|

Property Type |

2023 Avg PSF |

2025 Avg PSF |

% Change |

Notes |

|---|---|---|---|---|

|

Sentosa Cove Landed (Detached) |

S$2,100 |

S$1,870 |

-10.9% |

More resale listings, fewer foreign buyers |

|

Sentosa Cove Landed (Semi-D) |

S$1,950 |

S$1,780 |

-8.7% |

Most units held for longer-term legacy reasons |

|

Sentosa Cove Condo (Seafront, Cape Royale, Oceanfront) |

S$2,300 |

S$2,050 |

-10.9% |

Subsales slowing; rents slightly down |

The Fall and Possible Future of Sentosa Properties

Sentosa is no longer the unshakable status symbol it once was.

The market has shifted. Demand has cooled. Foreign interest has dried up. Prices have fallen. Rents are softening. And the cost of waiting could be steep.

So before you consider stepping into Sentosa’s market today, or if you already own a piece of this island paradise, this article is for you.

Once the Pride of Singapore’s Luxury Scene

There was a time when owning a home in Sentosa Cove wasn’t just about luxury; it was a statement.

It meant you’d made it. It meant you belonged to the elite club of owners who could say, “I live by the sea, on Singapore’s only island where foreigners can buy landed homes.”

From the late 2000s to the early 2010s, Sentosa properties were trading at jaw-dropping premiums, with seafront bungalows commanding prices as high as S$3,000–S$3,500 psf. It was the golden era of ultra-luxury real estate, fueled by foreign buyers, booming global markets, and optimism that Sentosa would become the “Monaco of Asia.”

But today, that glitter has dulled. The mood has shifted from “aspirational” to “cautious.”

Prices have stagnated. Demand has thinned. And the once-famous Sentosa address? It’s now a quiet reminder of how psychology drives markets more than postcards ever will.

Proof the Fall Is Real

Rental yields have softened, from 2.8–3.0% in 2023 to 2.3–2.5% in late 2025, as high-end expatriate leasing demand wanes.

Even though resale volume remains thin (barely 10–15 landed deals per year), the buyer pool has shrunk dramatically after the 60% ABSD was introduced on foreign buyers in 2023.

Many buyers paused. Locals held back. PRs considered option value and liquidity more keenly. Why pay for a villa on an island when a city-edge luxury condo offers equal cachet and better exit potential?

Source: URA Q3 2025

Prestige Without Practicality Becomes Risky

Luxury has a new language. Gone are the days when an isolated island villa alone guaranteed capital appreciation.

Sentosa is now too expensive to enter again.

A foreigner who sells a bungalow today for S$20 million would face another S$12 million in ABSD if they wanted to re-enter the market. That makes reinvestment in Singapore irrational from a financial standpoint.

Today’s global investor asks:

How fast can I exit? How many buyers are there? How many renters? Is this liquid?

In that lens, Sentosa’s isolation becomes a liability rather than a novelty. The tenant pool (and future buyer pool) shrank as perceptions changed.

Yes, Sentosa has views and berths, but are those enough when the alternative is a D9/D10 condo with connectivity, shorter quantum, and deeper demand?

The fear is that prestige, without liquidity and yield, becomes a cost. And in this market, cost compounds faster than emotion.

People are now prioritizing:

- Ease of entry and exit

- Rental resilience

- Tax efficiency

- Future liquidity

Sentosa, unfortunately, does not check any of those boxes right now.

So what do they do instead?

They hold if they’re emotionally attached, or sell and reallocate abroad where they can own more with less friction.

Learn more:

The migration of capital isn’t random — it’s strategic. Investors are going where returns are consistent, entry barriers are low, and governments welcome foreign ownership.

Let me share a true-to-life client story (name changed for privacy).

|

Case Study: “Alan” — A Former Sentosa Owner |

Sentosa Market Overview (2013 vs 2025)

|

Metric |

2013 |

2025 |

Direction |

|---|---|---|---|

|

Avg Detached Price (psf) |

S$2,900 |

S$1,870 |

↓ -35% |

|

Annual Transactions |

50+ |

10-15 |

↓ |

|

Rental Yield |

3.5% |

2.4% |

↓ |

|

Foreign Buyer Share |

70%+ |

<15% |

↓ |

|

Median Time on Market |

90 days |

200+ days |

↑ |

These aren’t small shifts; they’re structural. Sentosa is repositioning itself as a legacy product, not an ROI-driven one.

The Possible Future of Sentosa Properties

To fully understand Sentosa’s coming chapter, it helps to zoom out and see how it fits within Singapore’s broader 2030 vision. The city’s landscape is evolving rapidly, from rejuvenating established towns to expanding into new growth areas. I’ve covered these changes in detail in my recent articles:

Sentosa, while unique as an island luxury enclave, will not be isolated from these shifts. Infrastructure upgrades, demographic changes, and urban planning initiatives happening elsewhere will ripple through the entire southern corridor, shaping Sentosa’s desirability, accessibility, and market dynamics over the coming years.

1. Redevelopment and Masterplan Possibilities

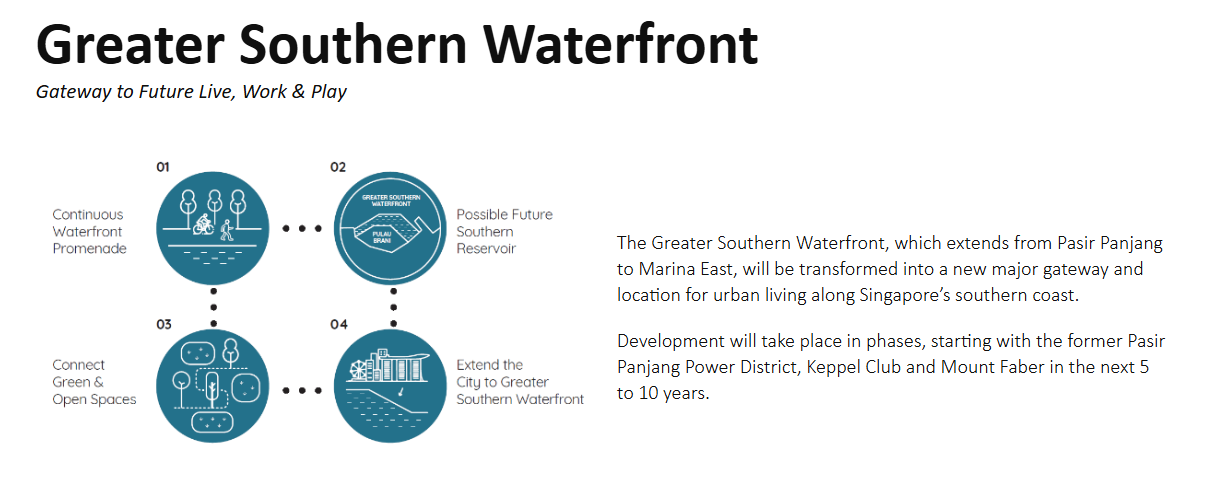

URA’s Greater Southern Waterfront transformation continues to be the wildcard for Sentosa’s future.

Once this massive stretch, from Keppel to Pasir Panjang, is fully realized, it could redefine connectivity and desirability across Singapore’s southern coastline.

Photo from URA

Potential benefits for Sentosa include:

- Improved ferry and bridge access from the mainland, making Sentosa more accessible.

- New commercial and hospitality developments attracting visitors and tenants

- Enhanced positioning as Singapore’s premier “leisure-luxury” enclave, linked with mainland attractions.

These changes align with Singapore’s broader 2030 urban rejuvenation goals.

2. Changing Buyer Profiles and Demand Dynamics

Though foreign buying has softened due to ABSD policies, a new generation of buyers is emerging:

- Chinese PRs benefiting from residency status and ABSD exemptions.

- Singaporean multi-generational families seeking prestigious lifestyle homes.

- Wealthy Southeast Asian buyers diversifying into high-end Singapore properties.

These buyers typically value legacy, exclusivity, and long-term lifestyle benefits rather than short-term gains.

3. Price Stabilisation and Market Outlook

URA data shows Sentosa landed property prices have corrected by 8–12% since their 2023 peak. This suggests much of the downside risk may already be priced in.

If Singapore’s economy remains stable and interest rates ease, expect:

- Modest demand recovery for waterfront homes under S$2,000 psf.

- Increased interest in renovated villas ready for rental income.

- Stronger bids for rare plots with unique features like private berths.

The recovery will likely be gradual and measured, appealing mostly to those focused on long-term holding.

Source: URA, Straits Times Graphics

So, Should You Hold or Exit?

It depends on your intent. I wrote a dedicated piece on this critical question, “Should foreign owners hold or exit Singapore property in 2025?” which I recommend you read.

It’s a deeper look at how top investors are positioning their portfolios right now, including when to hold, when to sell, and where to reinvest next.

Let’s Talk Before the Window Closes

Let’s be clear, Sentosa isn’t dead. But 2025 is a turning point, and your decision this year could shape the next decade of your wealth journey.

If you hold, you’ll want to hold for the right reasons. If you sell, you’ll want to sell into the last active cycle of local demand while PR and domestic buyers are still present. If you reinvest abroad, you’ll want to enter markets still early in their growth curves.

Let’s review your numbers together.

Message me now!