rental income, and when it’s time to sell, the interest won’t be there either.

Especially in Singapore, your property needs to stand out.

If this is your only shot—your big investment—are you absolutely sure it’s the right decision? If losing money doesn’t concern you, feel free to skip this article.

But if you’re serious about making a smart, profitable move, read on.

Owning a property near an MRT station isn’t just about convenience; it’s a gateway to long-term capital appreciation and strong rental demand. In a competitive market like Singapore, choosing the right property can make all the difference.

Let's dive into what makes MRT-connected properties a golden opportunity—and how you can secure one at the right price.

The MRT Effect

One of the most consistent trends in Singapore’s property market is the premium attached to properties located within a close radius of MRT stations—commonly defined as 500 meters or a 5-10 minute walk.

This phenomenon, often referred to as the "MRT Effect," is rooted in the enhanced accessibility and convenience these properties offer.

Investing in properties near MRT stations is a sure way —demand is consistently high, rental yields are stronger, and price appreciation outpaces other locations by 10-15%.

Emerging Demand for Properties Near MRT Stations

As Singapore continues to expand its public transport network, areas around new and existing MRT stations are witnessing a notable increase in property values. The anticipated launch of between 8,000 and 11,000 new residential units this year 2024 is set to reshape the market landscape. However, with this influx of supply, discerning investors must identify which projects offer the best potential returns.

But which projects should you look at, and how can you secure the best entry price? Let’s break it down.

Top MRT-Connected Projects of 2024

8@BT (Bukit Timah)

- Developer: Bukit Sembawang Estates Limited

- Tenure: 99-year Leasehold

- Units: 158

- Preview Date: 21st September 2024

- Launch Price: From S$2,530 psf

- MRT Proximity: 2 mins to Beauty World MRT (DT5)

- Nearby Schools: Wei Yuan Eduhub (Secondary) – 3 mins, Invictus International School – 6 mins

Meyer Blue (East Coast / Marine Parade)

- Developer: UOL Group Limited & Singapore Land Group Limited

- Tenure: Freehold

- Units: 226

- Preview Date: 21st September 2024

- Launch Price: S$3,050 psf

- MRT Proximity: 7 mins to Katong Park MRT (TE24)

- Nearby Schools: Tanjong Katong Primary School (1.35 km), Dunman High School: ~0.95 km

|

Why Meyer Blue Stands Out? Within the first two days of its launch, Meyer Blue achieved sales of approximately 60% of its total units. This strong initial demand reflects the project's appeal in a competitive market. The Thomson-East Coast MRT Line will further boost the area’s connectivity, enhancing both capital appreciation and rental potential. Owning a freehold asset near future MRT lines gives investors both security and growth—a rare combination. |

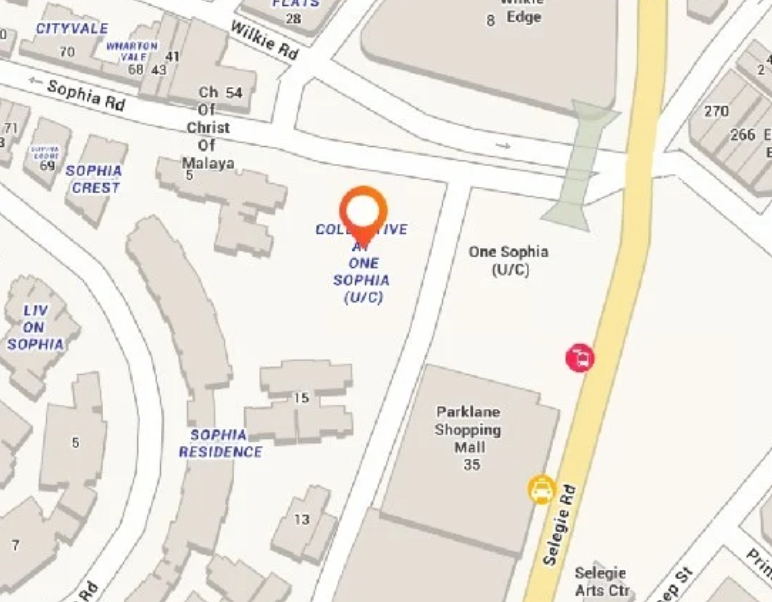

The Collective @ One Sophia

- Developer: CEL Development, Sing-Haiyi Crystal, and Ultra Infinity

- Tenure: 99-year Leasehold

- Units: Mixed-Used Devt (Resi/Office/Retail)

- Preview Date: September 2024

- Launch Price: $2,556 psf

- MRT Proximity: 3 min walk to Bencoolen MRT, 6 mins (407m) to Bras Basah MRT

- Nearby Schools: Asterie Tuition Centre – 1 min (12m), AiMS Learning Intl – 1 min (35m)

|

Why The Collective Stands Out? The Collective @ One Sophia stands out as a prime investment opportunity due to its strategic location in Singapore's Civic District, offering direct access to high foot traffic and nearby educational institutions; with a launch price of $2,556 psf, it is just a 3-minute walk from Bencoolen MRT and 6 minutes (407 meters) from Bras Basah MRT, ensuring excellent connectivity for retail or office space with strong rental potential. |

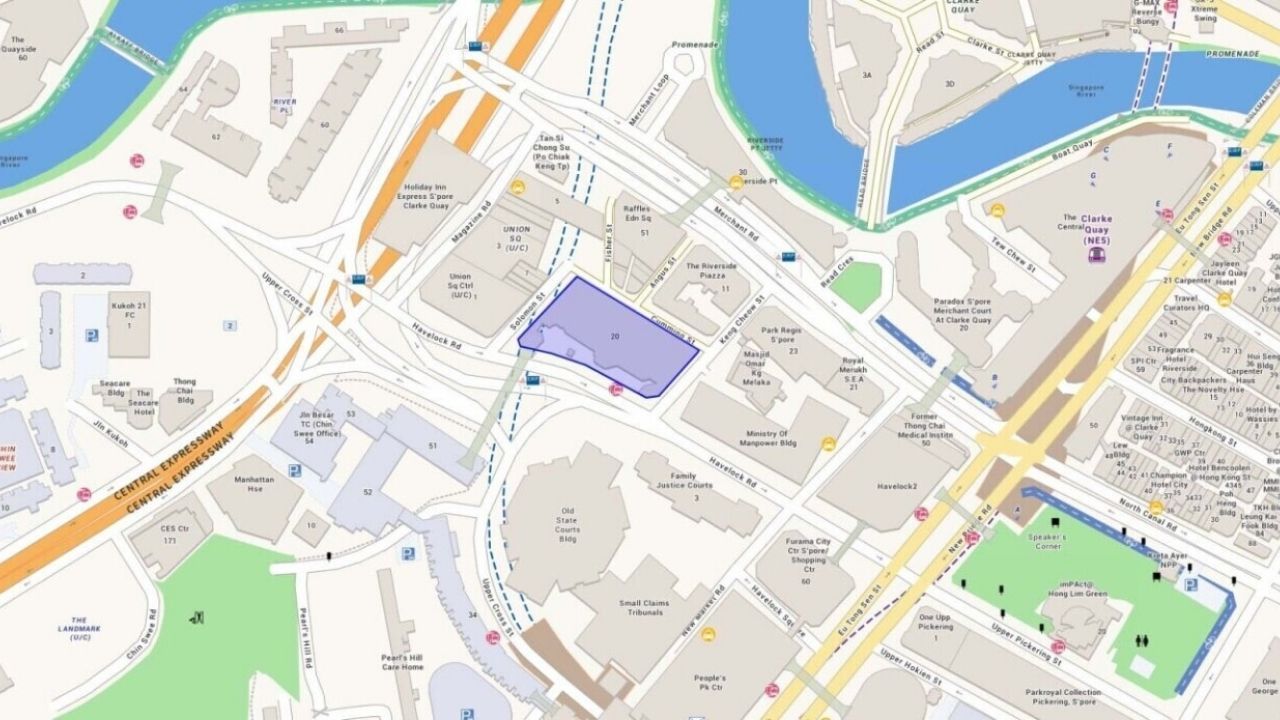

Union Square Residences (Havelock Road)

- Developer: City Developments Limited

- Tenure: 99-year Leasehold

- Units: 366

- Preview Date: September/October 2024

- Launch Price: S$2,700 psf (TBC)

- MRT Proximity: 7 mins to Chinatown MRT (NE4/DT19)

- Nearby Schools: River Valley Primary School (0.9 km), Outram Secondary School (1.5 km), SOTA (1.5km)

|

Why I’m Excited About Union Square Residences? Situated at the edge of the Central Business District (CBD), Union Square Residences offers prime city living with excellent connectivity. The proximity to Chinatown and Clarke Quay guarantees high rental demand from professionals working in the CBD. The resale potential is immense, making this a smart investment for those targeting capital appreciation. |

Nava Grove (Clementi Park / Upper Bukit Timah)

- Developer: MCL Land & Sinarmas Land

- Tenure: 99-year Leasehold

- Units: 552

- Preview Date: 2nd November 2024

- Launch Price: S$2,200 psf

- MRT Proximity: 24 mins to Dover MRT (EW22)

- Nearby Schools: Henry Park Primary School (1.4km), Dunearn Secondary School (1.8 km)

|

Investment Insight: Located in the up-and-coming Clementi Park area, Nava Grove offers great value. With plans for further infrastructure development in the area, the long-term potential for capital gains is strong. Investors looking for a safe entry point should seriously consider this project, especially with its attractive pricing relative to neighboring developments. |

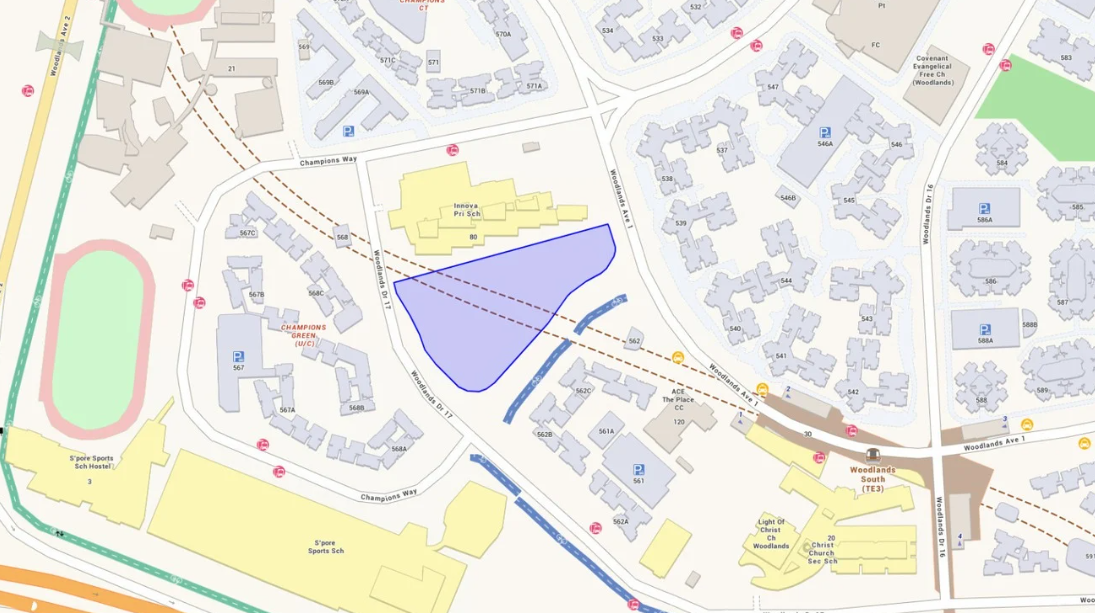

Norwood Grand

- Developer: City Developments Limited

- Tenure: 99-year Leasehold

- Units: 350

- Preview Date: 11th October 2024

- Launch Price: S$1,900 psf

- MRT Proximity: 5 mins (420 m) to TE3 Woodlands South MRT, 16 mins (1.3 km) to TE2/NS9 Woodlands MRT

- Nearby Schools: Innova Primary School (370m),Woodgrove Primary School(840m), Innova Junior College (1.5 km)

|

Why Norwood Grand is a Strong Contender? Located in the upcoming Woodlands district, Norwood Grand offers excellent connectivity and is surrounded by reputable schools. Its proximity to key MRT stations and planned developments in Woodlands positions it for strong price appreciation and rental demand. For families and investors alike, Norwood Grand represents a solid opportunity for both capital growth and convenience. |

Emerald of Katong (2024 Largest New Launch in Rest of Central Region (RCR)

- Developer: Sim Lian Land Pte Ltd and Sim Lian Development Pte Ltd

- Tenure: 99-year Leasehold

- Units: 840

- Preview Date: September/October 2024

- Launch Price: S$2,465 psf

- MRT Proximity: 10 mins (810 m) to TE25 Tanjong Katong MRT

- Nearby Schools: Chung Cheng High School (Main) (880m), Tanjong Katong Primary School – 9 mins (730m)

|

My Insight on Emerald of Katong Situated in the highly sought-after East Coast area, this project offers a beachfront lifestyle with excellent connectivity to the CBD. The upcoming Thomson-East Coast MRT line will further enhance its appeal, making it a strong option for investors seeking long-term appreciation and rental demand. |

Case Study: The Chuan Park

— A Successful Investment

To illustrate the power of strategic investment near MRT stations, let’s take a closer look at Chuan Park, a development located near Lorong Chuan MRT station on the Circle Line.

- Developer: Kingsford Group & MCC Land

- Tenure: 99-year Leasehold

- Units: 916

- Preview Date: September/October 2024

- Launch Price: S$2,400 psf

- MRT Proximity: 4 mins to Lorong Chuan MRT (CC14)

- Nearby Schools: Zhonghua Secondary School – 13 mins

Background: Chuan Park was an older condominium built in the 1980s, and for years, its resale prices remained relatively modest due to its age and lack of modern amenities. However, its proximity to Lorong Chuan MRT station, which provides easy access to major areas like Bishan and Serangoon, has always made it attractive for renters and buyers who prioritize convenience.

En Bloc Potential Realized

In 2022, after several attempts, Chuan Park was successfully sold in an en bloc deal for S$890 million, translating to a land rate of around S$1,254 per square foot per plot ratio (psf ppr).

Investors who had purchased units in Chuan Park years earlier saw substantial returns on their investments, with some owners making upwards of 40% to 50% profit from the collective sale.

|

My Insight on The Chuan Park: District 19 hasn’t seen a new launch in years, making The Chuan Park a unique investment opportunity. Chuan Park’s location played a significant role in its en bloc success. Buyers saw the potential in redeveloping the site into a new, modern development that could capitalize on the demand for properties near MRT stations. Its proximity several reputable schools ensures steady rental demand from families and expatriates. With 916 units, the development offers both variety and potential for capital appreciation. For investors looking at stable rental income, this project is a solid choice. |

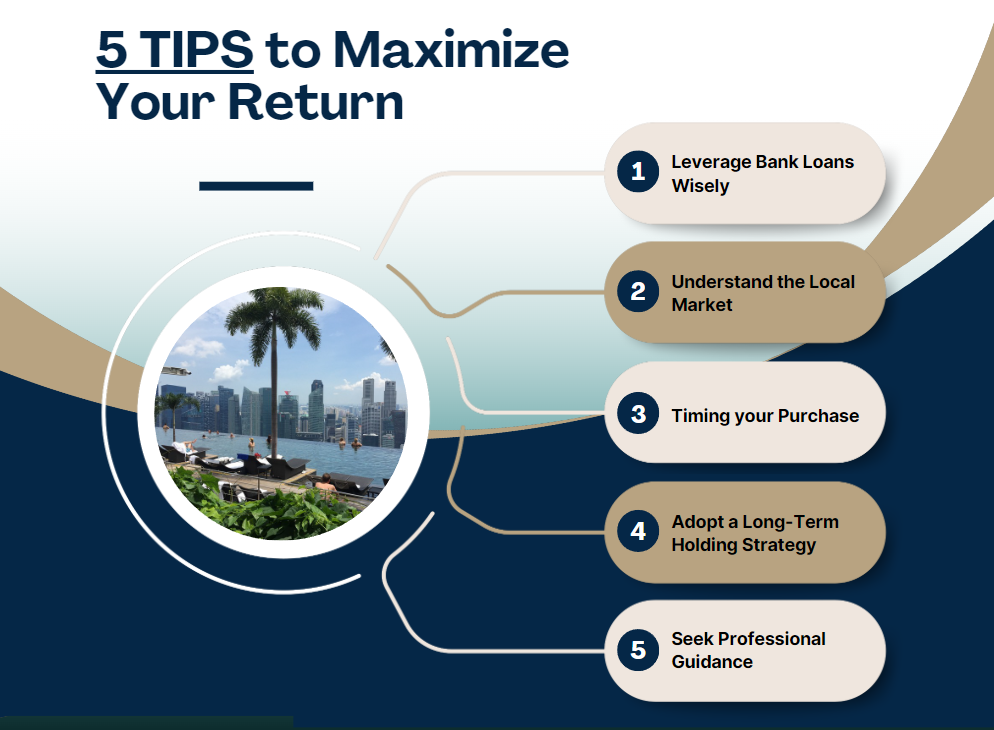

Investment Strategies: Maximizing Returns on MRT-Linked Properties

- Leverage Bank Loans Wisely

Take advantage of low-interest rates to finance your investment. Using rental income to cover mortgage payments can enhance your cash flow while your property appreciates.

- Understand the Local Market

Research growth prospects in different areas, focusing on factors like upcoming MRT expansions, educational institutions, and business hubs that can drive property values higher.

- Timing your Purchase

Research growth prospects in different areas, focusing on factors like upcoming MRT expansions, educational institutions, and business hubs that can drive property values higher.

- Adopt a Long-Term Holding Strategy

Given the steady appreciation of properties near MRTs, aim for a minimum 5-10 year hold to maximize your returns. The longer you hold, the more secure your investment becomes.

- Seek Professional Guidance

Consult with real estate professionals or property wealth planners for tailored advice on optimizing tax savings and structuring your investments effectively.

Invest Now or Regret Later: The Best Time to Buy is Now!

I’ve seen it too many times. Investors who hesitate often lose out on the best opportunities. By the time you’ve made up your mind, prices have already climbed.

The current market conditions, with stable interest rates and rising rental demand, make now an opportune time to invest.

If you miss this wave of launches, you may find yourself paying 5-10% more next year, and that’s a conservative estimate. Especially with MRT expansion continuing to influence property prices, delays in your decision could mean missing out on a safe, lucrative investment.

Don't let hesitation cost you. Secure a property near one of these MRT-connected developments before the window closes. With my years of experience and market insights, I can help you make the best decision for your future. Let's make sure you’re on the right side of the market shift—before it’s too late.

Contact me now!