Wondering Why Others Are Renting Faster at the Same Price in Peak?

What if you could boost your rental income without making a larger investment?

What if the rising demand for rental properties in Singapore became your next big financial win?

Right now, you have a unique opportunity to do just that, thanks to a new policy that could dramatically reshape the rental market.

Let me show you exactly how this can benefit you and why this is a chance you can’t afford to ignore.

Starting January 22, 2024, Singapore will allow up to eight unrelated tenants in larger HDB flats and private residential properties, opening the door to significantly higher returns.

Curious about how this can work for you?

Let’s dive into the details together and discover why this is an opportunity no investor should overlook—and how I, as your realtor, can help you make the most of it.

Understanding the New Occupancy Cap

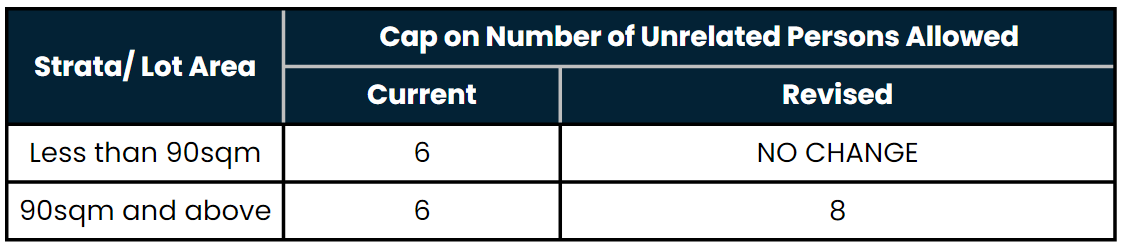

As of January 22, 2024, the Singapore government have introduced a new rule:

- the occupancy cap has been raised from six to eight unrelated tenants for HDB flats (four-room and larger) and private residential properties with at least 90 square meters.

This policy change is designed to address the growing demand for affordable housing options in a city where living costs can be prohibitively high and will be in effect until December 31, 2026.

By permitting more tenants, the government aims to alleviate some of the pressure on the rental market and provide more flexible living arrangements, providing a temporary window of opportunity for investors to capitalize on increased rental income.

Who Benefits?

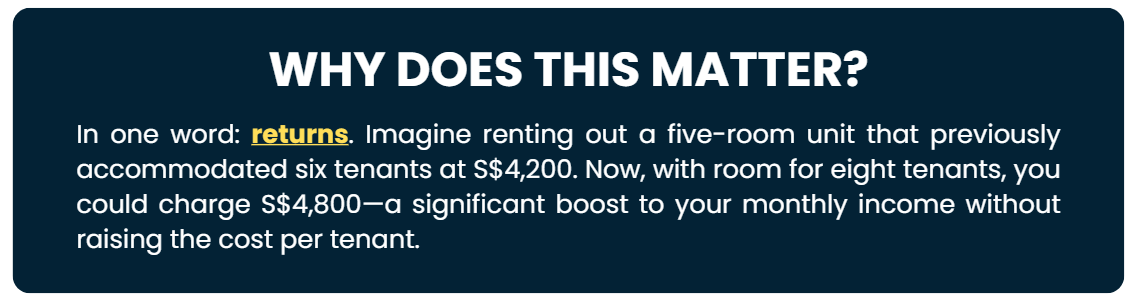

- Landlords and Investors: You can now maximize the rental potential of your properties. More tenants mean higher rental income, which also spreads the cost per tenant, making your property more attractive in a competitive rental market. If you do it correctly.

- Tenants: For tenants, downward pressure on demand will ease the supply for shared accommodation with colleagues or friends working in Singapore. this change means more affordable living options.

The Result?

A win-win situation for everyone involved—especially for you, the investor, who is positioned to seize this unique market shift.

The Impact on Rental Prices:Stabilization

High Supply and Softening Demand

- The rental market is facing an oversupply of units, particularly in the condominium sector.

- Rental deals that used to close within a day now take much longer as tenants have more options. The number of condominiums available for rent has surged, with listings increasing threefold year-on-year as of January 2024. And even now on the ground, rentals remain competitive.

This influx has led to prolonged vacancies for landlords, who are now under pressure to lower rents to attract tenants.

Rental Price Trends

- After a period of rapid growth, rental prices have started to stabilize. In 2023, private home rents increased by 8.7%, a significant slowdown compared to the previous year's 27.9% rise.

Rental prices are expected to continuously remain weak due to the absorption of excess supply, but may stabilize or slightly increase later in the year as the market adjusts to lower supply levels.

Tenant Behavior: How the Market is Shifting

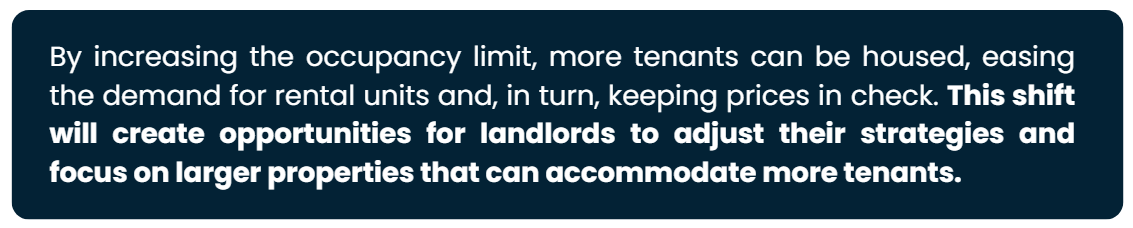

One crucial trend to note: as the occupancy cap increases, tenants will have more bargaining power. With more options available to them, tenants may start negotiating better rental terms.

This is why it’s critical for landlords to stay competitive;

- Offer attractive rental agreements,

- maintain high property standards, and

- stay ahead of the curve will keep your property in demand.

How Can You Maximize Your Returns?

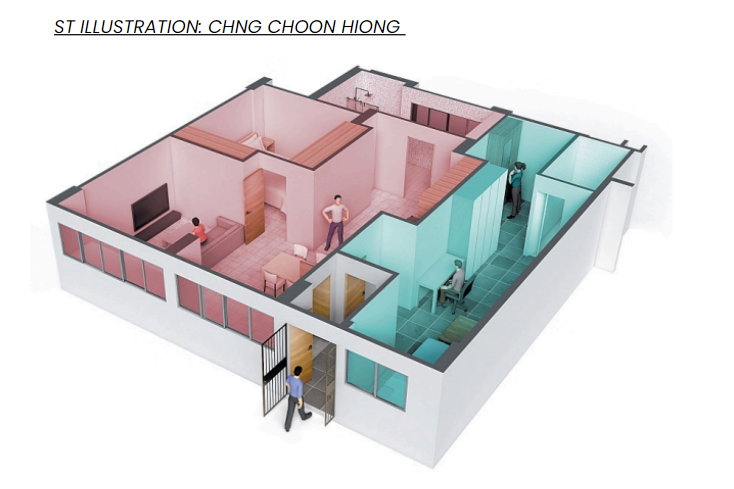

Convert Larger Units into Co-Living Spaces

Older properties, particularly larger flats or private residences, can be redesigned to create more private living spaces for tenants. This appeals to the growing demand for co-living arrangements, where tenants can enjoy privacy within a shared environment.

- Creating Private Spaces: Transforming a traditional flat into a dual-key unit can create separate living spaces for multiple tenants while maintaining privacy.

This can be achieved by reconfiguring the layout and adding necessary amenities like kitchenettes and bathrooms.

- Flexible Spaces: Creating flexible living areas that can be easily adapted for different tenant needs will make properties more appealing. This could include modular furniture or movable partitions that allow tenants to customize their space.

Upgrading Amenities

Properties with additional perks like cleaning services, communal spaces, and leisure facilities will be highly attractive to tenants willing to pay more for convenience and comfort. Consider these value-adding features when marketing your property to prospective renters.

For example, a basic conversion might cost around $40,000, while more extensive renovations could reach upwards of $150,000. However, these investments can lead to significantly higher rental yields, making them worthwhile.

Practical Advice for Landlords

- Avoid Concrete Structures

Homeowners should not construct permanent structures to allow for easy reinstatement of the original layout if needed in the future.

- Communal Spaces

It is advisable to leave room for communal areas, such as kitchens and yards, to enhance space efficiency.

- Careful Planning

When converting a HDB, meticulous planning is essential.

For example, a 1,200 sq ft flat can be transformed into a studio apartment and a one-bedroom apartment, each with its own front door and connected by a shared foyer.

This layout ensures tenant privacy while allowing the owner to maintain their own living and dining area, as well as a separate kitchen and bathroom.

- Tenant Retention Strategies

Building strong relationships with tenants can reduce turnover rates.

Consider offering incentives for long-term leases or creating a sense of community within the property.

- Future Selling Challenges

Selling dual-key units may be difficult as renovations cater to a specific buyer demographic, potentially limiting the pool of interested buyers in the future.

Singapore Property Market Q3 2024: What to Expect?

The current landscape presents a compelling opportunity for buyers and sellers alike, as the market evolves to meet the needs of owner-occupiers and value-driven seekers.

- Consistent Economic Growth

Singapore's economy is projected to maintain a steady growth trajectory, which will positively influence the property market. With the economy expanding, homeowners may feel less pressure to lower their asking prices, allowing them to hold firm on valuations. This stability creates a favorable environment for both buyers and sellers, as confidence in the economy underpins property values.

- Navigating High Prices and Interest Rates

The persistence of high asking prices and elevated interest rates may pose challenges for some buyers. Those who find themselves priced out of the market should consider exploring options that offer value without compromising affordability.

- Growing Interest in Outside Central Region (OCR) Properties

A notable trend is the increasing interest in properties located in the Outside Central Region (OCR), particularly those near MRT stations. Recent launches of major condominiums in the OCR, such as Grand Dunman, J’den, and Watten House, have seen impressive performances, indicating a shift in buyer focus towards more accessible and value-driven locations.

Investors should consider this trend as a potential opportunity to tap into a growing segment of the market.

Future Trends in the Singapore Rental Market

As Singapore’s rental market prepares for a wave of newly completed units between 2024 and 2025, savvy investors must stay ahead of emerging trends. With rental prices expected to adjust, landlords should be prepared to align their expectations to avoid prolonged vacancies.

But what does this mean for you, especially if you’re still on the fence about investing in Singapore property?

- Expected Rental Price Declines

While more units entering the market may lead to a dip in rental prices, this doesn’t mean opportunities are shrinking.

In fact, this is the perfect time to secure a “right layout” property before prices potentially stabilize at a new equilibrium.

- Shift in Tenant Preferences

The demand for co-living spaces, flexible lease terms, and properties with top-notch amenities is on the rise. Tenants today prioritize sustainability, proximity to transportation, and a lifestyle that aligns with modern values.

As a result, properties that meet these evolving expectations are likely to stay competitive, regardless of rental price trends.

- Long-Term Investment Potential

For both local Singaporeans and global investors contemplating entry into the market, the outlook remains promising. The combination of a resilient economy, evolving buyer preferences, and a balanced supply-demand dynamic creates a conducive environment for long-term investment.

Ready to Take the Next Step?

Let’s Make Your Investment Count!

I understand that every client is different, which is why I tailor my approach to suit your specific requirements. Whether you're focused on maximizing rental yields, minimizing risk, or achieving long-term growth, I’ll tailor my recommendations to match your investment objectives and financial aspirations.

Whether you’re a Singaporean looking to rent, sell, or expand your property portfolio, or a global investor seeking to tap into Singapore’s real estate market, I’m here to guide you every step of the way. My goal is to help you navigate the market with clarity and confidence.

At the end of the day, your satisfaction is my top priority.

Don’t wait any longer! Let me assist you in maximizing your investment returns in Singapore's property market!

Connect with me now!