Singapore Property Is Shifting — What Investors Must Know Before Q1 2026

The November numbers shocked even me.

I’ve been in this industry long enough to see cycles come and go, bubbles inflate and burst, and policies reshape markets overnight.

But what happened lately wasn’t “noise.” It was a preview of the next chapter in Singapore's property market…

A chapter most casual buyers will only understand six months too late.

If you’ve been following my past articles, like Where Singapore Capital Is Going in 2026: Australia, Japan & Thailand, or my deep dive into Should Foreign Owners Hold or Exit Singapore Property in 2025, or even the Sentosa case study in The Fall and Possible Future of Sentosa Properties, you’ll notice one common theme: Smart money moves early. Everyone else reacts later.

Today’s article is your early signal. Let’s break it down together.

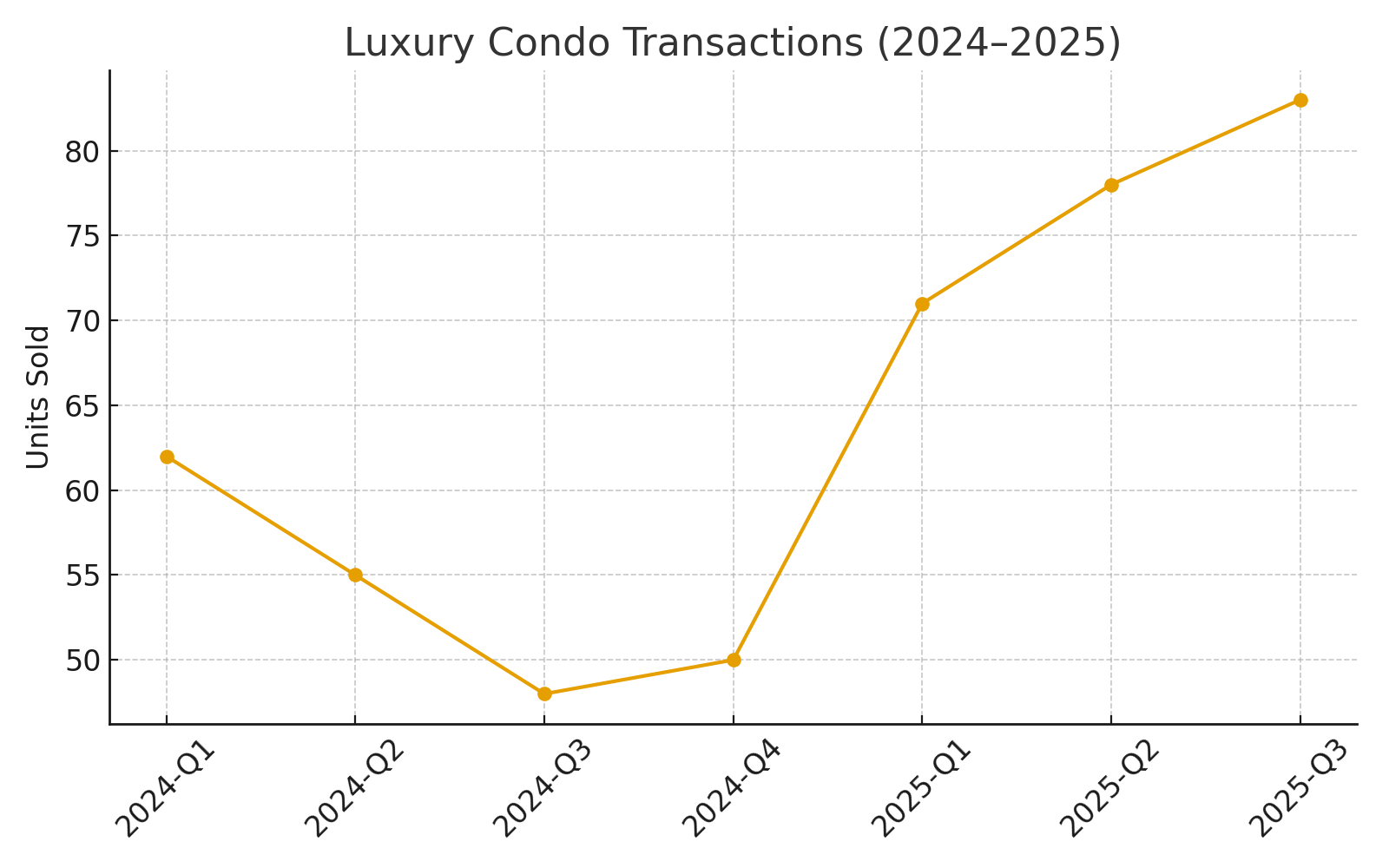

1. Luxury Sales Are Back — And It’s a Domestic Affair

The luxury market doesn’t rebound casually. It’s usually the last segment to wake up. But in Q1 2025, the luxury property market surged.

- There were 143 transactions of private homes priced above S$5 million, a 44.6% quarter-on-quarter jump, according to data from the Urban Redevelopment Authority (URA) and leading market analysts.

- Within this, the ultra-luxury segment (homes ≥ S$10 million) saw sales rise from 10 units in Q4 2024 to 17 units in Q1 2025.

- Most notably, of those 17 ultra-luxury sales, Singapore Citizens and PRs accounted for 13 units, indicating strong domestic wealth confidence.

To understand this shift in greater detail, let’s examine the buyer demographics and how the market composition has evolved over the past year.

2. The Biggest Buyer Shift in 10 Years

Buyer Demographics Shifting in Singapore’s Luxury Property Market (2025)

- By Q1 2025, 98.7% of private residential purchases in Singapore were made by Singaporeans and Permanent Residents (PRs), with foreigners accounting for only 1.0%. (Source: Huttons Group Residential Market Report, Q1 2025)

In the luxury segment, the trend is even clearer.

- During the first half of 2025, out of 193 luxury non-landed homes sold, 56.5% went to Singaporeans, 35.8% to PRs, and only 7.8% to foreigners.

- The ultra-luxury bracket — including the iconic S$38.9 million penthouse at Park Nova (S$6,593 psf) — saw 57.1% of 28 ultra-luxury sales purchased by PRs in the same period.

- Looking closer at the Core Central Region (CCR), homes priced at S$5 million and above saw a surge in local buyers. From July to September 2025, 76% of the 171 luxury units sold were snapped up by Singaporeans.

By October 2025, this dominance intensified.

- 86.7% of luxury buyers were Singaporean, with PRs making up about 12% and foreigners only 1.3%.

Foreigners have stepped back because of the high ABSD, and the gap left by foreigners was immediately filled by PRs.

And you know what? Whenever locals & PRs dominate luxury buying, it tells me one thing: They are positioning for a strong 2026–2028 cycle. Prices won’t drop; supply is simply too tight.

This PR is one of the strongest, stealthiest demand drivers heading into 2026.

And honestly, if you’ve read “Singapore 2030: Where Singapore Is Expanding Next,” you already know the government is preparing for population growth, not decline.

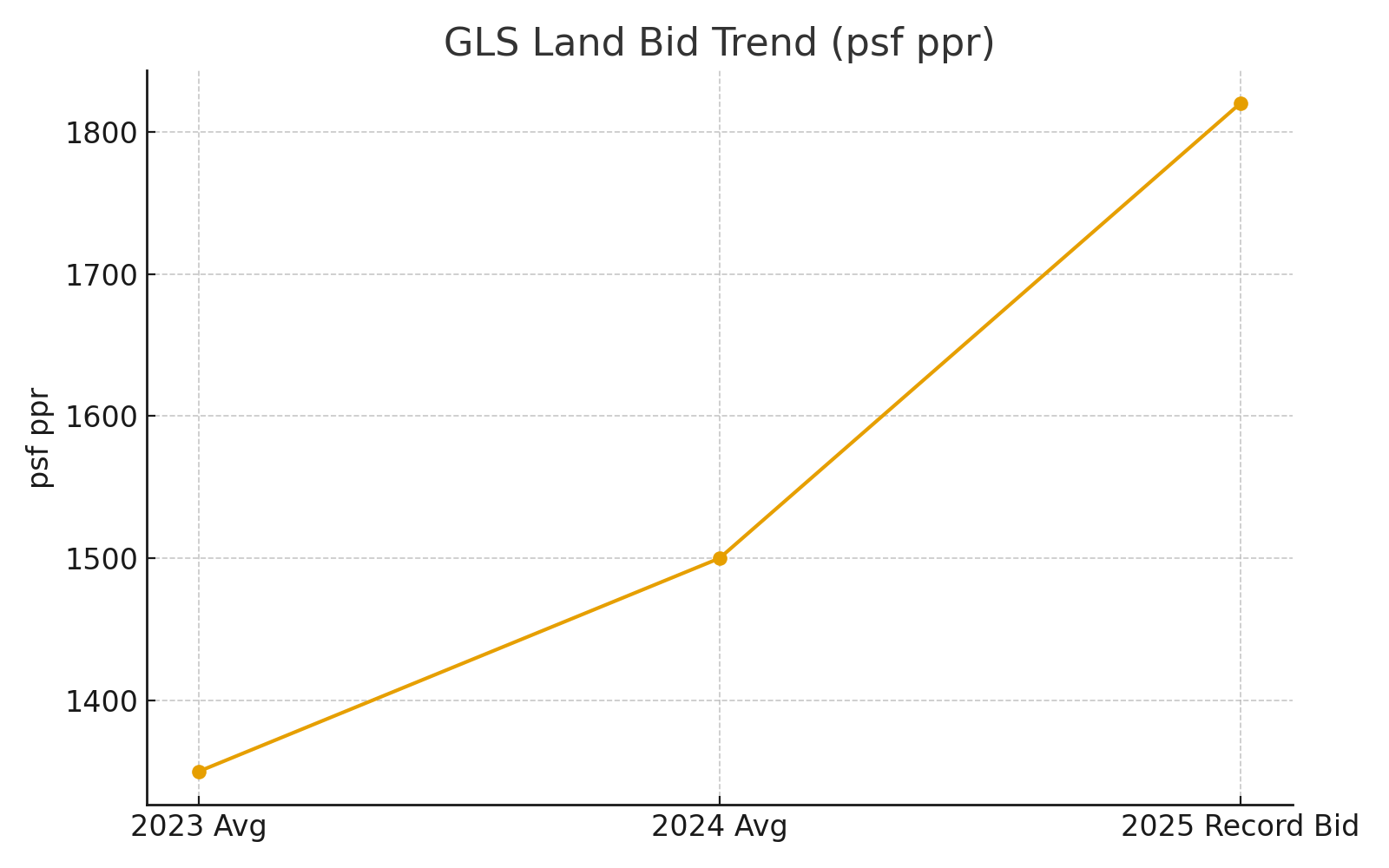

3. The November GLS Surprise — Developers are Signalling Conviction

This is the part I wish more investors understood.

You know why? Because it's very interesting when developers are showing serious conviction.

- On 11 November 2025, a 99-year private-housing GLS site along Bukit Timah Road (Newton) closed with eight bids, and HH Investment Pte Ltd topped the tender at S$566.29 million (S$1,820 psf ppr). The winning offer was roughly 12.3% higher than the runner-up and came from a group linked to Taiwan’s Huang Hsiang / Liao family, underlining that big-name players see Newton/Bukit Timah as a premium play.

That land rate sets a new benchmark for recent CCR GLS tenders (it’s the highest GLS land rate in the CCR since the Cuscaden Road award in 2018).

Developers NEVER bid aggressively unless they are extremely confident about future demand, future price bands, and the next five-year growth cycle.

Do you know what a S$1,820 ppr land price means?

Launch prices will need to be S$3,400–3,800 psf. Minimum.

This is the same “early signal” we saw in 2017 and again in 2021. Both times, prices jumped in the following 24 months.

And just like I explained in “Singapore 2030: Opportunities,” infrastructure, population, and land scarcity are merging again.

We are heading into another structural uptrend.

4. Caldecott Hill: The Story Nobody Is Talking About

Perennial exploring a sale of their Caldecott Hill mansion site? That’s huge. And overlooked. This tells 3 things happening beneath the surface:

Developers are avoiding long, risky land cycles

- With ABSD remission clocks still ticking, developers today prefer predictable, faster-turnaround projects instead of multi-year landed redevelopments.

Construction costs haven’t stabilised — they’ve continued rising

- Tender prices, labour, and materials remain elevated in 2025, making large bespoke builds harder to justify unless margins are very strong.

Freehold landed redevelopment is becoming increasingly infeasible

- Not impossible — but slower, costlier, and more complex than ever. GCB-standard freehold plots are finite, approvals take longer, and few owners are willing to sell.

If you've read my article on foreign owners’ exit options,

you’ll know this isn’t the time to gamble with risky landed projects.

But it is the time to secure rare freehold and CCR trophy assets, because supply is drying up.

The Sen: Proof That the Market Isn’t Weak — Just Smart

When The Sen launched at an average of S$2,358 psf, the response was steady: it sold 23% of its 347 units over the launch weekend, with particularly strong take-up of one-bedroom units.

To me, this clarifies several things:

- Buyers are willing to pay for quality. The Sen’s compelling location and design clearly resonated.

- They buy when pricing is well-calibrated. The launch price is lower than many comparable RCR projects, suggesting a considered entry rather than speculative buying.

- They’re not banking on a crash. This isn’t panic buying — it’s patient, deliberate demand.

- Developer confidence remains intact heading into 2026. Sustained Land’s measured launch suggests they understand the market and have conviction.

In short, the Sen acted as a thermometer check, and what we’re seeing is warm demand, not a chilled market.

The 2026 Launches That Could Shape the Next Cycle

These early-2026 launches aren’t just new condos; they may very well set the psychology and pricing benchmark for the next 24 months.

The Robertson Opus

Situated in prime District 9 on Unity Street, this 999-year leasehold project by Frasers Property and Sekisui House is rare. With 348 units and a riverside lifestyle, it’s already seeing strong demand: 143 units (41%) sold at launch weekend, averaging S$3,360 psf.

The composition of its buyers (83% Singaporeans, 16% PRs) suggests local high-net-worth buyers are deeply interested in this kind of legacy, city-fringe asset.

W Residences Marina View – Singapore

This is IOI’s landmark branded residence, 683 luxury units integrated with a W Hotel at Marina View.

The first 100 units launched in October 2025, starting from around S$3,230 psf, highlighting its premium positioning.

Branded residences are becoming a powerful vehicle for ultra-high net worth individuals to combine prestige, service, and investment.

River Green

While not branded, River Green is attracting serious attention. Early reports from the weekend launch suggest 88% take-up at an average of S$3,130 psf. (Note: these are broker / forum-sourced figures.)

If this momentum holds, it could be a mass-affluent signal, showing that upgraders are confident and willing to pay for efficient CCR living.

Why These Matter

These three projects together represent different buyer segments — trophy/riverside, high-luxury branded, and mass-CCR — but all carry a common thread: scarcity, quality, and developer conviction.

Watch how fast this moves. All three will influence the entire pricing structure for Q1–Q2 2026.

So, What To Do Before Q1 2026?

Here's the truth.

❌ Prices are not going down. (There’s no index-based evidence that prices are falling)

❌ Supply is getting tighter.

❌ Developers are signalling higher price bands.

❌ Locals & PRs are replacing foreigners in demand.

❌ Land cost is rising sharply.

You don't need to buy immediately.

But you do need to position yourself before Q1 and Q2 launches, and reset price expectations.

3 Things I Would Do If I Were You

1. Look at your numbers now.

2. Shortlist now.

3. Be ready before the first 2026 launches.

Because once the new launches set the new benchmark pricing, everything else — resale, undervalued CCR, older freehold — will move up behind them.

If you want me to help you plan this properly, send me a message.

Let’s map out your game plan before Q1 begins.

Connect with me now!